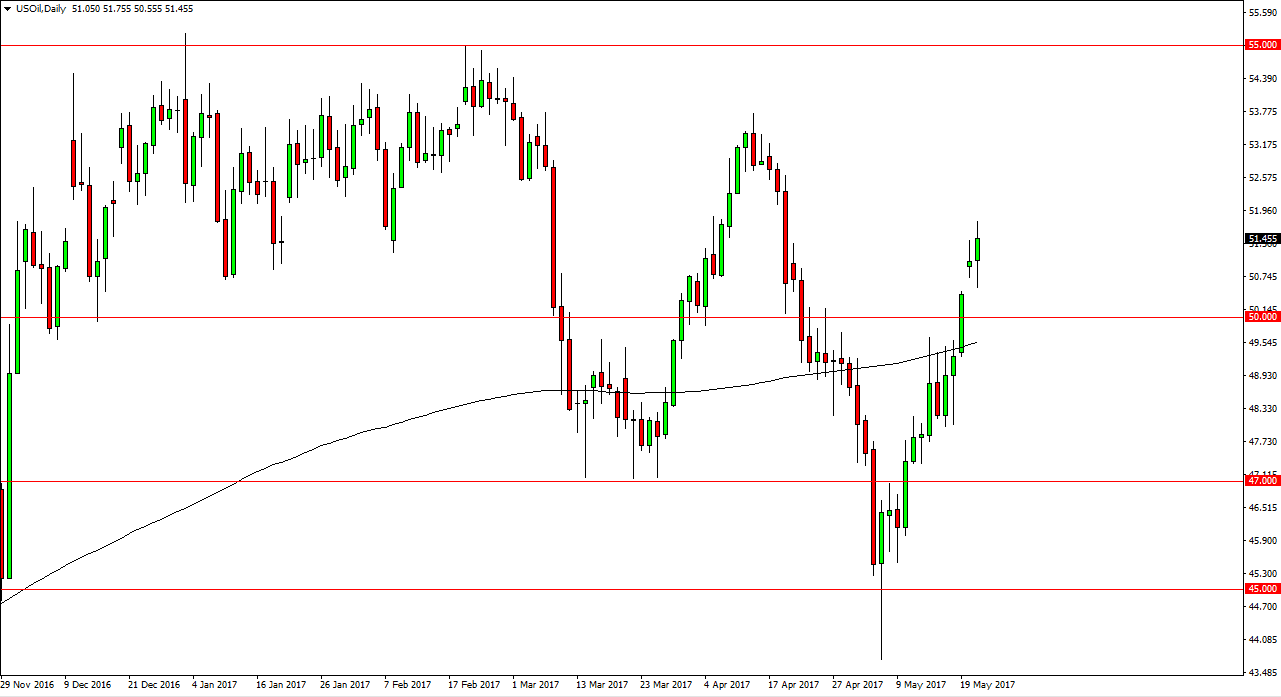

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Tuesday, but found the bottom of the gap supportive as one would expect, and then bounced significantly. We have a massively important OPEC announcement coming out after the meeting on Thursday, and while the market expects production cuts, I believe that we could have a bit of a “sell on the news” event on that day. Nonetheless, if the cut is stronger-than-expected, then I believe that the $50 level will offer support. Between now and then, it’s probably best to stay away from this market as although there is an upward bias, I have a hard time believing it’s going to be easy to hang on to any gains until we get more clarity.

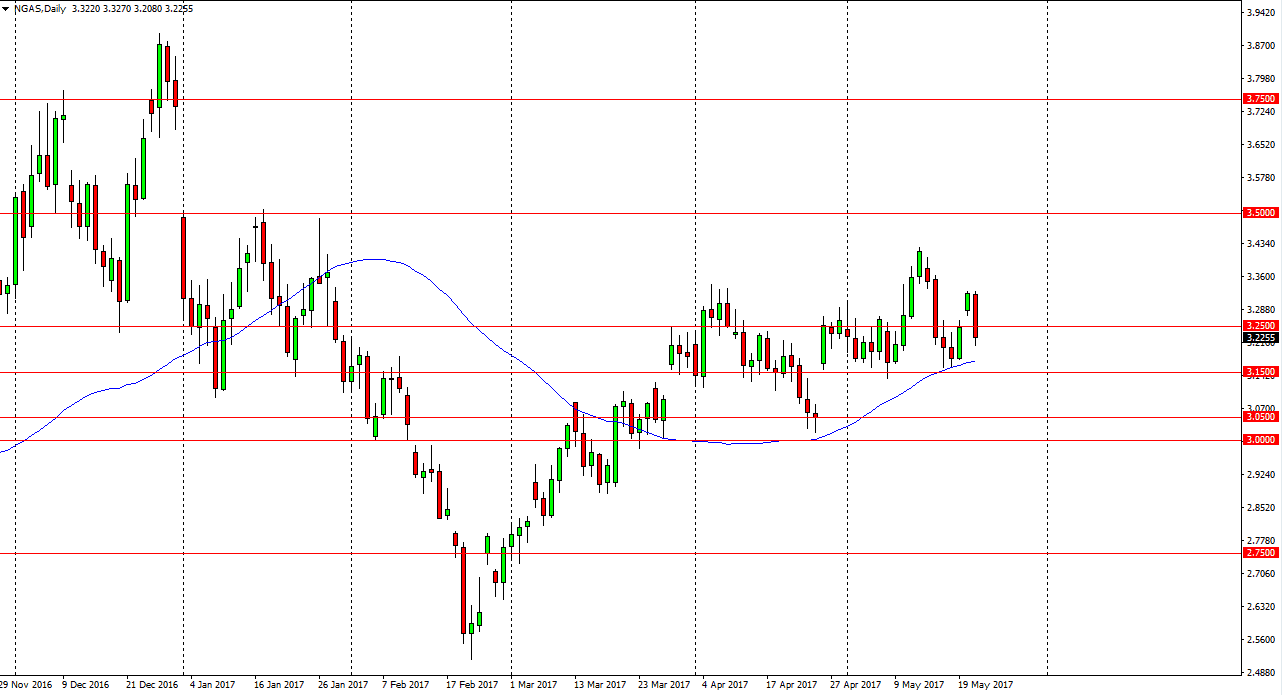

Natural Gas

Natural gas markets fell significantly during the day on Tuesday, breaking through the $3.25 level. However, the $3.15 level underneath offers a significant amount of support, but if we can break down below there, it’s likely that the market will have to go down to the $3.05 level underneath as it would have to fill the gap. Alternately, if we bounce in their I expect to move back towards the $3.33 level, either way is can be very volatile as natural gas is starting to head out of season, as warmer temperatures come into the United States. There are a lot of moving parts at the moment, and what OPEC decides will of course possibly affect the demand picture for natural gas, as an alternative fuel source for business.