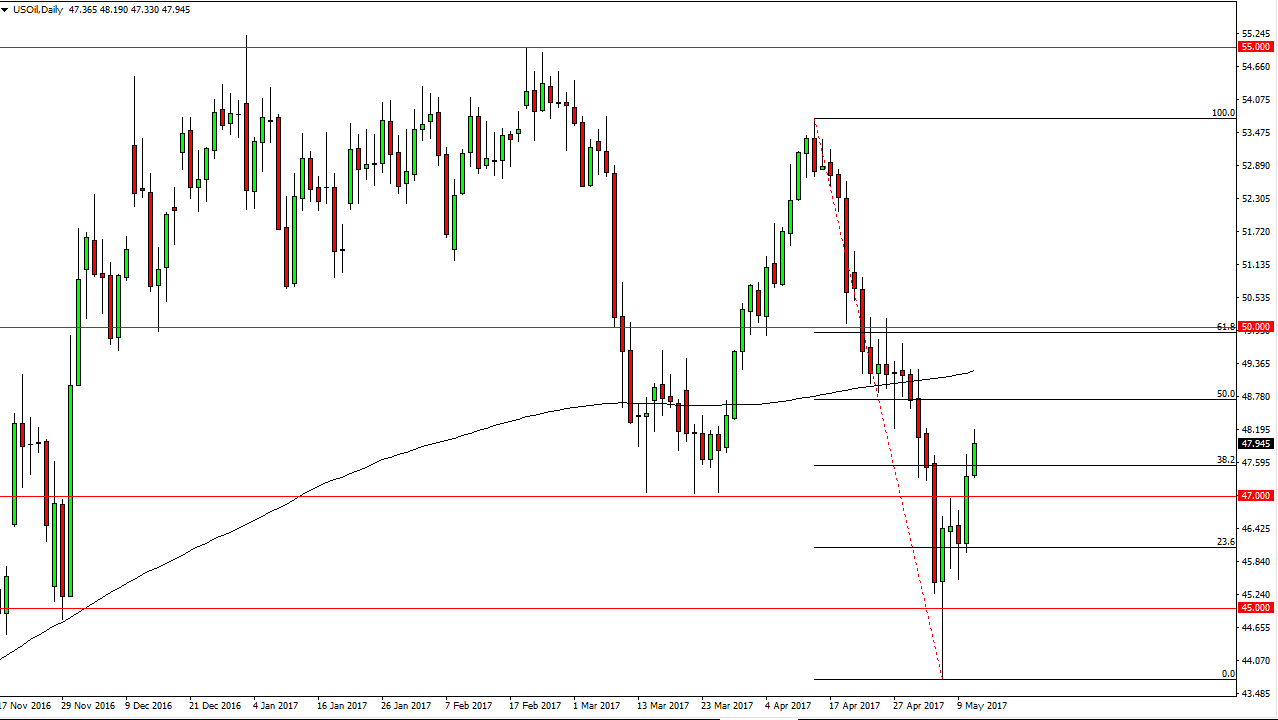

WTI Crude Oil

The WTI Crude Oil market rallied on Thursday, breaking above the $47.50 level. I think that the market is going to run into a bit of resistance in this general vicinity, and I am still waiting to see and exhaustive candle that I can start selling. Ultimately, I think that the market should then reach down to the $47 level, and then $45. However, I do recognize that there is quite a bit of bullish pressure, so I think it’s only a matter of time before the buyers make another attempt. I’m not willing to buy this market currently, least not as long as we are below the black 200 exponential moving average on this chart. I think that this window been and I selling opportunity, but I need to see a candle that tells me it’s time to do so.

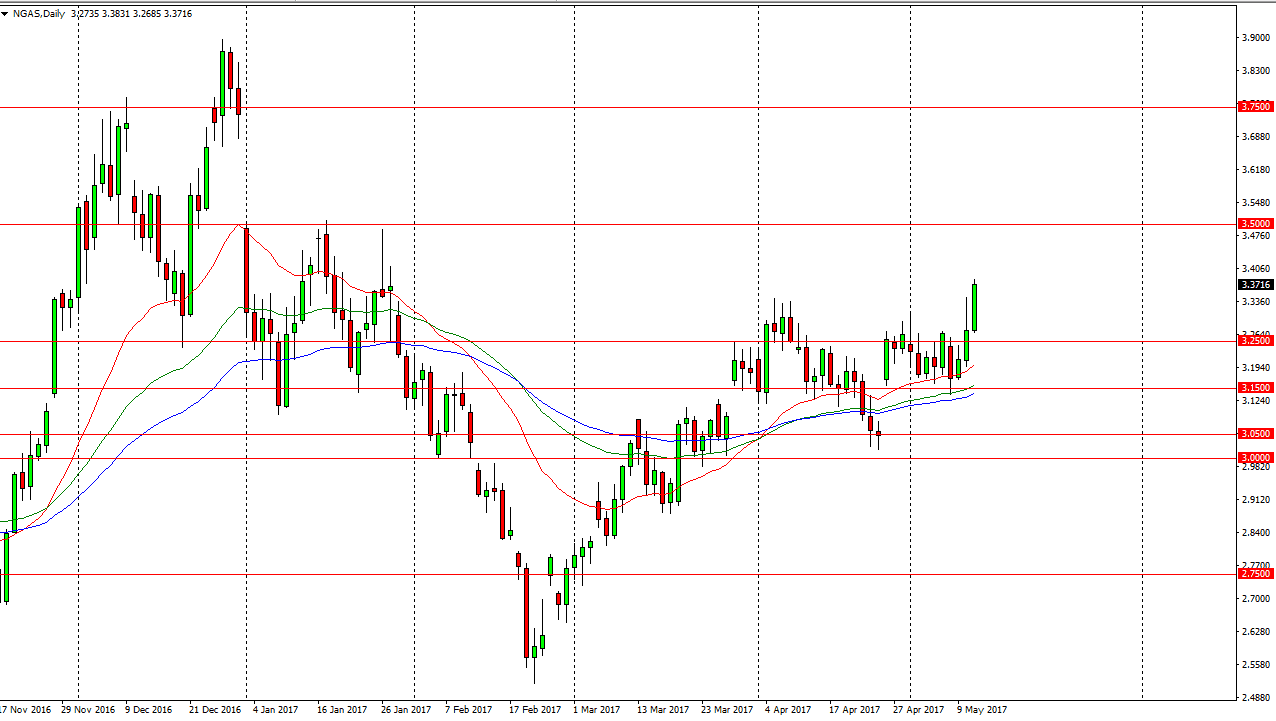

Natural Gas

The natural gas markets broke above the $3.33 level during the session on Thursday, showing signs real strength and I think we may go looking for the $3.50 level which will be more resistive. In the meantime, I think short-term pullbacks that show signs of support will be buying opportunities in a market that has clearly broken out to the upside. The moving averages are starting to turn up words, so that shows that the momentum is starting to stick. I don’t if we can break above the $3.50 level yet, but I think that the market is certainly looking to try to get there. The candle looks very bullish from the session, as we closed towards the top. I have no interest in shorting the natural gas markets now that I have seen this move. The $3.25 level underneath should continue to be massively supportive as well.