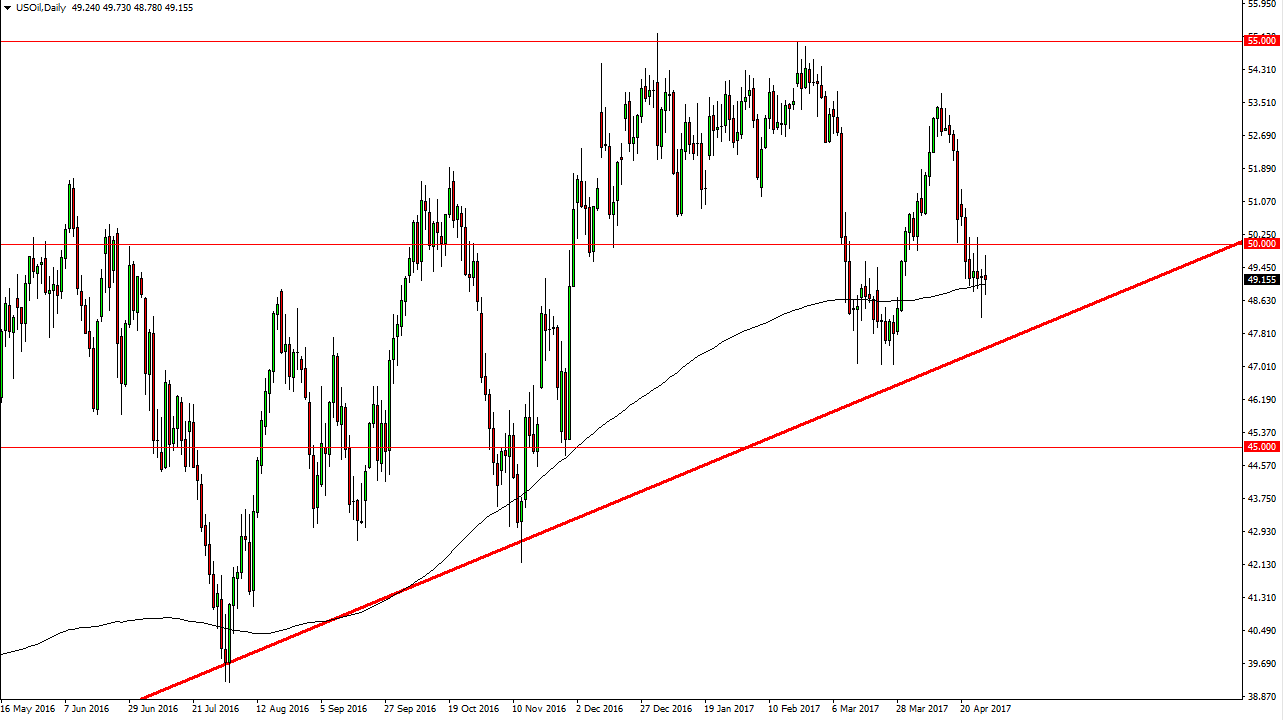

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the session on Friday, but found enough resistance just below the $50 level. The market has turned around to form a neutral looking candle, but the weekly candle is a bit of a hammer. If we break down below the bottom of the hammer, the market could very well find itself going much lower, perhaps reaching towards the $47 level and then the $45 level after that. If we can break above the shooting star from the Wednesday session, which is essentially the $50.25 level, the market could go much higher, perhaps reaching towards the $53 level at that point. Either way, I suspect there’s going to be quite a bit of volatility in the market, as we must make what I think will be longer-term decisions rather soon.

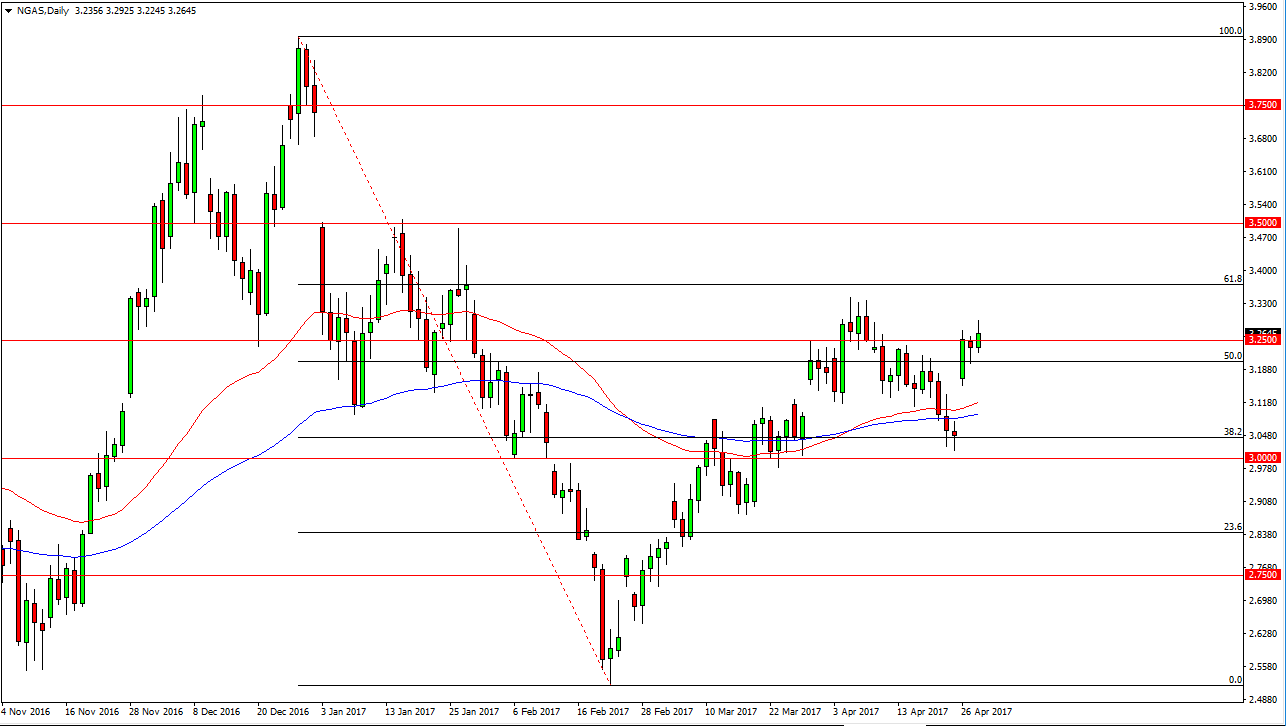

Natural Gas

Natural gas markets rallied on Friday, clearing the $3.25 handle. That’s a very bullish sign, and it looks as if the market will probably try to reach towards the $3.33 level above. That’s an area that had caused quite a bit of resistance, and getting above there would be a very bullish sign. At that point, I anticipate that the market will probably reach towards the $3.40 level above, and then the $3.50 level after that.

On the other hand, we could break down below the hammer from the Thursday session, and that would be a very negative sign but I think that there is a massive gap in the market, and that gap could be an excellent place to pick up value in a market that seems to be so bullish all the sudden. I think that the market will continue to be very choppy and volatile, but given enough time I think it’s only a matter of time before the buyers come out on top as market forces continue to focus on exports from the United States.