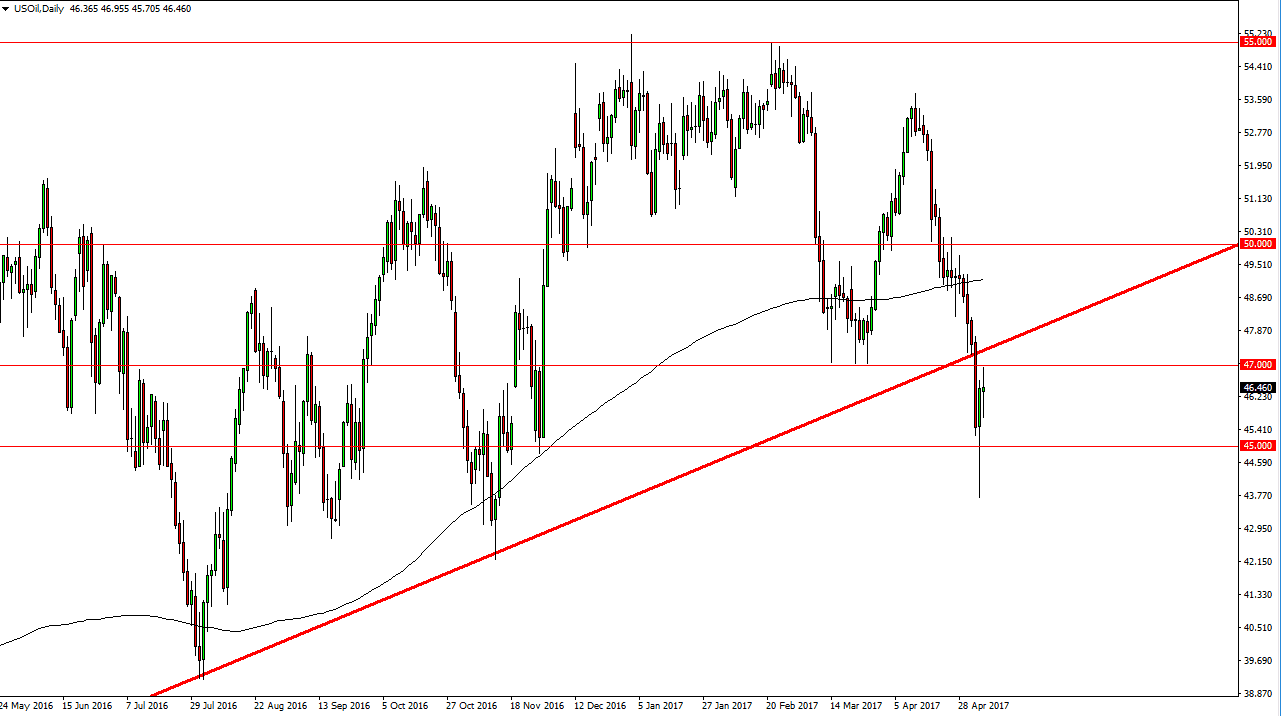

WTI Crude Oil

The WTI Crude Oil market had a volatile session on Monday, testing the $47 level above. This was an area where the uptrend line had previously crossed. Because of this, we had tested the previous support which should now be resistance, and now I believe that if we can break down below the bottom of the candle for the session on Monday, the market will go looking for the $45 level, and then perhaps even lower than that. Short-term exhaustive candle is near the $47 level could be an opportunity as well. I have no interest in buying this market, least not until we break above the $48 level, something that doesn’t look very likely. A breakdown below the $44 level should send this market much, much lower.

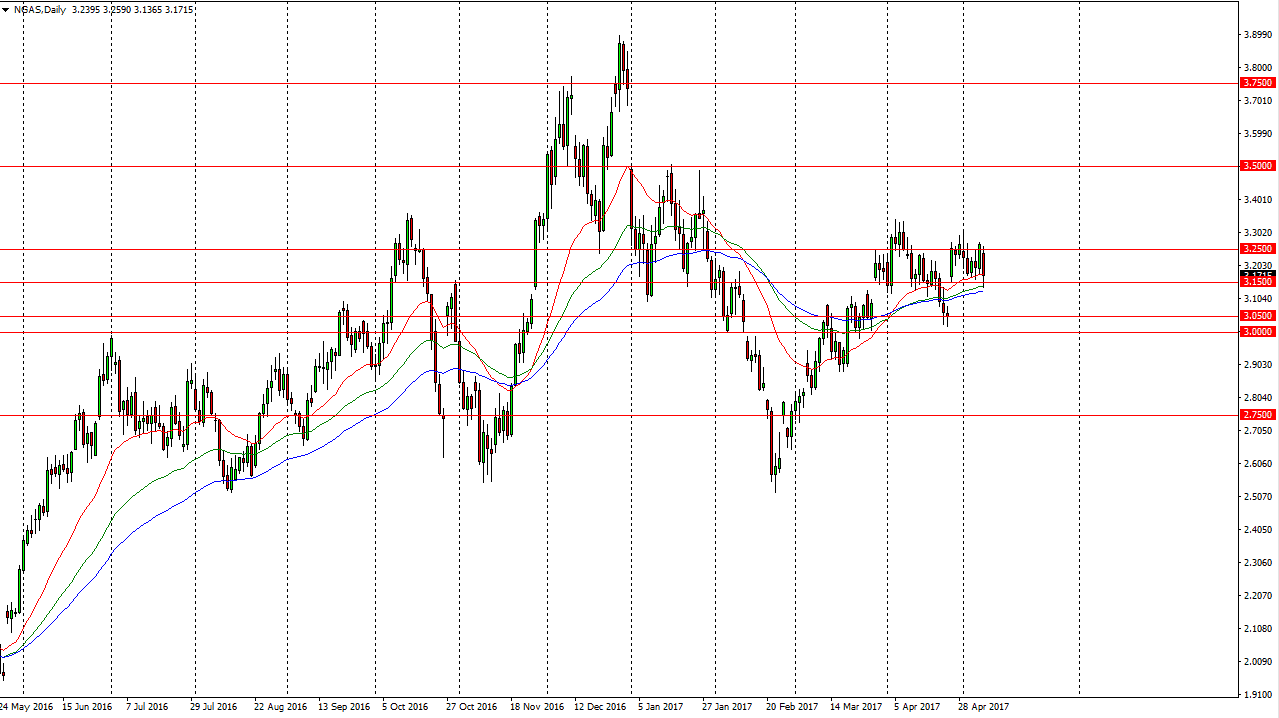

Natural Gas

Natural gas markets had a negative session during the day as well, but continue to find supporters near the $3.15 level. There are several important moving averages is just below, and more importantly a gap. The gap should offer support, but if we break down below the bottom of the daily range on Monday, I feel that the market should then go to the 3.05 levels underneath, where the gap started. A breakdown below there sends this market looking for the $3 level.

The markets continue to be very choppy and more or less short-term trading at best. The market offers nice short-term trading, but right now it’s difficult to trade this market from the longer-term perspective. I think that eventually the downward pressure will take over, but I also have to keep in mind that it’s possible that we break out to the upside. Because of this, I will watch the longer-term charts, but I recognize that the best opportunities are on the smaller side, so you will have to be nimble as you range trade this market.