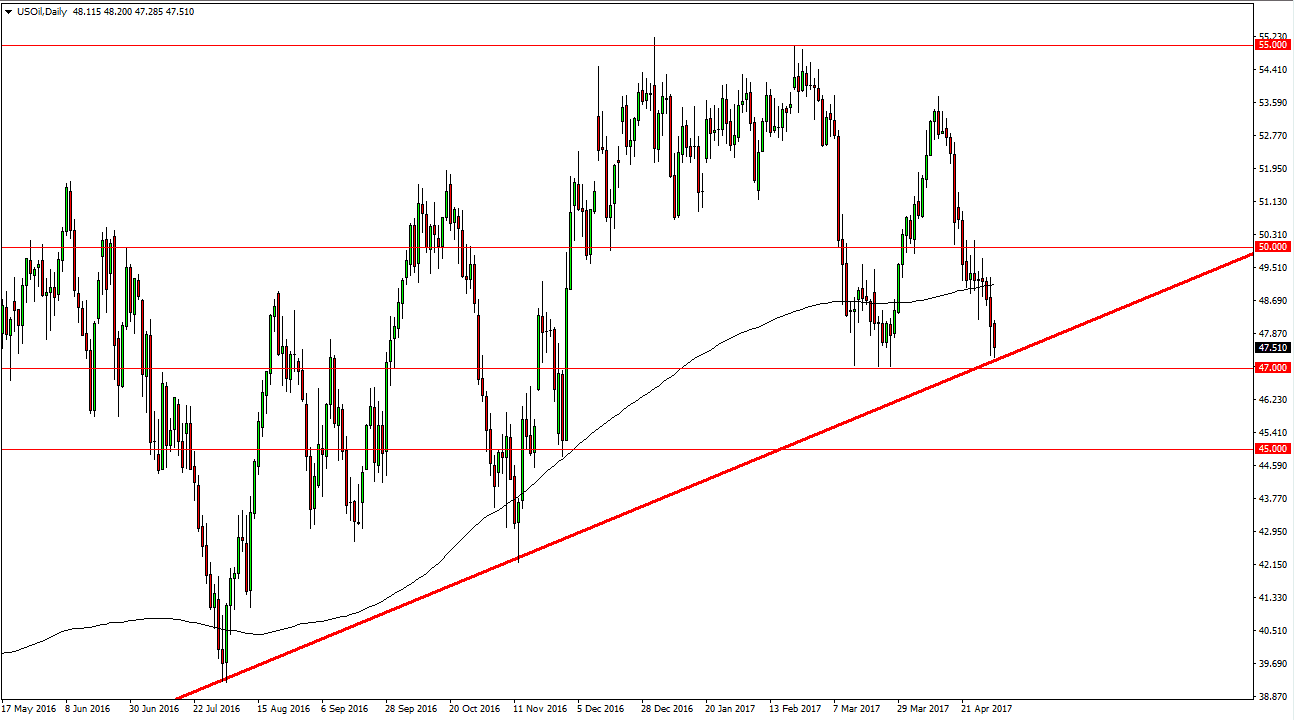

WTI Crude Oil

WTI Crude Oil markets continued to sell off during the session on Wednesday, testing a massive uptrend line. This uptrend line meets the $47 level just below, and because of that I believe that the market will accelerate to the downside if we can break down below the $47 handle. At that point, I would anticipate that the market reaches towards the $45 level. The fact that we closed towards the bottom of the candle suggests to me that it’s likely to happen. However, I’m not willing to short this market until we breakdown below the $45 level, which would be a significantly bearish signal. In the meantime, we could rally from here but I think that the selling pressure above will continue, and therefore offer short term selling opportunity based upon failed rallies.

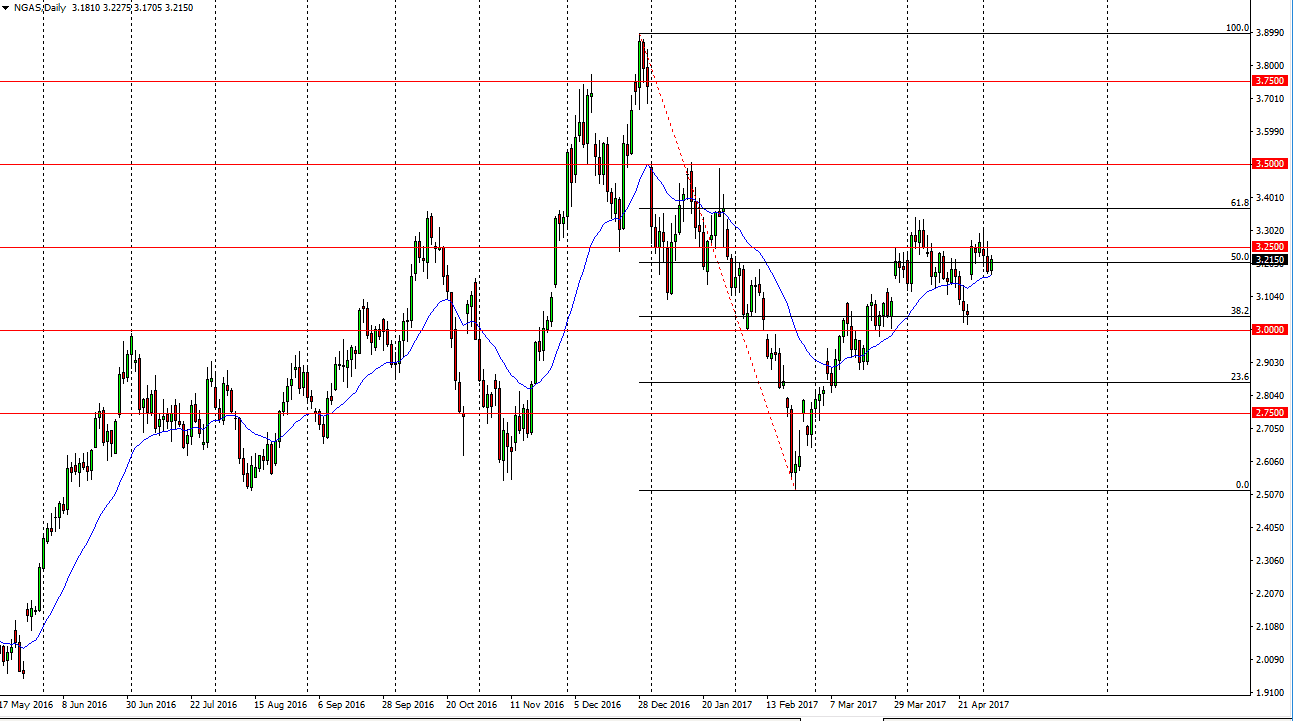

Natural Gas

Natural gas markets rallied a bit during the day on Wednesday, as we continue to see bullish pressure in a market that has gapped twice recently. Because of this, I still prefer going long, but I recognize that it is going to be very choppy. If we breakdown below the $3.15 level, we would probably drop to fill the gap, and that could offer short term selling opportunity, but that’s about it. It’s really not until we breakdown below the three dollars level that uncomfortable selling for a longer-term move. That being said, I’m not expecting much in the way of impulsivity over the next couple of sessions. I think we are going to continue to hover the $3.25 level, grinding back and forth on both sides of that handle. This is a market that short-term range bound trading will probably work out best in, so therefore if you have the ability to treat short-term charts, this might be a good place to do that.