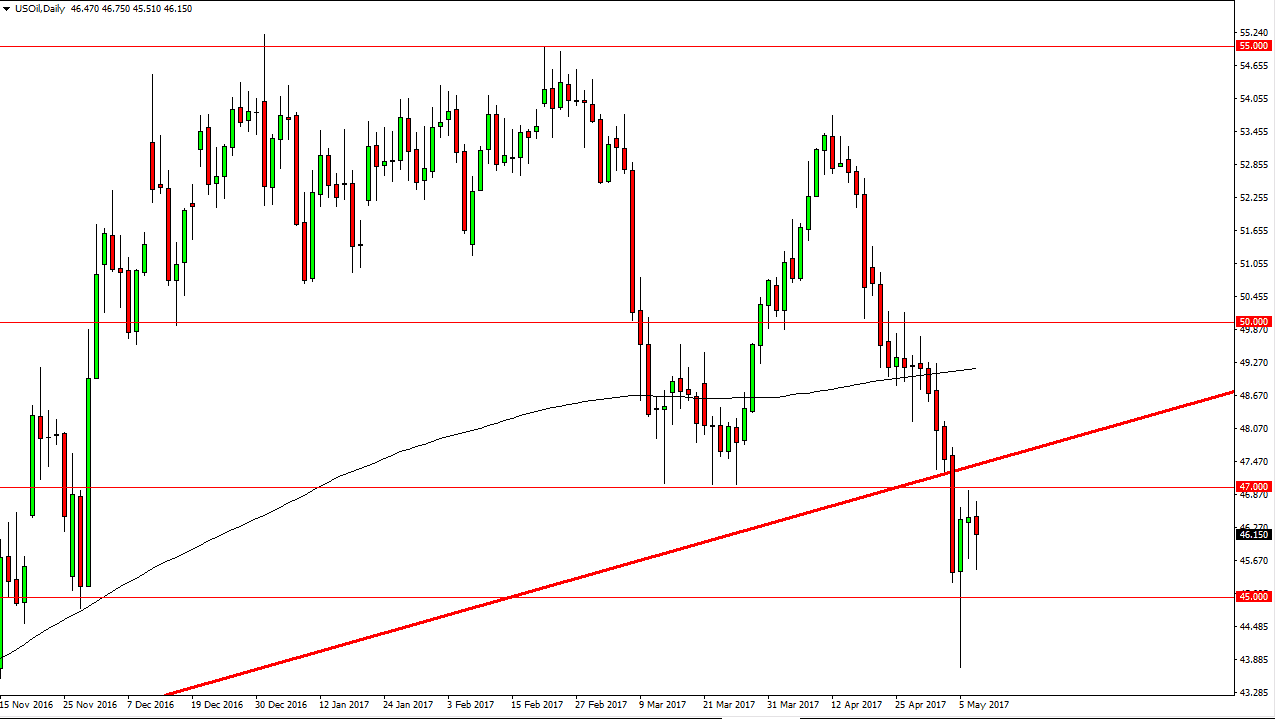

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Tuesday, dropping initially, but finding buyers late in the day. This makes quite a bit of sense though, because we have the Crude Oil Inventories announcement coming out. That will have a massive effect on this market, but the previous uptrend line should now offer resistance as it has so far, as well as the $47 level. I believe that the rallies at this point should be nice selling opportunities, but the announcement will probably be the catalyst for any type of exhaustion. The $45 level underneath should be the first target to the downside, and then the $44 level after that. I believe that the overhang and the oversupply should continue to be an issue in this market.

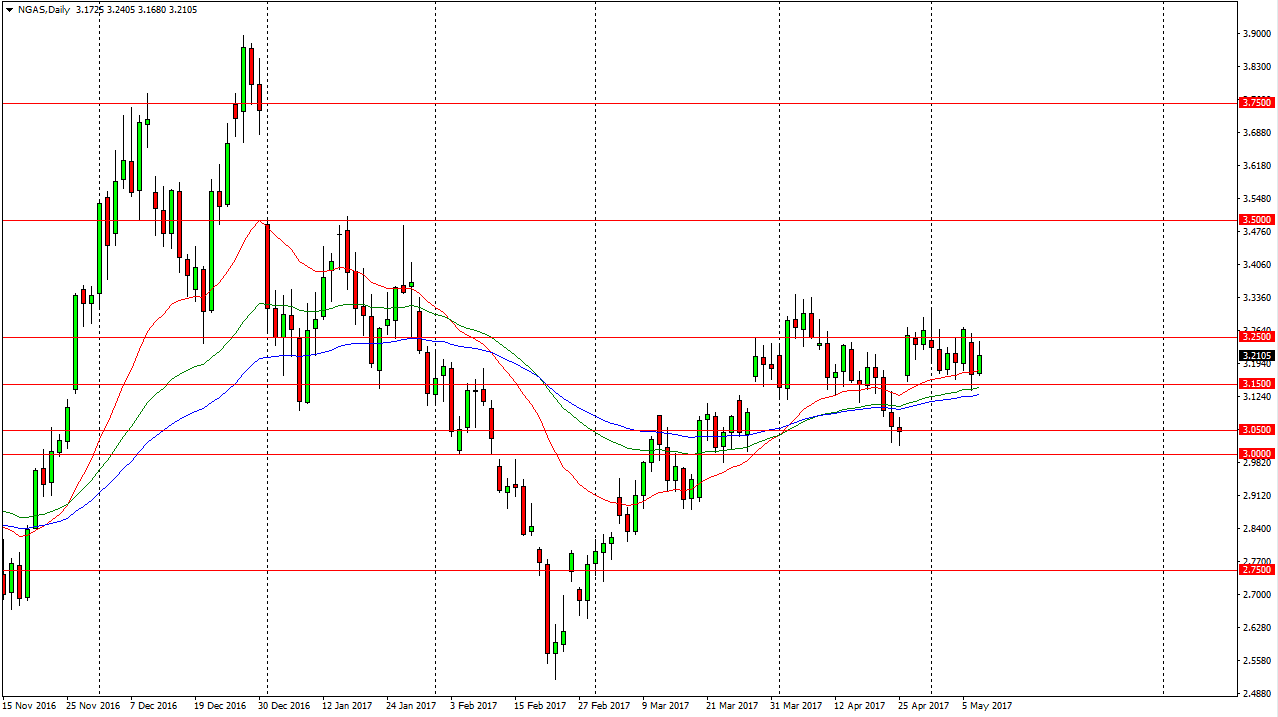

Natural Gas

The natural gas markets went back and forth during the session on Tuesday again, as the $3.15 level on the bottom continues to offer support, and the $3.25 level above continues to offer resistance. The market continues to be choppy, and of course range bound. Ultimately, the market should continue to be a short-term affair, as I don’t see much in the pipeline to move the market. There is a massive gap underneath that should continue to be interesting for the markets and of course supportive, but typically they do get filled. So, if we can break down from here I think that the market will then go to the $3.05 level. A break above the $3.33 level should send this market much higher. In the meantime, I think back and forth range bound trading systems are probably about as good as this market gets, on short-term charts. It should be said that overall there seems to be a little bit more uptrend pressure than downtrend.