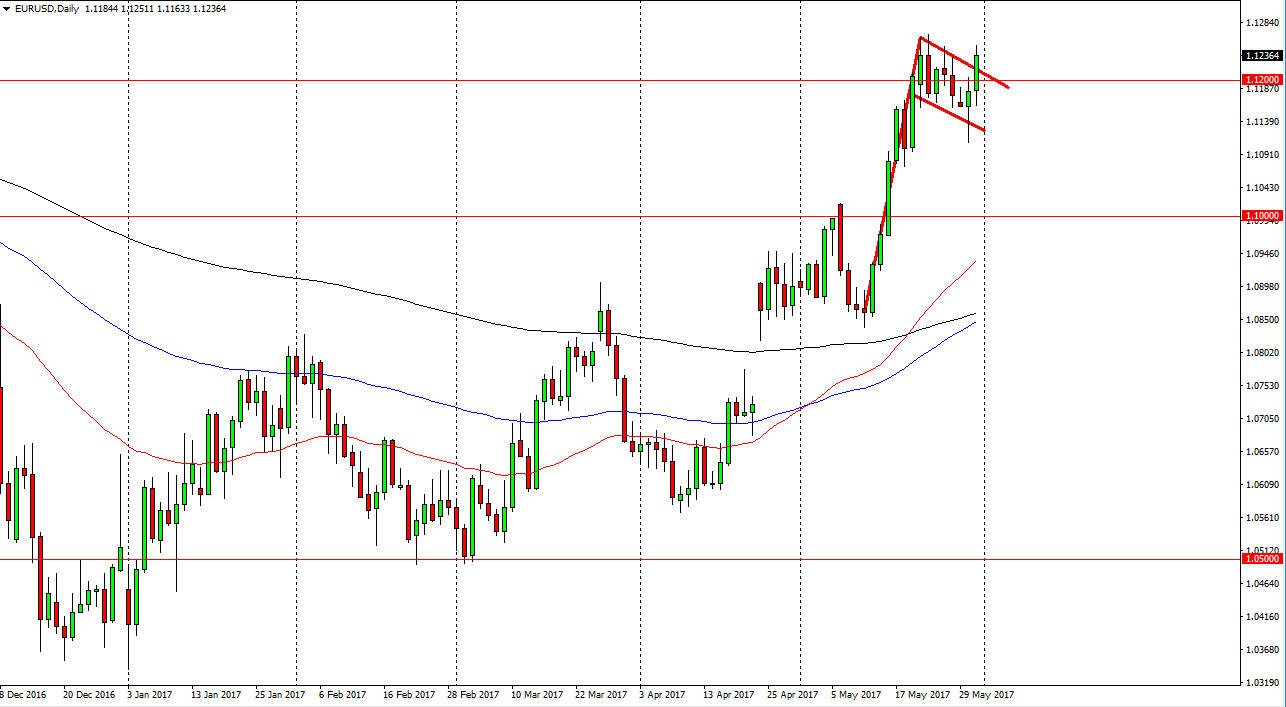

EUR/USD

The EUR/USD pair broke out during the session on Wednesday, clearing the top of the bullish flag that I have marked on the chart. Now that we are clearly above the 1.12 level and of course have broken above the top of the hammer from the previous session, the market looks likely to continue going higher. If the bullish flag does present itself to be true, the market should then go looking towards the 1.14 area. I believe that the market continues to be a “buy on the dips” type of situation, and with this in mind I am a buyer. I don’t have any interest in shorting this market, I believe that we are going to go reaching towards the 1.15 level, which is the top of the recent consolidation area between the 1.05 level and the 1.15 level that the market has been obeying for 3 years.

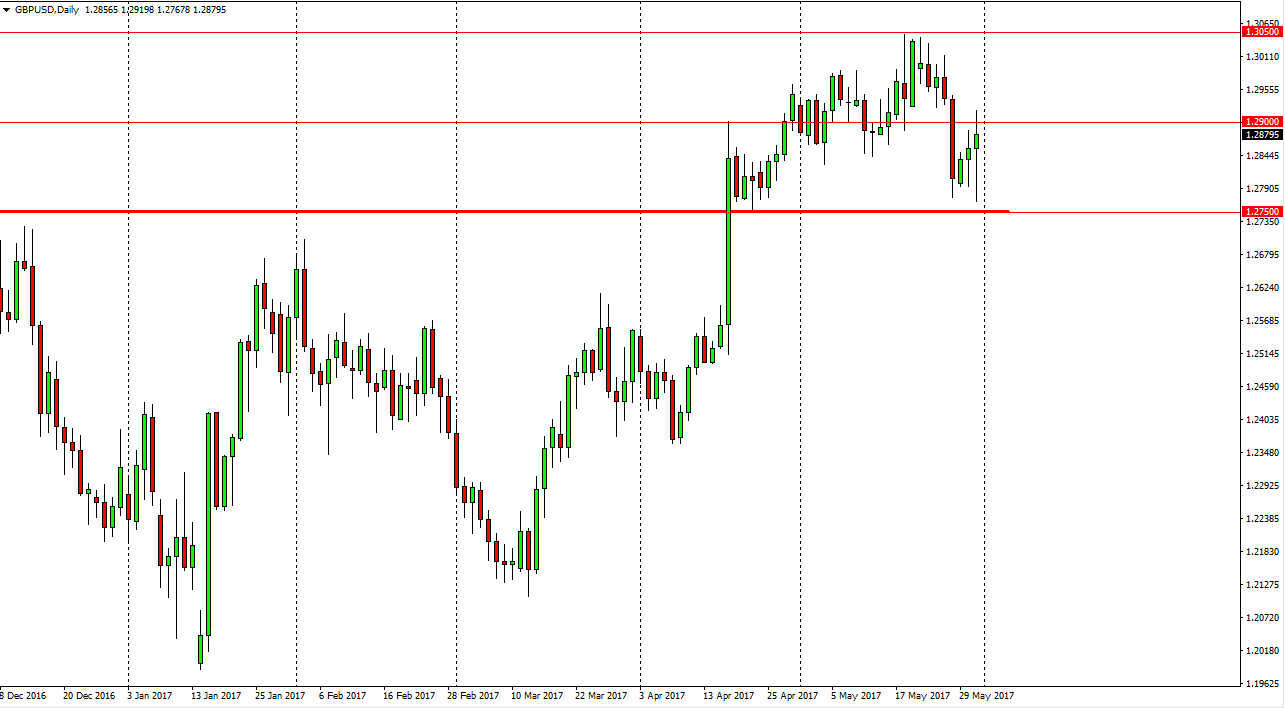

GBP/USD

The British pound went back and forth during the day, initially falling towards the 1.2750 level, and then trying to break above the 1.29 level. The market then pulled back a little bit and as a result it looks like we are trying to form some type of hammer. A break above the top of the candle is a bullish sign and should send this market looking towards the 1.3050 level above which was significantly resistive. A move above there then allows the British pound to go hunting for the 1.3450 level. That is an area that is the top of a significant consolidation area from quite some time ago, and I believe that will offer a nice juicy target that most traders will be looking for. I don’t have any interest in shorting this market until we break down below the 1.2750 level, something that does look very likely after Wednesday’s action.