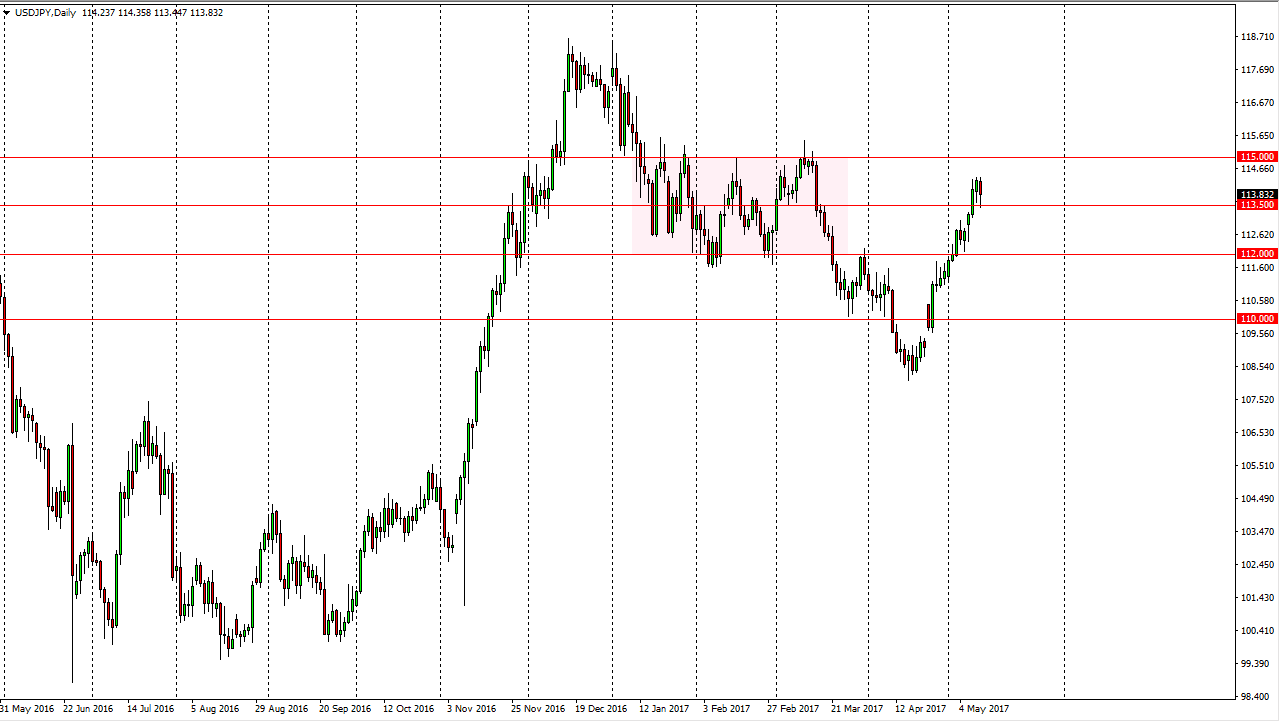

USD/JPY

The US dollar fell against the Japanese yen initially during the day as a bit of a “risk off” move started. Not only did we see it in this currency pair, but we also sought and stock markets as well. However, the 113.50 level has offered support again, and it looks as if every time we pull back of value hunters are willing to step in and push higher. Given enough time, I expect that this market should reach towards the 115 handle. That is an area that was massively resistive in the past, and if we can break above there it’s likely that we will continue to reach the higher levels, which I currently have slated as 118.

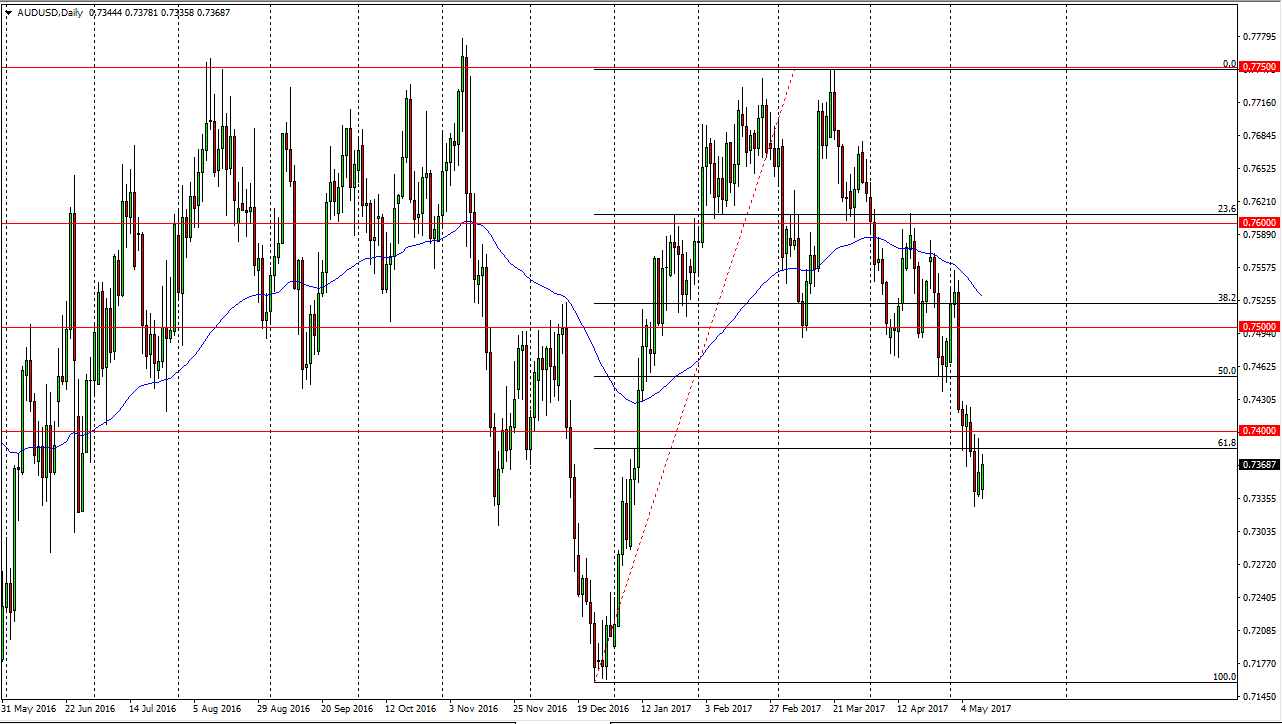

AUD/USD

Ironically, in a somewhat “risk off” session, the Australian dollar rallied. Perhaps this is a bit of a reaction to the gold markets, as some people will buy that contract when things are concerning. However, the 0.74 level above should be resistive, so is not until we break above there that I would be impressed. I would look for an exhaustive candle in the short term to start selling, as breaking below the 61.8% Fibonacci retracement level is typically a very bad sign. If things pan out, I would expect a complete reach race all the way down to the 0.7150 level underneath. Either way, I think you can count on a lot of volatility, but if we broke out to the upside, I believe even more resistance will be found at the 0.75 handle above. This is an area that was noisy previously, so it would make sense that we would see quite a bit of noise in that area again. I believe that Chinese consumption numbers are falling and that of course will continue to weigh upon the Australian dollar as well. I remain bearish in general.