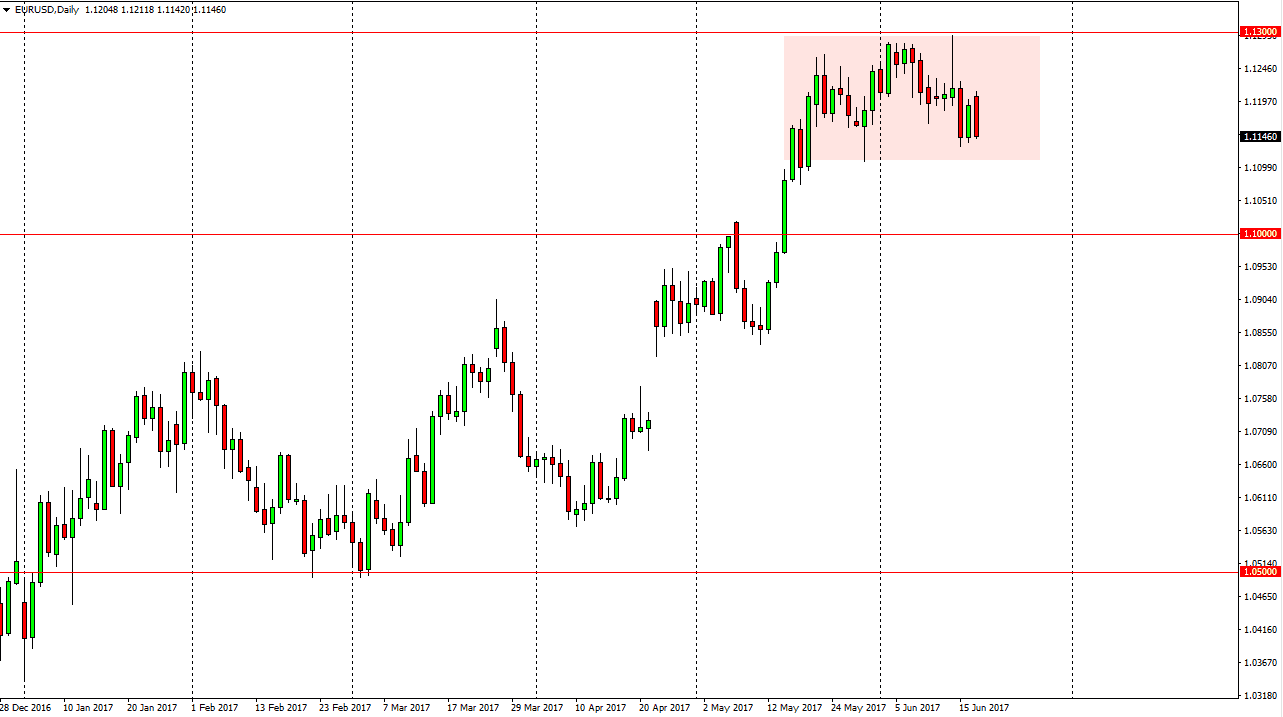

EUR/USD

The EUR/USD pair fell during the day on Monday, testing the bottom of the consolidation area that the market has been in for several weeks. Ultimately, the market looks likely to find support at the 1.11 handle, and a breakdown below there should send this market to the 1.10 level underneath. The market has continued to show bullish pressure in general, and I believe that a move to the upside will more than likely happen. However, there is a gap below that has yet to be filled, so if we were to break down below the 1.10 level, then I think the market would go looking to do just that. Longer-term, the pair has been bouncing around the below the 1.05 level on the bottom, and the 1.15 level on the top. I think there is more likely buying pressure underneath in the short-term, and therefore I think this is an opportunity present in itself.

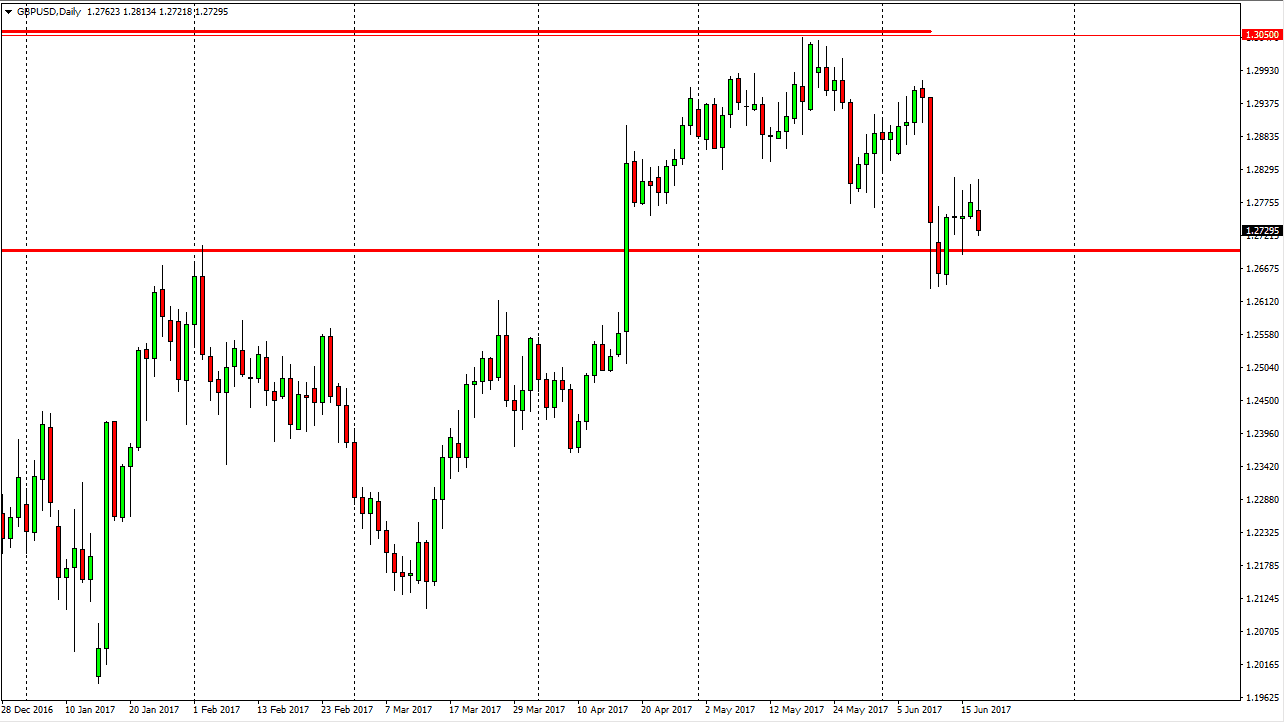

GBP/USD

The British pound initially tried to rally during the day on Monday, but turned around to form a negative candle. I think there is plenty of support just below, and it’s only a matter of time before the buyers reenter. However, if we breakdown below the 1.26 level, we could then start to see this market selloff rather significantly. That being the case, it’s likely that there is a lot of interest in the immediate area. A break above the 1.2850 level senses market to the 1.3050 level after that, and then I break above that should send the market to the 1.3450 level. I don’t have any interest in trying to place huge positions right now, I think that the volatility will continue to be a major issue, so playing it safe is probably the best route.