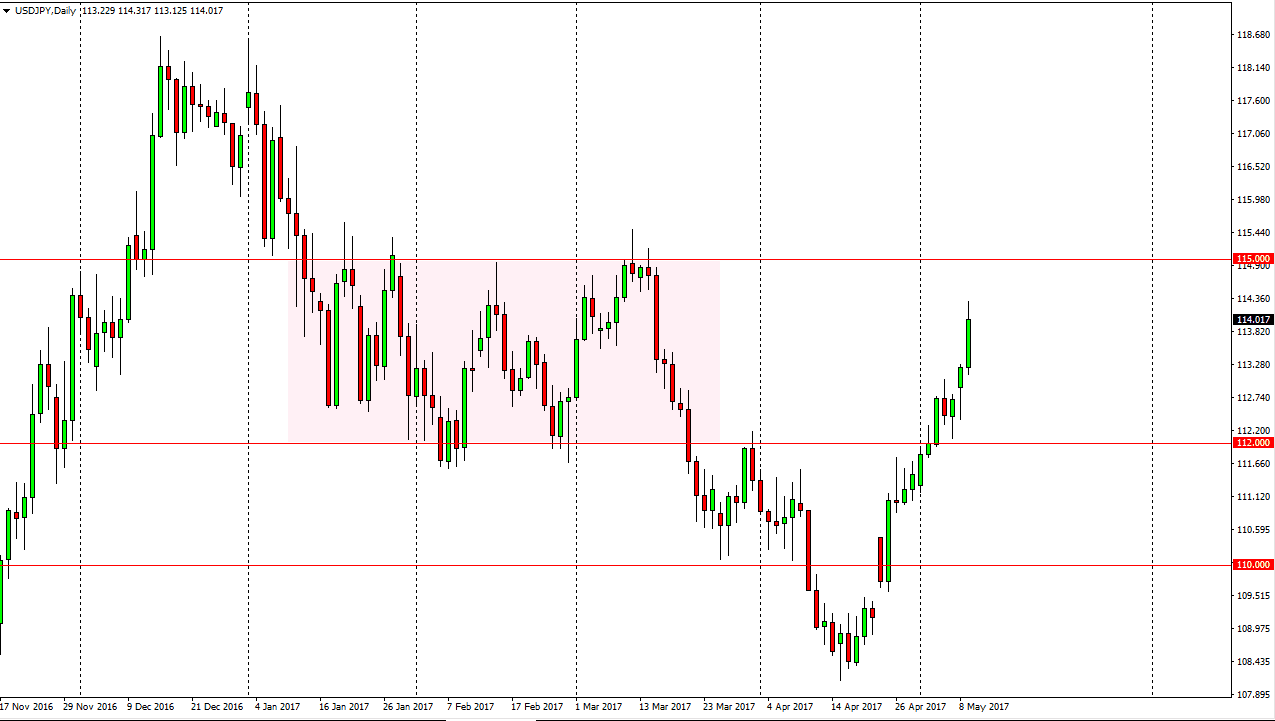

USD/JPY

The US dollar broke higher on Tuesday, as we cracked above the hammer from the Monday session. We touched the 114 handle, and even broke above there during the day. Because of this, it’s likely that we will continue to see buyers jumping to this market on short-term pullbacks. Those pullbacks should offer value that people are willing to take advantage of, and as long as the stock markets behave relatively stable, this pair should do fairly well. We saw the Japanese yen selloff against most currencies around the world, so obviously, the US dollar was never going to be any different. I believe that the 115 handle above is going to be the target, where we should see much more significant resistance based upon the previous consolidation area.

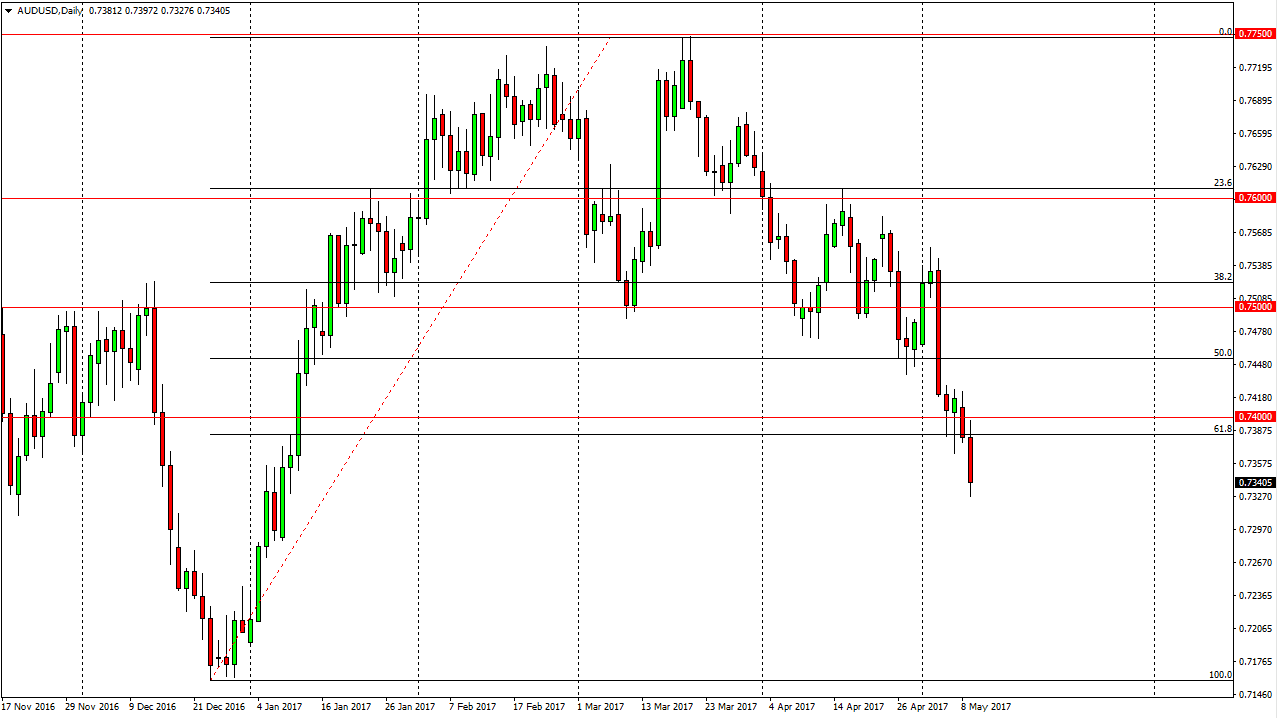

AUD/USD

The Australian dollar broke down on Tuesday, driving through the 0.74 level. That being said, it looks as if we have broken well below the 61.8% Fibonacci retracement level, and that suggests that we are going to retrace 100% from the initial move. That should have this market looking for the 0.7150 level underneath, although we may get rallies from time to time. I believe that the 0.74 level should be massively resistive. Ultimately, that is a level that I think will continue to attract sellers going forward. Exhaustive candles on short-term charts might be a nice selling opportunity as the US dollar has been strengthening in general, and with that being the case, we have to look at the gold markets as well, as gold seems to be struggling overall. Gold is a major influence on the Australian dollar, and as it falls, the Aussie typically does as well. Ultimately, gold will find support at much lower levels, so therefore I am still very bearish on the Aussie.