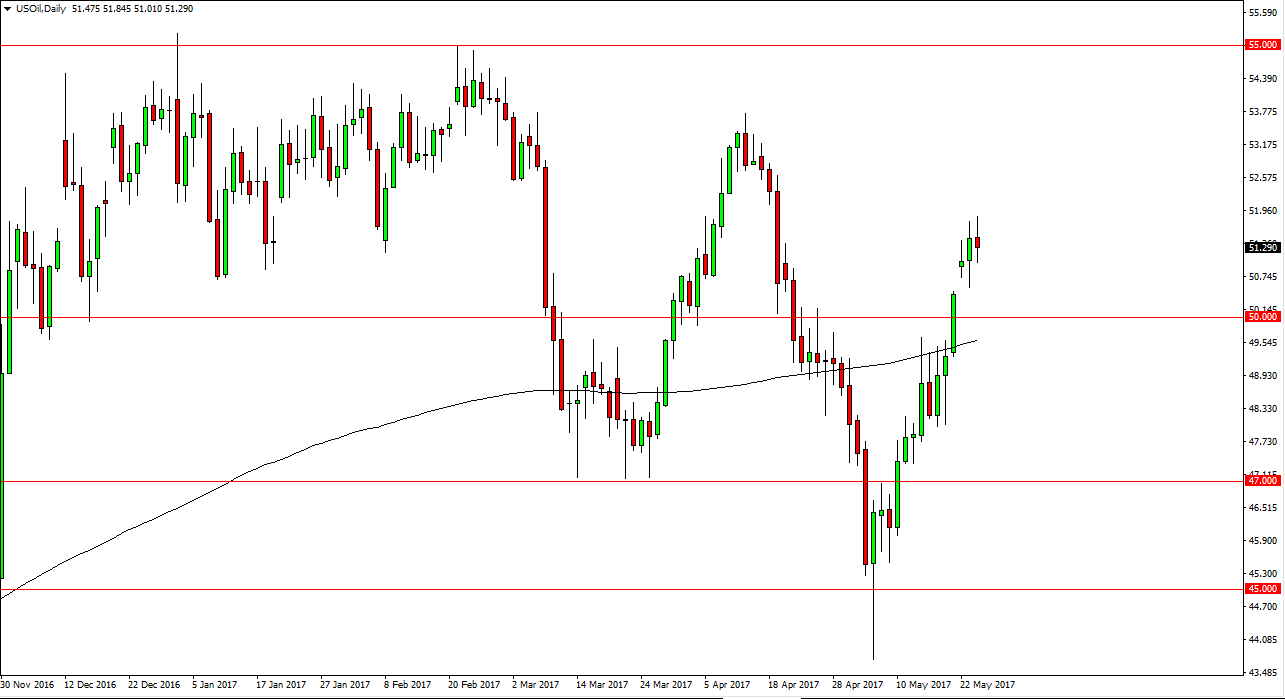

WTI Crude Oil

The WTI Crude Oil market continues to grind sideways, as the market looks likely to continue to go sideways until we get the announcement coming out of OPEC as far as production cuts are concerned. I believe that we could get a “sold on the news” type of situation, but if the cuts and production timeline is much longer, it’s likely that the market could continue to go higher. Ultimately, I believe that the next couple of sessions will be very difficult, but it’s likely that the longer-term situation will present itself as the higher price goes, the more likely American and Canadian drillers continue to extract oil from shale. Longer-term, we still have an overhang, but I believe that the next couple of sessions could go to the upside if the announcement is more bullish than expected.

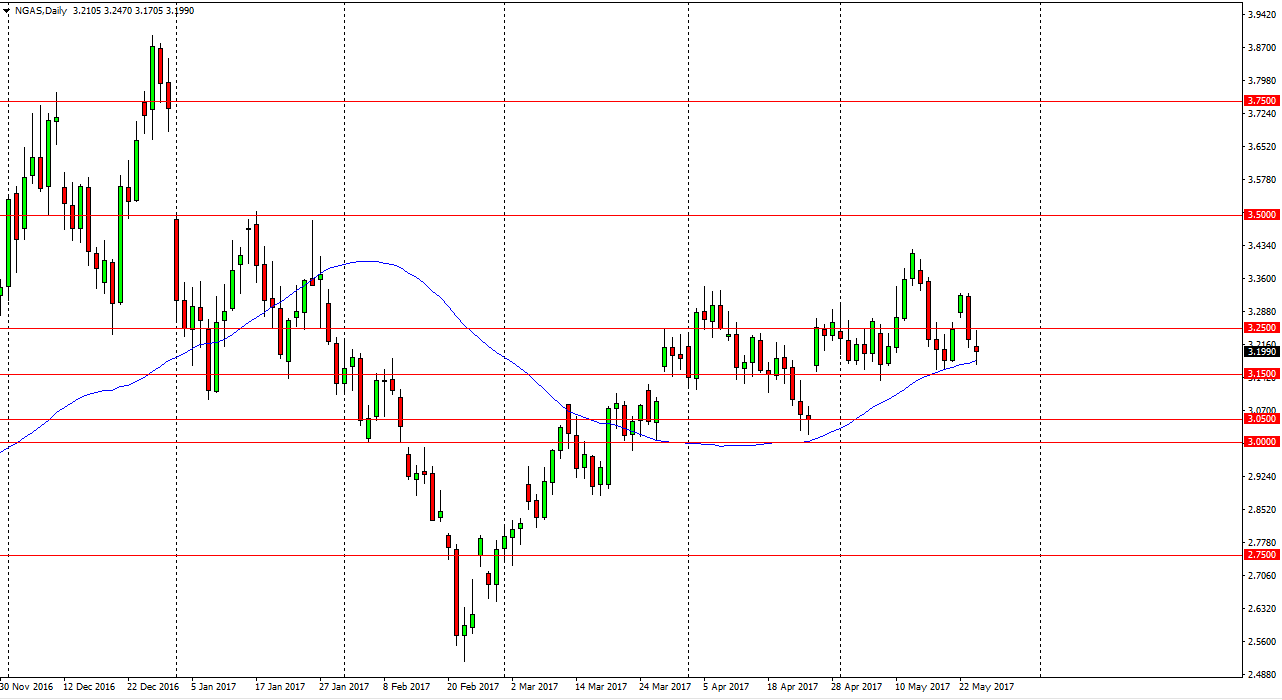

Natural Gas

Natural gas markets continue to go back and forth, as the Wednesday session was a bit choppy. We remain supported at the $3.15 level. Ultimately, I believe that level will continue to hold of support, but if we did breakdown below there the market will reach down to the $3.05 level below which would fill the gap. Alternately, if we can break above the $3.25 level, the market should then go to the $3.33 level. A break above there can send this market looking to the $3.40 level. Longer-term, we have seen a bit more of a bullish position that I bearish one, as the market has tried to grind higher. Ultimately, we could try to break above the $3.50 level, and that would fill the gap from the beginning of the year, reaching towards the $3.75 level. Ultimately, this is a market that will probably be easier to trade from the short-term, as the choppiness will continue.