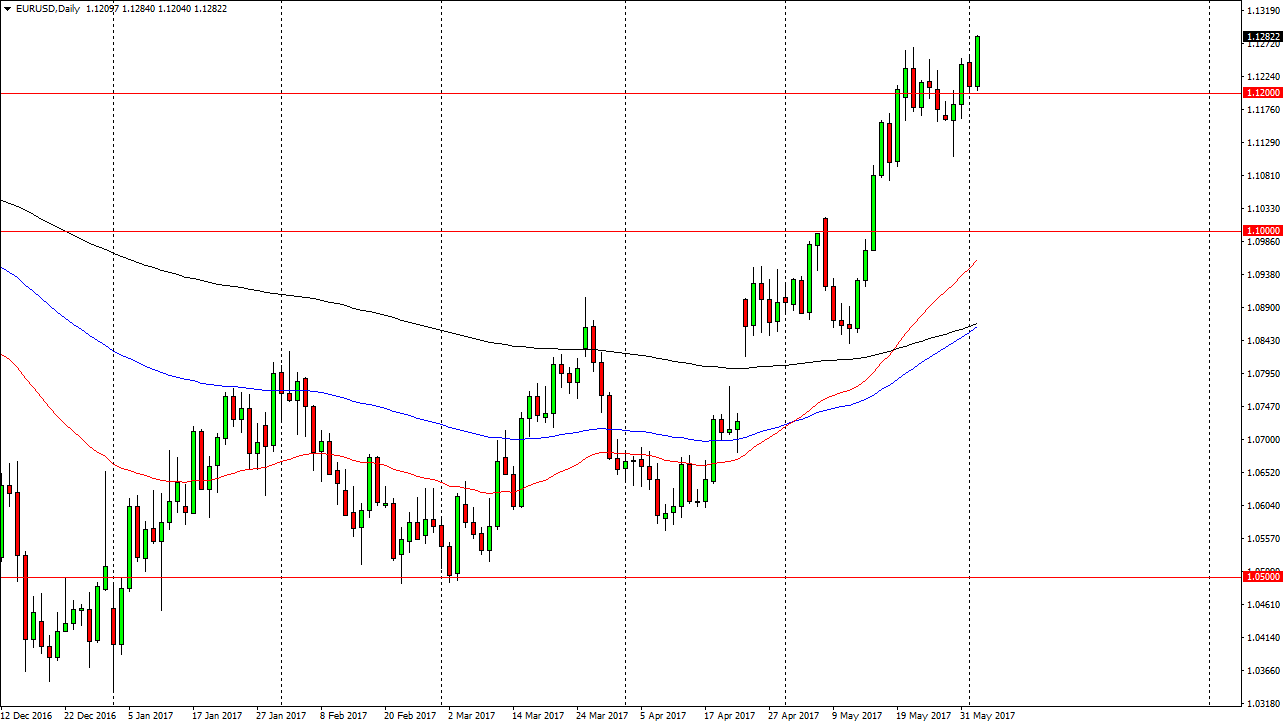

EUR/USD

The EUR/USD pair had a very positive session during the day on Friday, bouncing off of the 1.12 level and continuing to go much higher after that. The market looks as if it is going to continue a move higher as we closed at the very top of the range. When you look at the longer-term charts, we are consolidating between the 1.05 level on the bottom and the 1.15 level on the top. I think pullbacks continue to offer value, and we should continue to go towards the 1.15 level over the next several weeks. I have no interest in selling, I believe that the market continues to show bullish pressure over the longer term regardless, and with that I believe that the 1.1150 level is now going to offer a “floor” in what looks to be extreme strength.

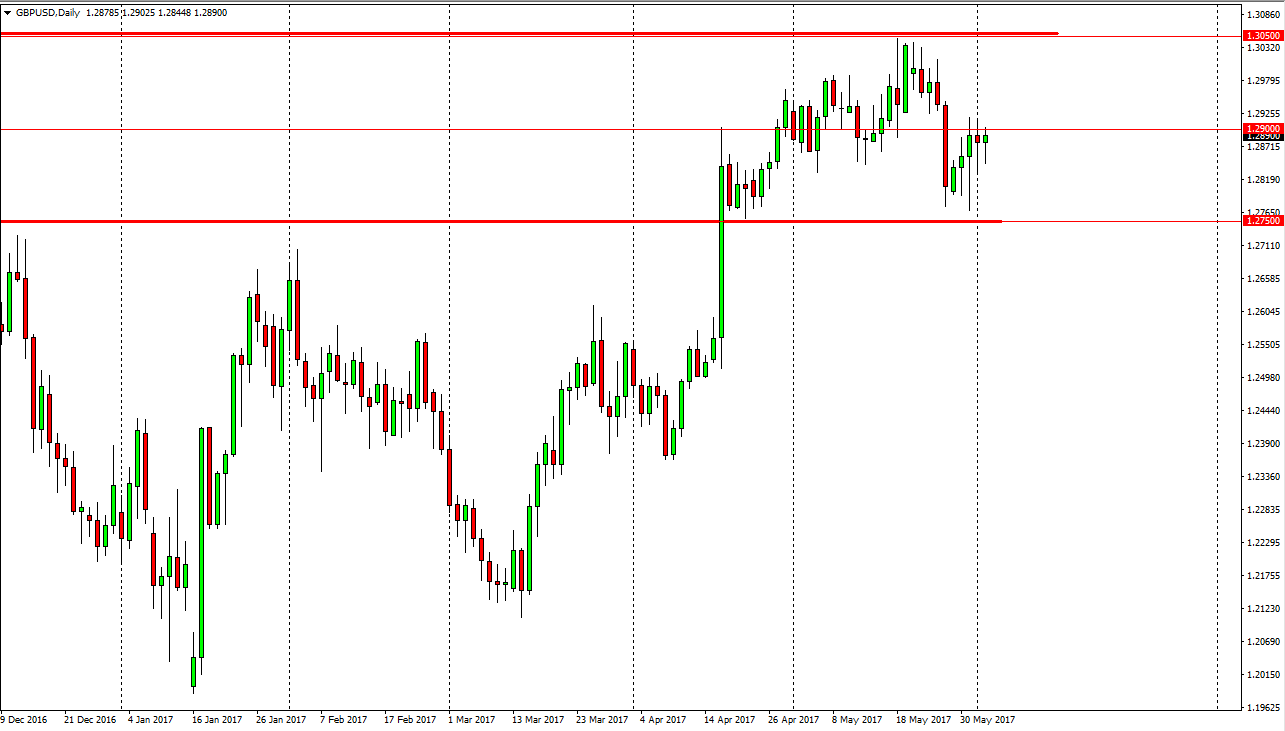

GBP/USD

The GBP/USD pair fell initially during the day on Friday, but found enough support underneath to turn around to form a hammer. The hammer was preceded by a hammer on Thursday, and I believe that if we can break above the 1.29 level, the market should then go to the 1.3050 level. A break above there should send this market even higher, perhaps reaching my longer-term target of the 1.3450 level. I also believe that the 1.2750 level underneath is massively supportive, and is essentially the “floor” for the longer-term trend. As long as we can stay above there I don’t have any interest in shorting this market, and I believe there will be a bit of a built-in “bid” to the market, and with that being the case, I believe that a short-term pullback at this point in time should be thought of as value as the British pound has bottomed in my estimation.