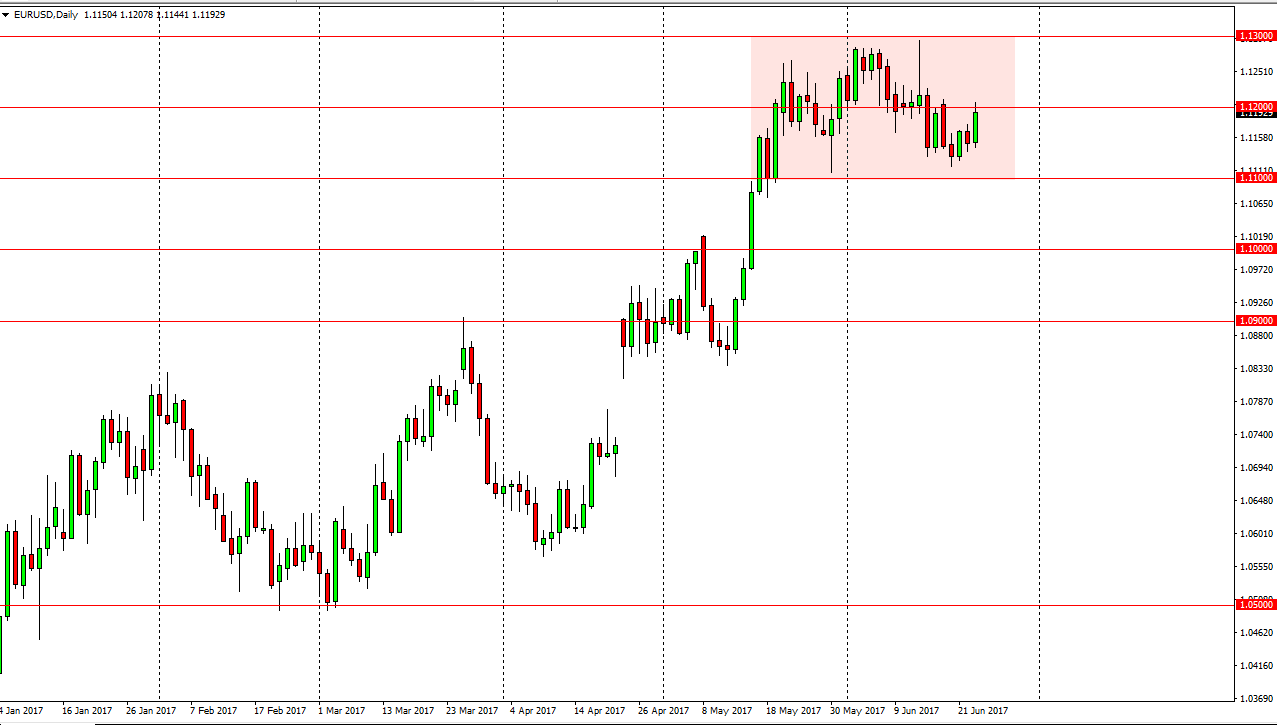

EUR/USD

The EUR/USD pair broke higher during the day on Friday, testing the 1.12 level above. That’s an area that has been both support and resistance as of late, as it is essentially the “fair value” level for this market. We have been consolidating between the 1.11 level on the bottom, and the 1.13 level on the top. Because of that, the 1.12 level is the midpoint. I think that the longer-term uptrend should continue though, so pullbacks will more than likely be buying opportunities closer to the 1.11 handle. If we could finally break above the 1.13 level, then I feel that the market is probably free to go looking for the 1.15 handle. Volatility will continue to be a mainstay in this market though.

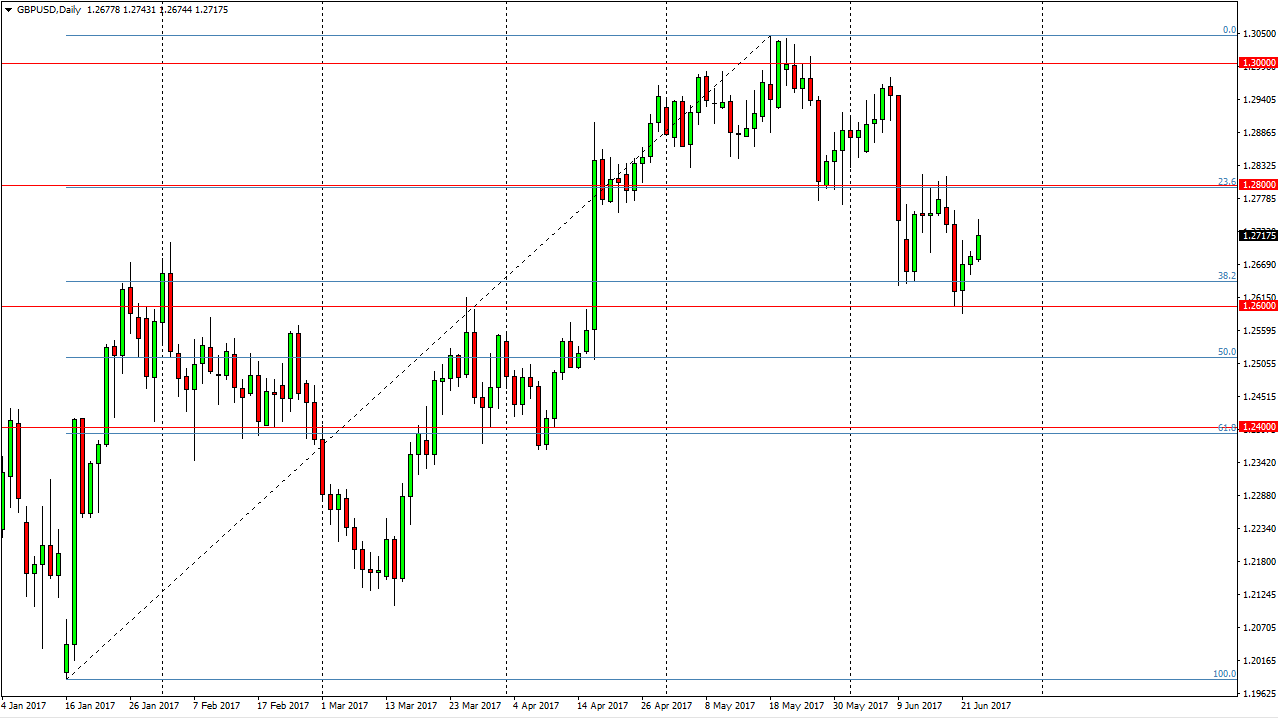

GBP/USD

The British pound broke higher during the day on Friday, testing the 1.27 level and breaking above it. I believe that the market may go looking for the 1.28 level, but it is good to take a significant amount of time to get there, as there is a lot of bearish pressure. Alternately, the 1.26 level underneath should be supportive, and that will continue to attract a lot of attention. If we did breakdown below there, the market could drive down to the 1.25 level which of course is the 50% Fibonacci retracement level. That could be the next area that buyers come back into, but in the short term it would be very negative sign. Given enough time, I think that both buyers and sellers will come back into the market and push things around in both directions. On the weekly chart, there is a hammer, so if we break above the 1.28 level, the moved to the 1.30 level is a little bit more obvious for me. Either way, it’s going to be volatile.