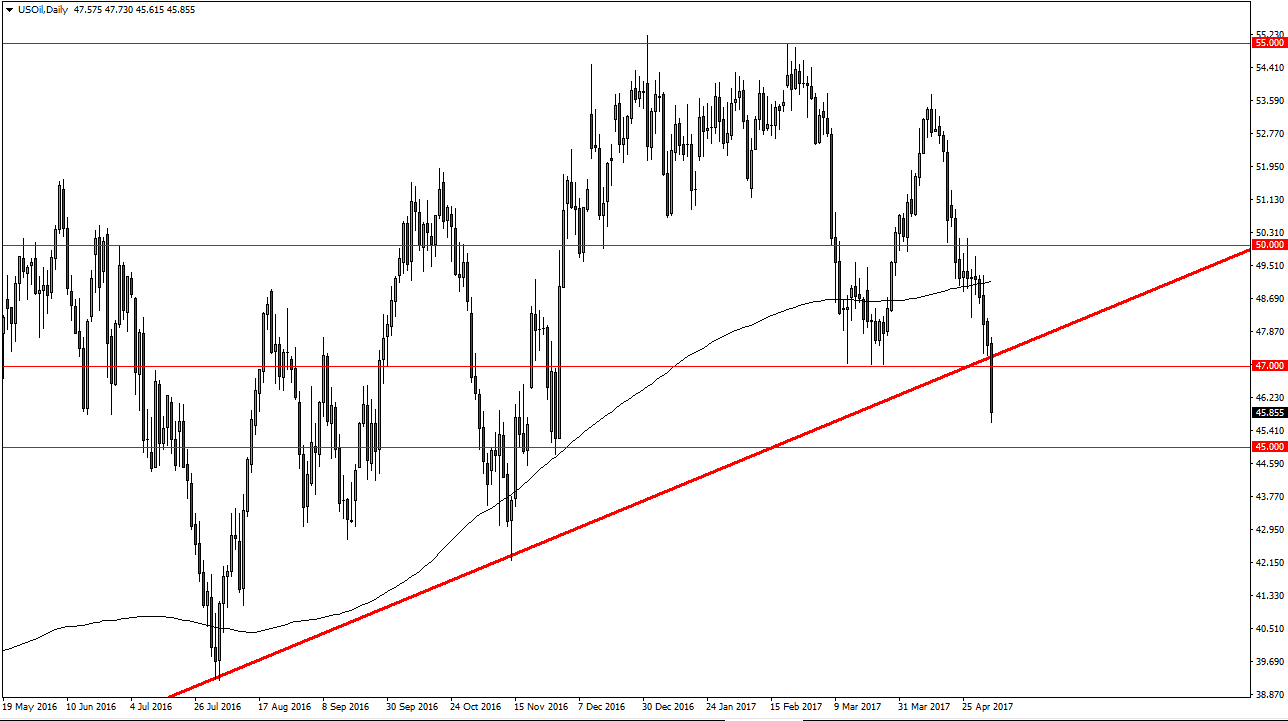

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the day on Thursday, slicing through an uptrend line that has been important. Not only that, we breakdown below the $47 level, and that of course is a reason enough to think that we will continue to reach towards the $45 level underneath. That is an area that should be supportive, but quite frankly now that we have broken down below the uptrend line, I feel that we go much lower. Short-term rallies should be selling opportunities, as the oversupply in oil continues to cause major issues. Buying isn’t even a thought, I believe that the $50 level will be a ceiling in this market.

Natural Gas

Natural gas markets tried to rally during the day but struggled at the $3.25 level. We turned around to form a negative candle, and it looks as if we are going to try to fill the gap below. If that’s the case, I would be selling underneath the $3.15 level, and even for the $3.06 handle. Alternately, if we managed to break above the $3.25 level, then we could rally but I suspect that the gap needs to be filled first to continue the move higher. If we can break down below the $3 level, then the market should continue to go even lower, perhaps reaching towards the $2.90 level under that. Ultimately, I think that this market continues to see volatility but I must question whether the seasonality is starting to slip into the market again as temperatures warm in the United States. With this, I think there’s a built-in amount of bearish pressure of the market, so while we could rally, I think there’s always going to be a certain amount of doubt when it comes to the viability of a natural gas rally.