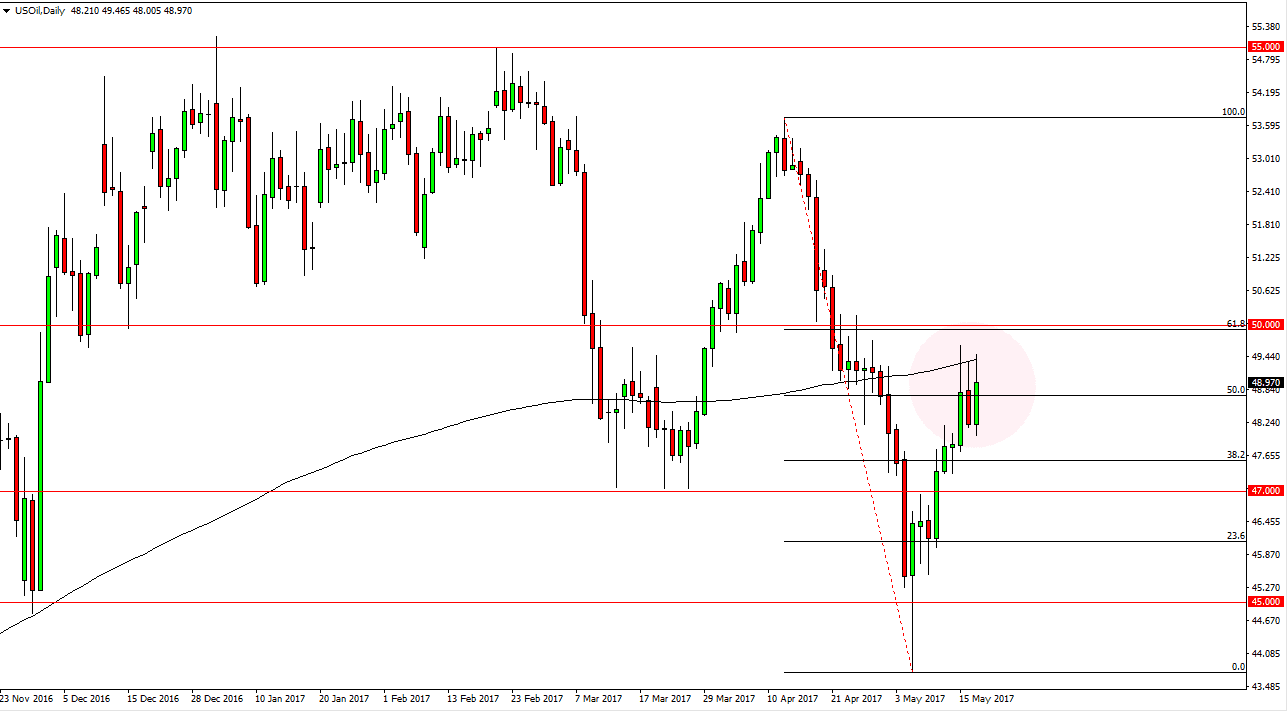

WTI Crude Oil

The oil markets rallied during the session on Wednesday, as we tested the 200-exponential moving average yet again. We got bullish inventory numbers, but you can see that we got a bit of pushback at that area, so having said that it’s likely that we will continue to struggle. At this point, I need to see the market close on a daily chart above the $50 level to feel comfortable buying. That’s not to say that I think we’re going to fall apart here, I just think that the market is looking a little bit strange in this area, as you would think the numbers today could have pushed things much higher. If we break the bottom of the range for the day on Wednesday, then I think the market goes looking to the $47 level for support.

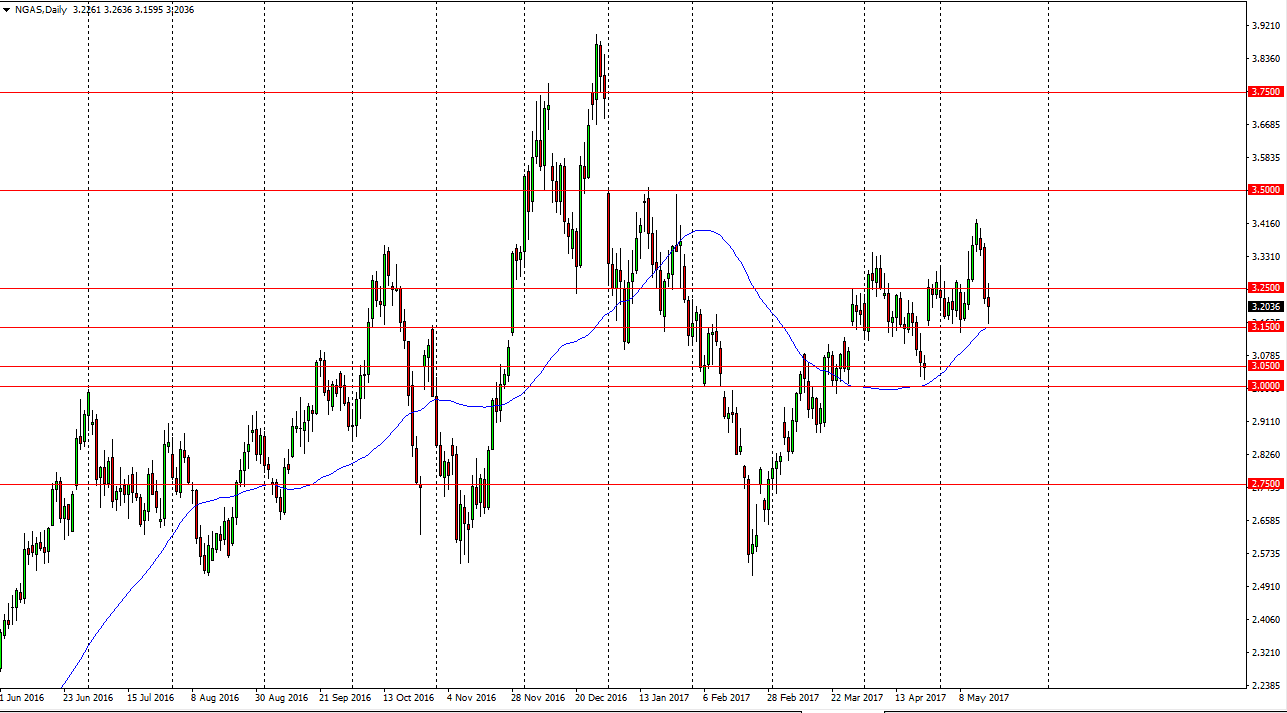

Natural Gas

Natural gas markets had a volatile session as well, touching the $3.15 level underneath. That area offered enough of a bounce to turn things around, and of course we have the 50 day exponential moving average touching that level as well. Because of the way the market in did, I suspect that this candle is now a trigger for a bigger move. If we can break above the top of it, I think we go fishing towards the top of the recent range again. Alternately, if we can break down below the $3.15 level, the market will then go looking to fill the gap below, which should extend the losses down to the $3.05 handle. I am a longer-term seller if we can break below the $3 level, but I don’t think that’s going to happen as the gap should offer support. This market does tend to be very volatile anyway, so I think were about to see fireworks in the natural gas bits.