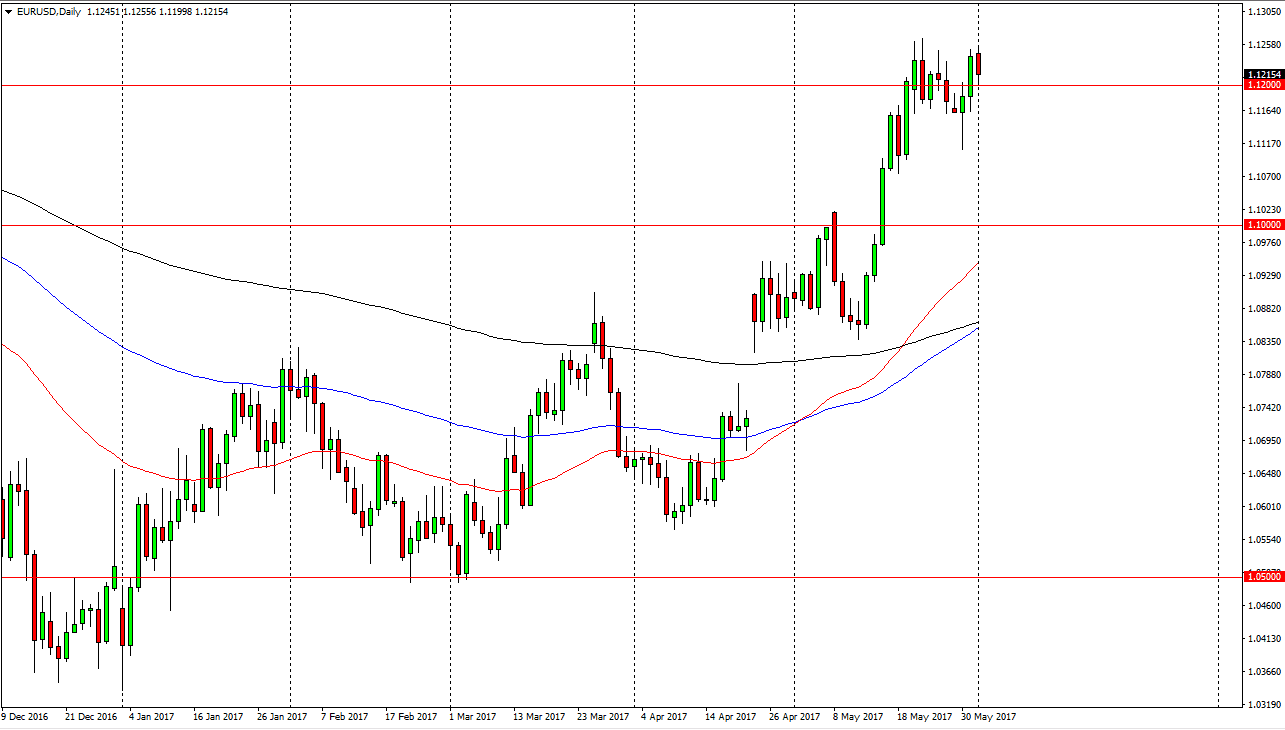

EUR/USD

The EUR/USD pair fell a bit during the session on Thursday, testing the 1.12 level. I believe there is a significant amount of support below, so the market has a proclivity to go to the hindsight. However, this is a market that tends to be very volatile during these announcements, so a pullback would not be surprising at all. Having said that, I believe that the longer-term trend to the upside will continue, and that a pullback will more than likely offer value. If we never break below the 1.12 level, that’s an extraordinarily bullish sign, and send this market much higher. I still have a longer-term target of 1.15 above, but realize that it is going to take a significant amount of time to get there. In the meantime, short-term “buying the dips” types of trades are probably going to be the majority of trades available for you.

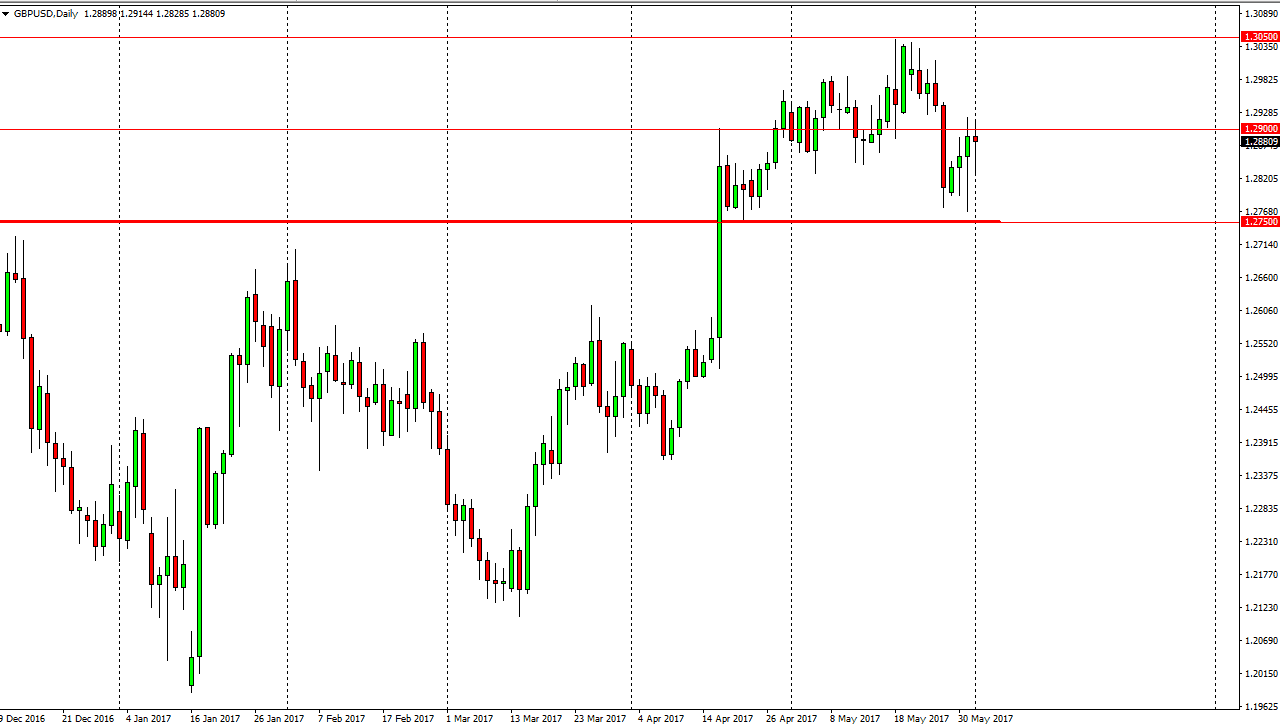

GBP/USD

The British pound had a volatile session, ultimately settling on a relatively neutral candle. We are just below the 1.29 level as I write this, and the 1.2750 level underneath has in fact offered a significant amount of support. I believe that longer-term we will go higher but today will be volatile to say the least. The 1.2750 level underneath continues to be massively supportive as it was massively resistive in the past, so I think that the market will reach to the upside, and head towards the 1.3050 level after the announcement. I don’t know if we need to fall first in order to get enough momentum, but that is what I suspect will happen. A break above that level was very bullish and send this market looking to the 1.3450 level longer term. I recognize that it is going to be very choppy and volatile between now and then, so I would keep my position size relatively small.