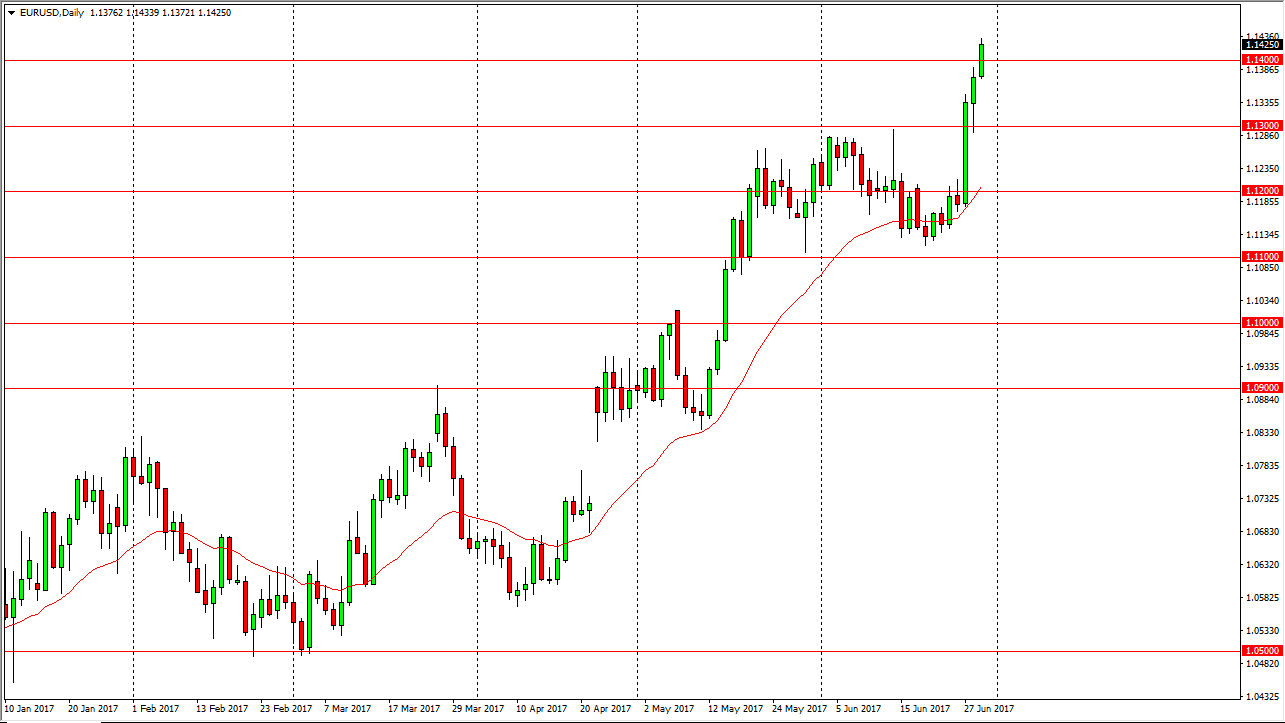

EUR/USD

The EUR/USD pair broke higher during the Thursday session, clearing the 1.14 level. This is a very bullish sign and it should send this market looking for the top of the 3 or consolidation area at the 1.15 handle above. If we can break above there, that is a major change in the longer-term trend, which should send this market much higher. Alternately, if we see some type of exhaustion and that area, it could be and I selling opportunity. The next several sessions can probably turn out to be some of the most vital over the course of the summer. I think that patients will be needed, but in the short term it looks as if the buyers are going to run this market to the upside.

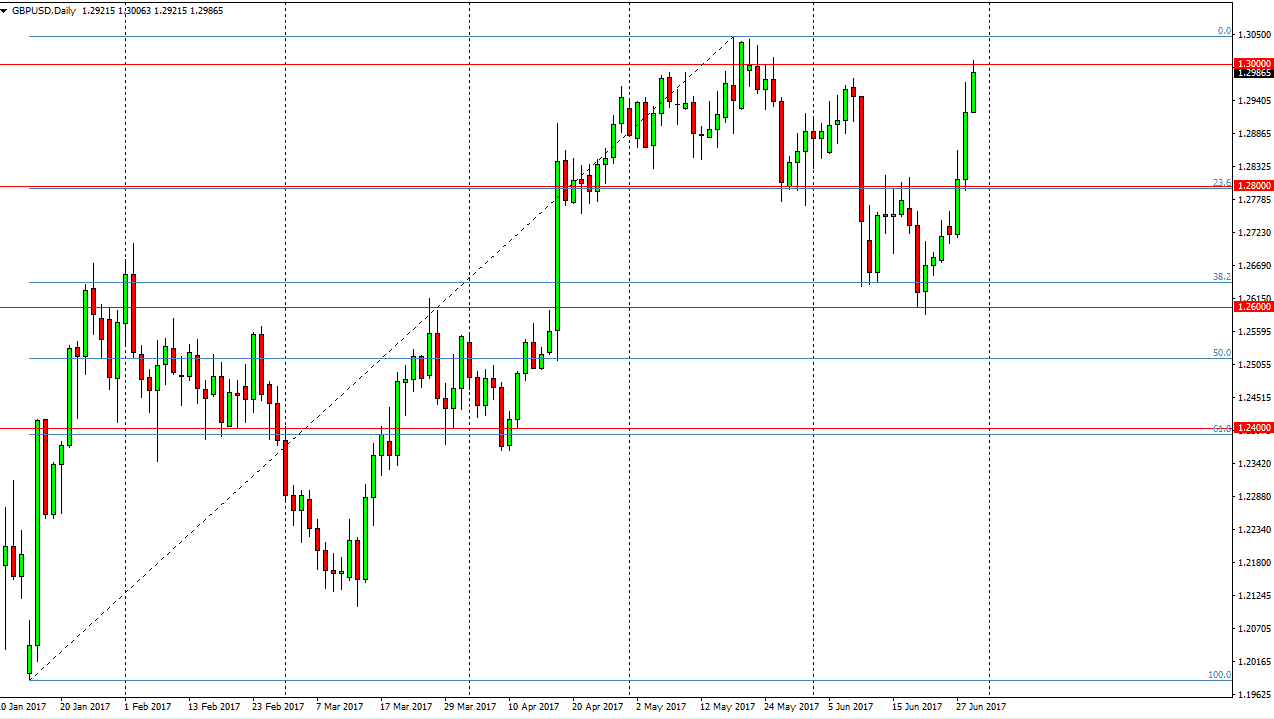

GBP/USD

The British pound rallied during the day on Thursday, reaching towards the 1.30 level. There is a significant amount of resistance just above, so if we can break above the 1.3050 level, that would be a very bullish sign, perhaps sending this market to the 1.3450 level. I think that exhaustion should be a selling opportunity, and that being the case it’s likely that the sellers are looking to get involved. However, if we break out to the upside I think that the move higher should be very massive, and it could signify a certain amount of volatility. I believe that the market should continue to be very volatile, but given enough time we should then go back down to the 1.28 handle. Either way, pay attention, this is going to be a very interesting market. The fact that we have rallied so much should be an opportunity that we could be a bit overextended, and therefore short-term pullback is very possible. I expect volatility, and keep in mind the North American traders have independence celebrations over the next several sessions, and that of course will affect liquidity at certain times.