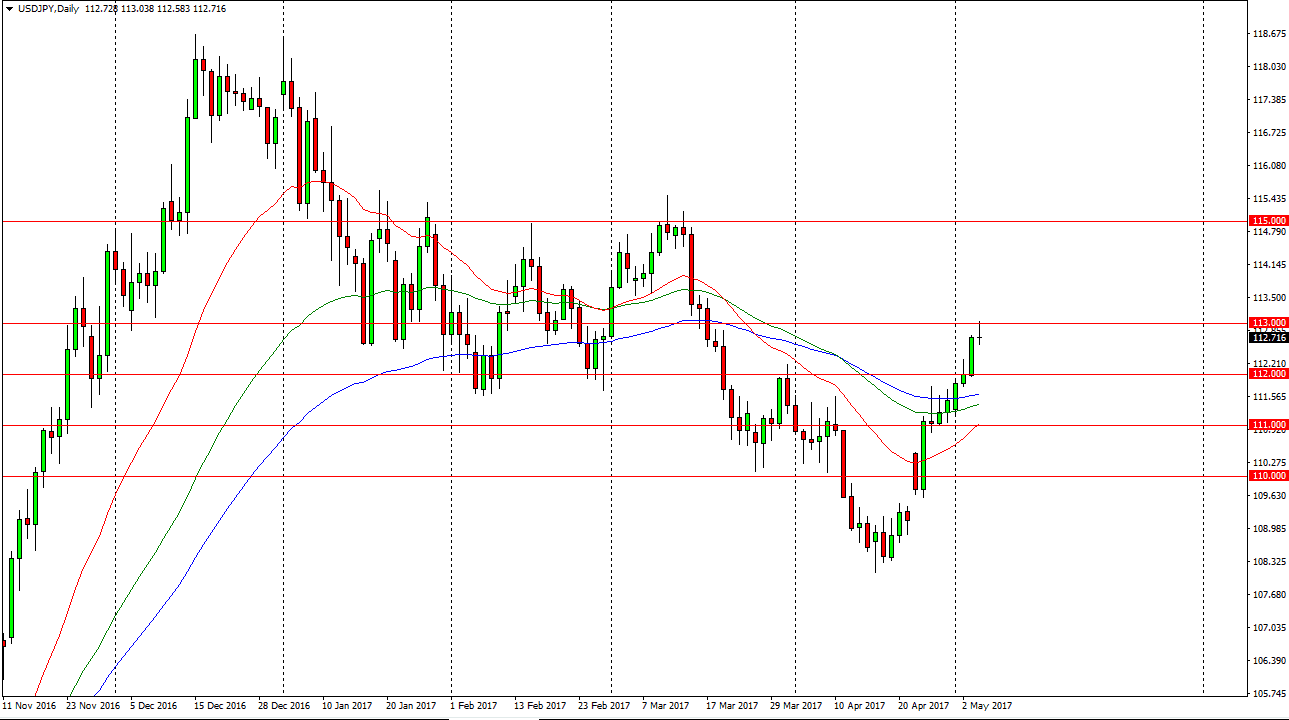

USD/JPY

The USD/JPY pair initially tried to rally during the day on Thursday, but found the 113 level to be too resistive to continue going higher. By doing so, looks like the market looks as if it is trying to pull back a little bit but the 112 level underneath could offer support. That we have the jobs number coming out today, and that of course can continue to be a bit repressive when it comes to price action. We’ve seen a strong move higher, so a pullback would make a lot of sense. However, with the jobs number coming out during the day it’s likely that the markets will focus more on that than technicals.

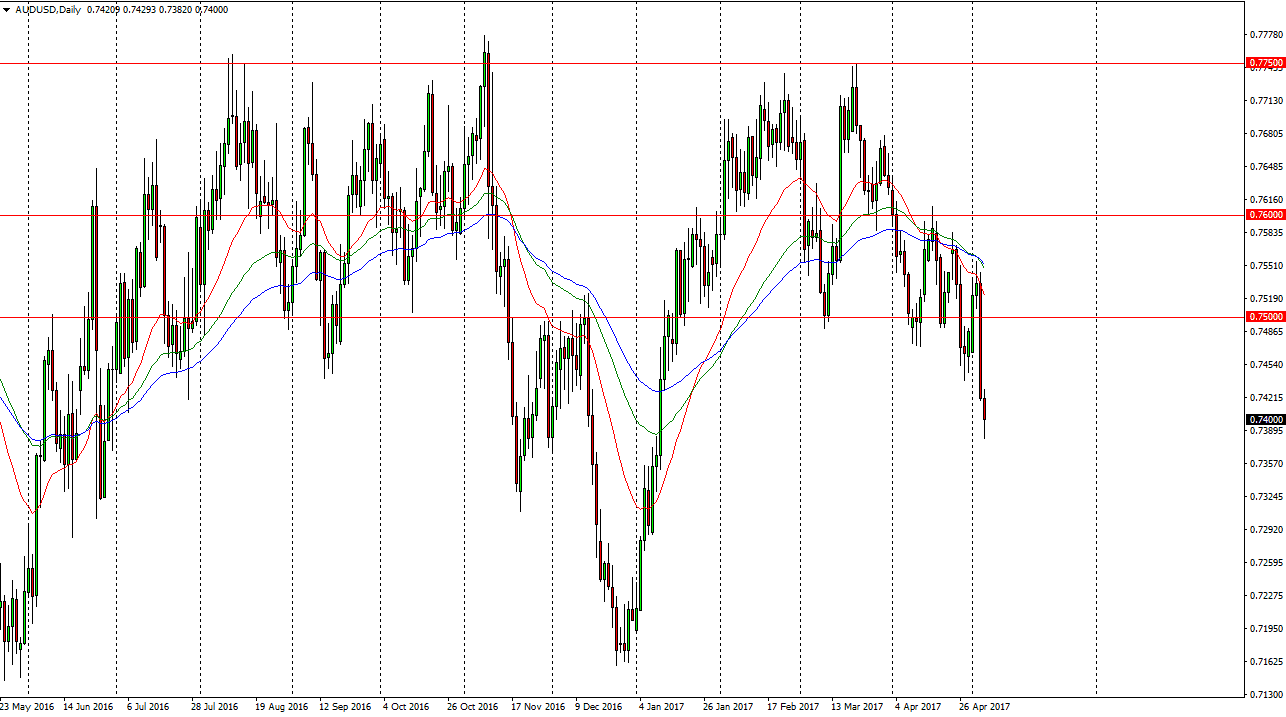

AUD/USD

The Australian dollar broke down significantly during the day on Wednesday, and Thursday was more of the same. We broke below the 0.74 level, and I feel that the market is going to continue to go lower. Ultimately, I believe that the market is probably going to reach towards the 0.73 level, and then down to the 0.7150 level over the next couple of weeks. Pay attention to gold, it has been breaking down as well, and that only as more pressure to the Australian dollar. Because of this, I think this will be a very interesting pair to play during the day, and the jobs number of course will influence how the markets react to risk. Remember, the Austrian dollars a very risk sensitive currency, and if the markets get spooked by a bad jobs number, that should only put more bearish pressure on this market. I don’t have any interest in buying the Aussie dollar until we break above the 0.75 level, something that I do not expect to see today. With this, I remain a seller and look for short-term rallies as an opportunity to take advantage of that.