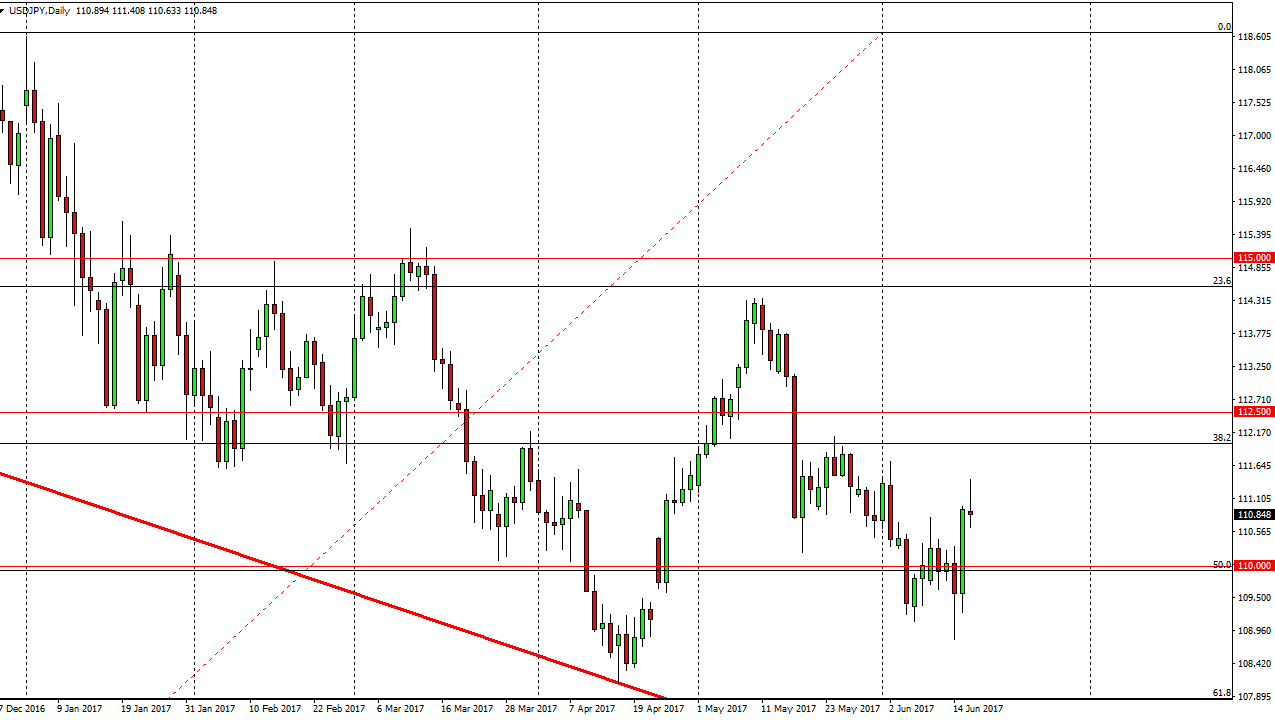

USD/JPY

The US dollar initially tried to rally during the day on Friday, but you back most of the gains to form a shooting star like candle. Because of this, it looks as if the market is starting to run into a bit of exhaustion but when you look at the weekly chart, it looks very bullish. Because of this, I think that if we break above the top of the shooting star from the Friday session, it’s likely that we go much higher. The 110 level should offer support below, so short-term pullbacks could offer buying opportunities, but a breakdown below the bottom of the range for the Thursday session would be very negative. I expect a lot of volatility in this market, but I think we are trying to change the longer-term trend to the upside again, so depending on your time frame you may be willing to buy and hold.

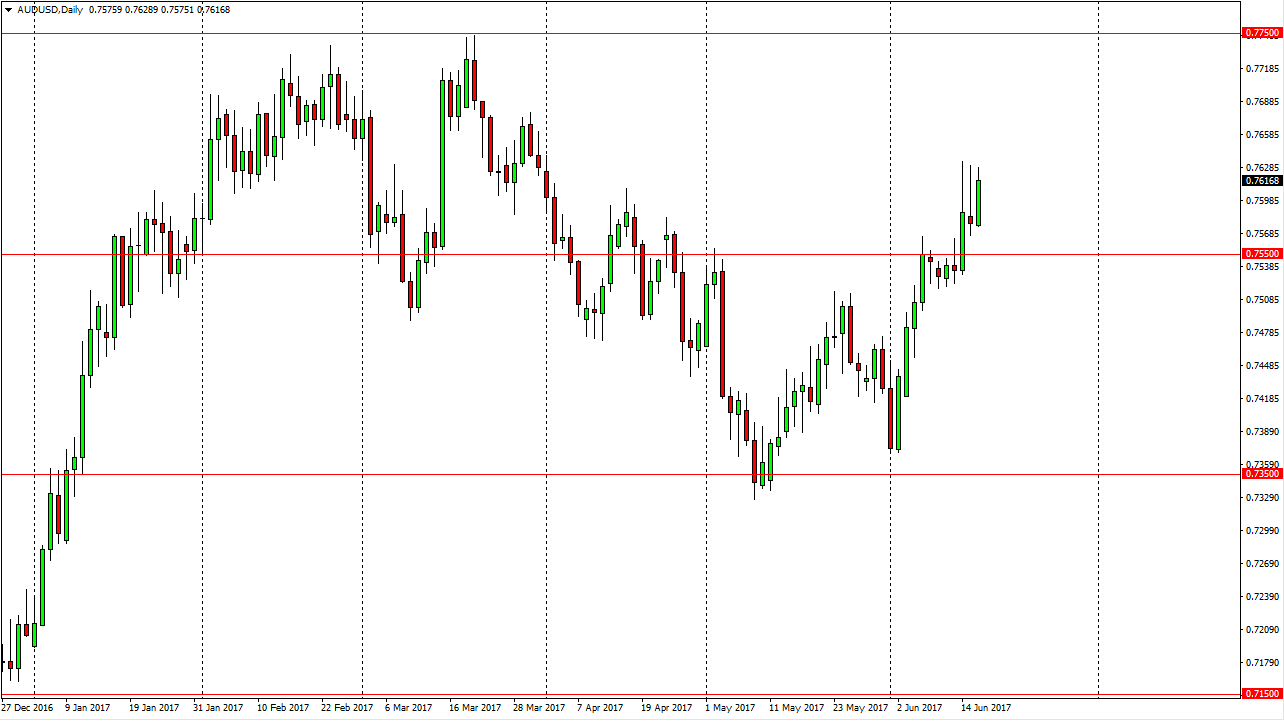

AUD/USD

The Australian dollar rallied on Friday, reaching towards the top of the shooting star from Thursday. I think that the market is ready to continue to go higher, and perhaps reach towards the 0.7750 level after that. Pullbacks are buying opportunities that you should be able to take advantage of as long as we can stay above the 0.7525 handle. The Australian dollar has been very bullish of late, so short-term pullback makes quite a bit of sense as we are trying to build up momentum in general. I break above the 0.7750 level would send this market much higher, perhaps reaching towards the 0.80 level after that. I believe that the Australian dollar could be influenced by gold if it starts to rally, which it has sold off for a while. All things being equal, I’m a buyer but I also recognize that volatility is going to be a mainstay of this currency pair.