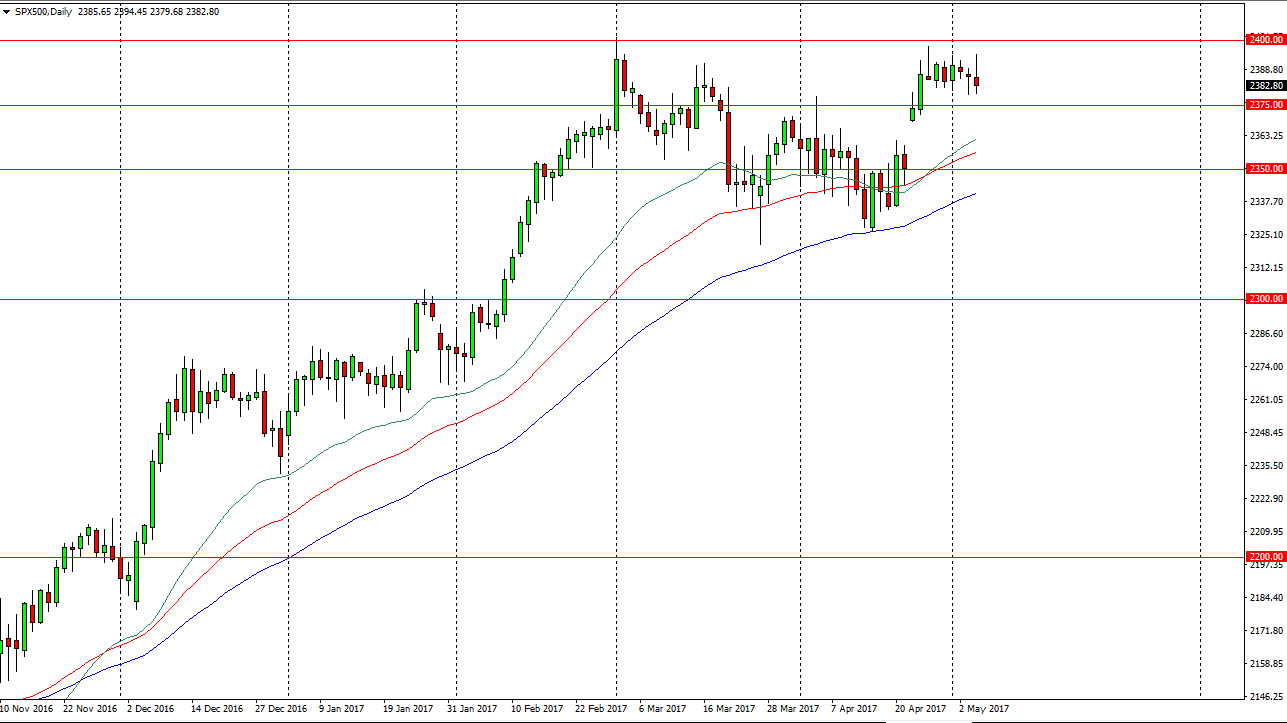

S&P 500

The S&P 500 initially tried to rally during the day on Thursday, but turned around to fall. I think that we are going to continue to consolidate overall, but if we can find a poor jobs number, the market then could drop to fill the gap below. The gap below should be massively supportive though, so if we fall from here, I suspect that the buyers will get involved near the 2360 handle. With this being the case, a supportive candle has me buying this market, just as a break above the 2400 level will be. The market is not one that I want to sell, so I believe that it’s either by at higher levels, or buy at lower levels on signs of support.

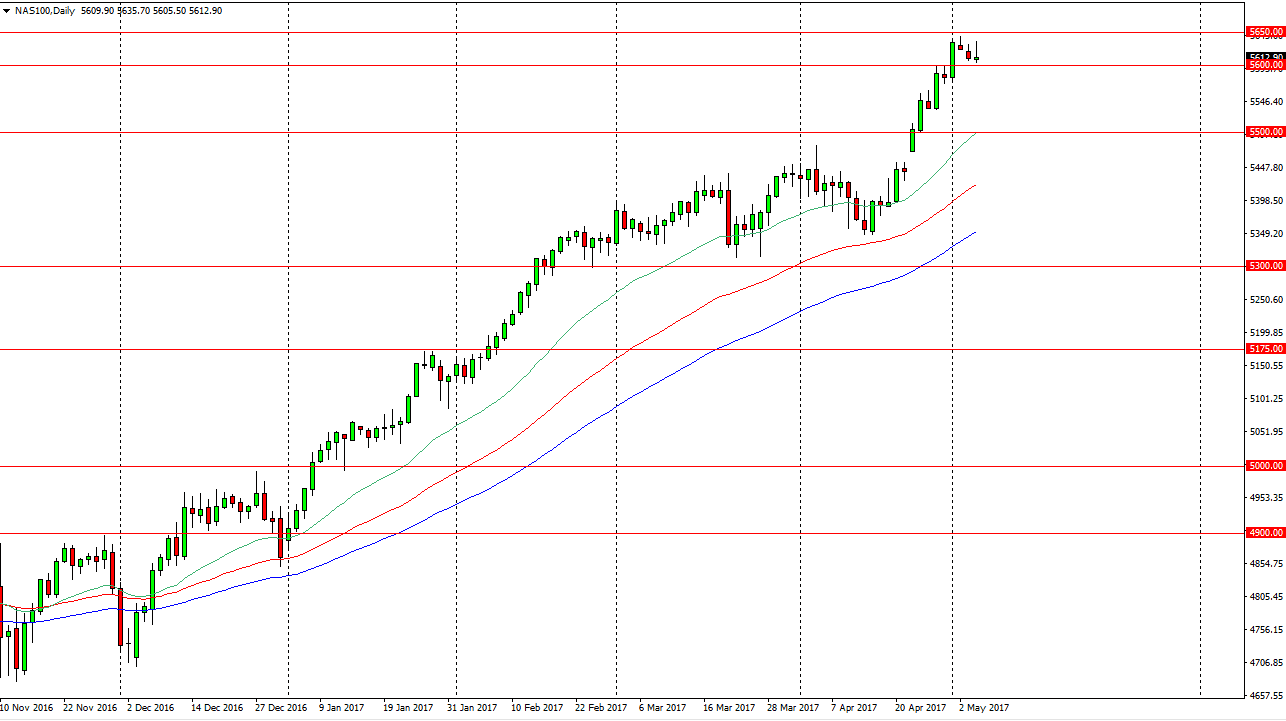

NASDAQ 100

The NASDAQ 100 has been rolling over for the last couple of sessions, showing that the 5650 level above has offered resistance. I also believe that the 5600 level below should be supportive but if we can break down below there the pullback will continue. I believe that the market will find a bit of a “floor” at the 5500 level, so any signs of support or a supportive candle underneath should be a nice buying opportunity. Alternately, if we can break above the 5650 handle, the market will go higher from there as well. I don’t have any interest in shorting, I believe that the longer-term uptrend is still very much intact, and the NASDAQ 100 has been far too bullish to think about shorting anytime soon. Much like the S&P 500, it’s only comes down to where I am buying, not if. The NASDAQ 100 will continue to benefit from the US being one of the more active stock markets and of course bullish as well. The moving averages all look good, it just seems as if we got a little ahead of ourselves over the last couple of weeks.