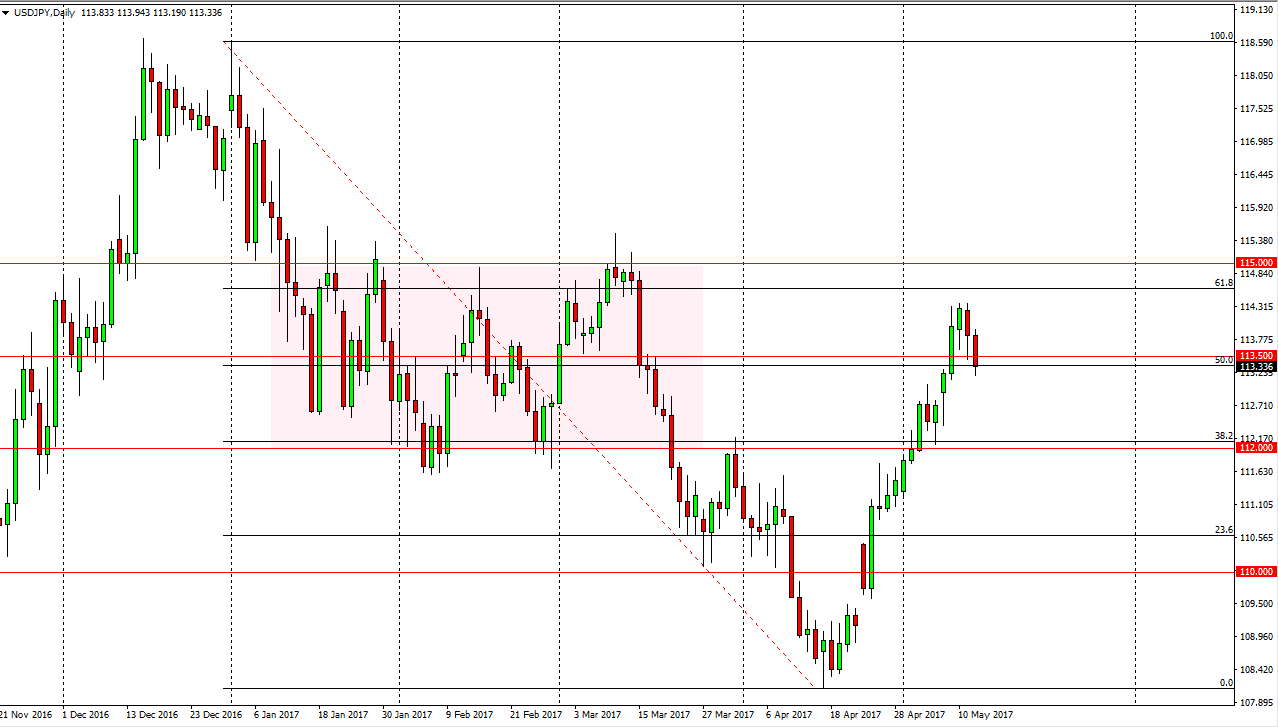

USD/JPY

The US dollar fell against the Japanese yen on Friday, breaking through the 113.50 level. This was in reaction to less than stellar economics numbers coming out of America, and this signifies that we may get a bit of a pullback. The weekly chart shows a shooting star, so it suggests that the pullback is needed, and I think we will then go looking for the 112 level. That’s an area that should be supportive, so I think short-term traders will get the opportunity to sell, but I believe that in the next session or so the buyers will return. Remember, this pair tends to be reactive to the stock markets, especially the S&P 500 which looks like it might have a bit of bullish pressure built in.

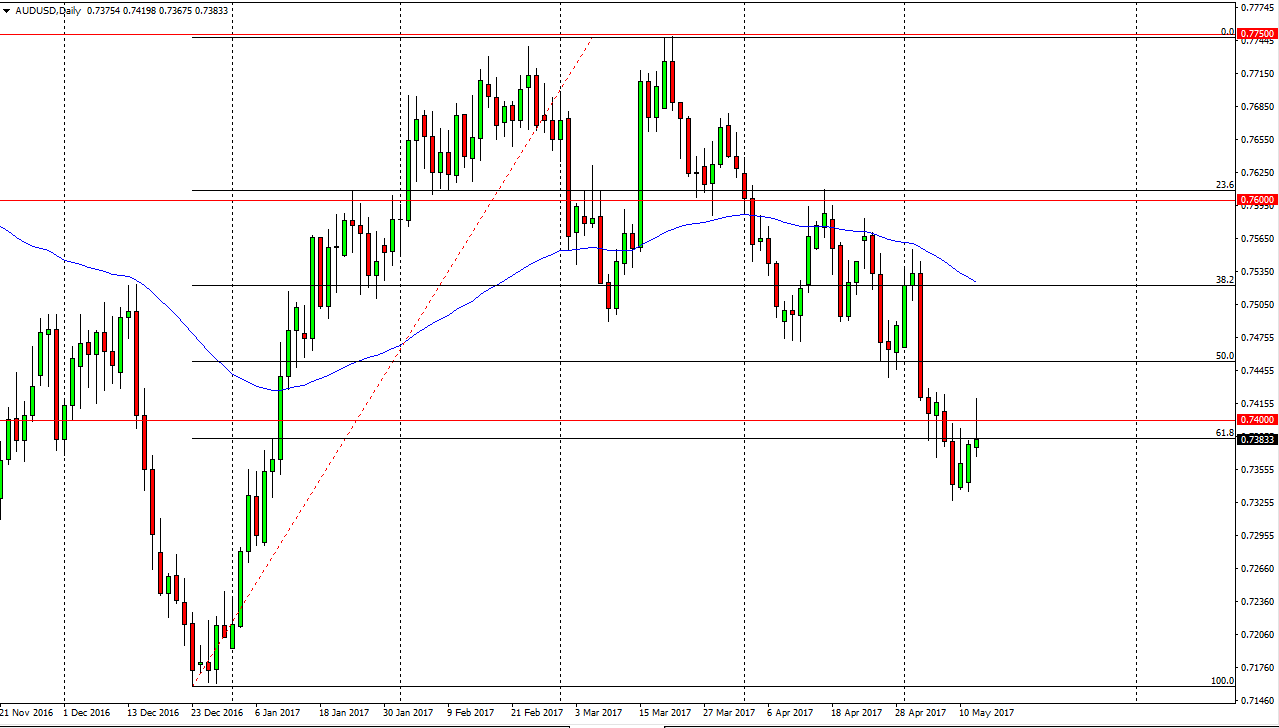

AUD/USD

The Australian dollar tried to rally on Friday but struggled as we reached above the 0.74 level. While this looks bearish, I would be hesitant to start shorting here because the weekly candle is a hammer. I think the best trade is probably to buy this market on a break above the top of the shooting star, because it goes with the longer-term candle. However, if we break down below the lows of the week, that then becomes a very negative sign and we should continue to go down and retrace the entire moved to the 0.7150 level. Pay attention to gold, it will be important as well, but it did show signs of life over the last couple of sessions, so because of this I tend to believe the weekly hammer more than the daily shooting star. Regardless of what happens, it is going to be choppy, and that being the case it’s likely that the market will offer several different opportunities in both directions.