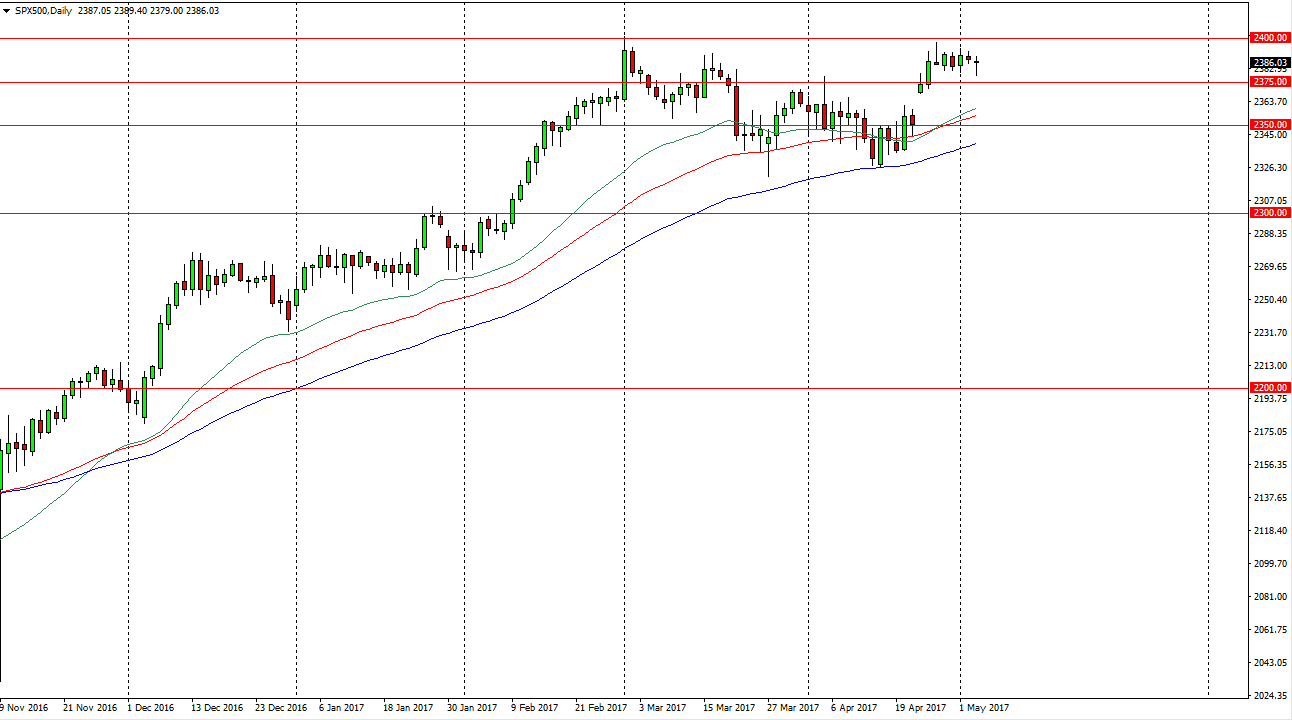

S&P 500

The S&P 500 fell during the day on Wednesday but found enough support just above the 2375 level to turn things around to form a hammer. That’s a very bullish sign, and I believe that we will continue to find buyers every time we dip. Ultimately, I think that we will break above the 2400 level, and once we do, I believe that the market will continue to grind towards the 2500 level over the longer-term. I have no interest in shorting the S&P 500, even though I recognize we could fall to fill the gap from last week. If we do, I will simply wait for a buying opportunity closer to the 2350 handle. As we exit earnings season, I believe that the buyers will return.

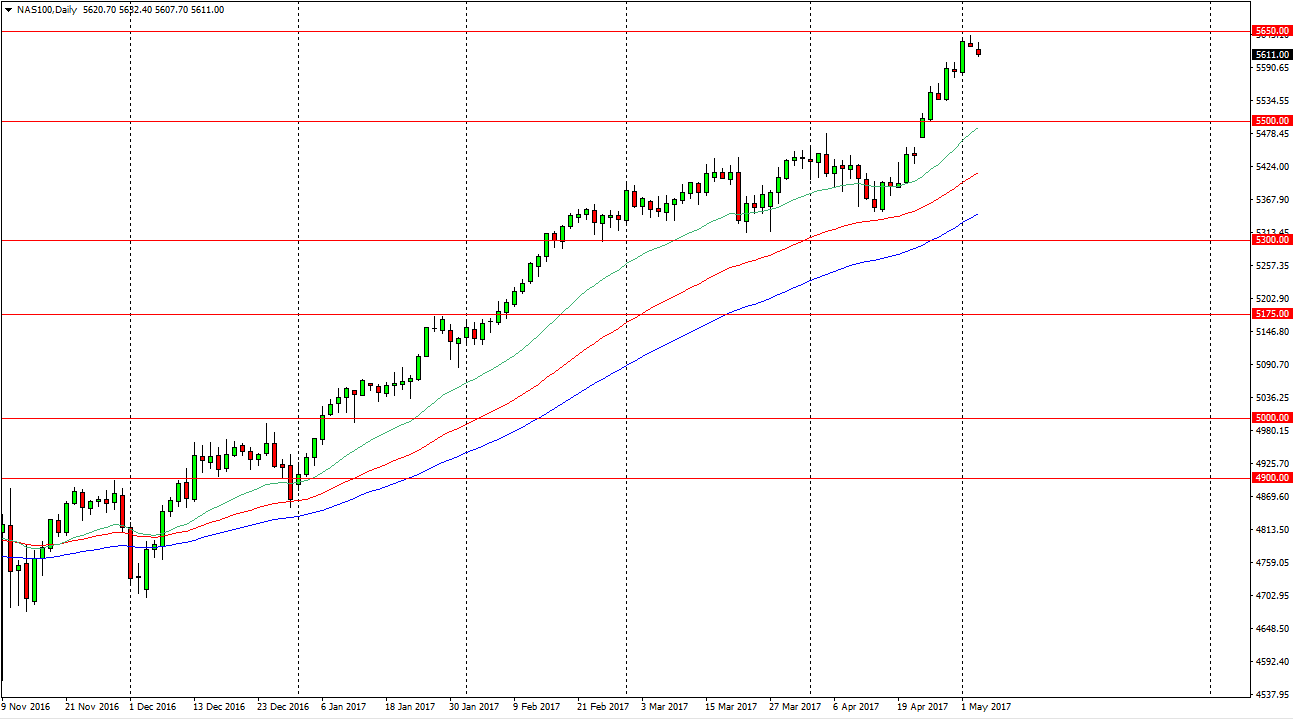

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Wednesday but rolled over again to form a shooting star. I believe that this market is overbought, and it looks as if the sellers will continue to push a little bit lower. That doesn’t necessarily mean that the markets going to fall significantly. I think that there is plenty of support near the 5500 level to keep the NASDAQ 100 afloat, so I look at this as an opportunity to pick up value in a lower level. With this, I wait to see a supportive daily candle to go long, and I believe that it will present itself in the next several sessions. The market has been leading the way for other US indices as of late, and I don’t think that’s going to be any different going forward. If we can break out above the 5650 level, I think the market then goes to the 5700 level above. With this, I’m a buyer but I am going to be very patient as to what I do.