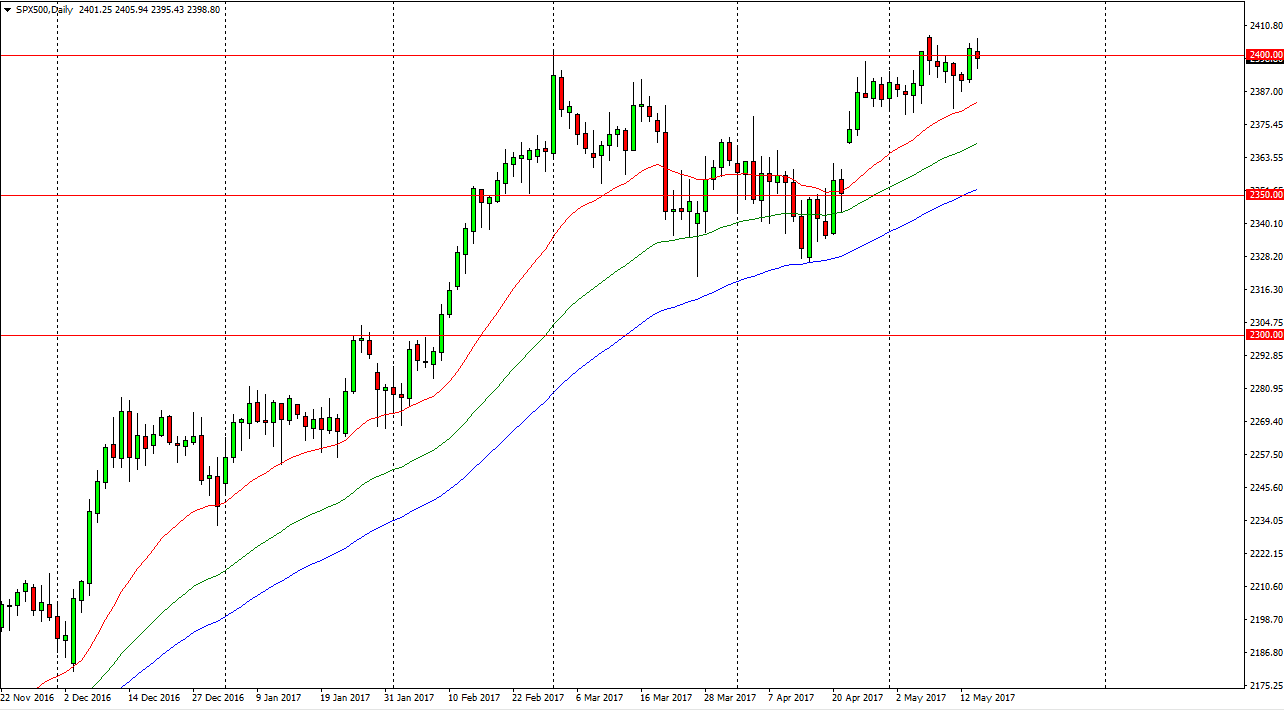

S&P 500

The S&P 500 had a choppy session during the day on Tuesday, as we continue to jump around the 2400 level. I believe that the market will eventually break out to the upside though, even though we may get a little bit of a pullback. That pullback should offer value, and I recognize that the market will probably target the 2500 level above. There is a gap underneath, and that may need to be filled, so we could roll over, but I doubt it’s going to happen right now. After all, we have seen the earnings season coming go, and it seems now that the markets are stable enough to go higher with a little bit of help, and I think that’s what we are getting towards soon. Because of this, market should continue to be a “buy on the dips” scenario.

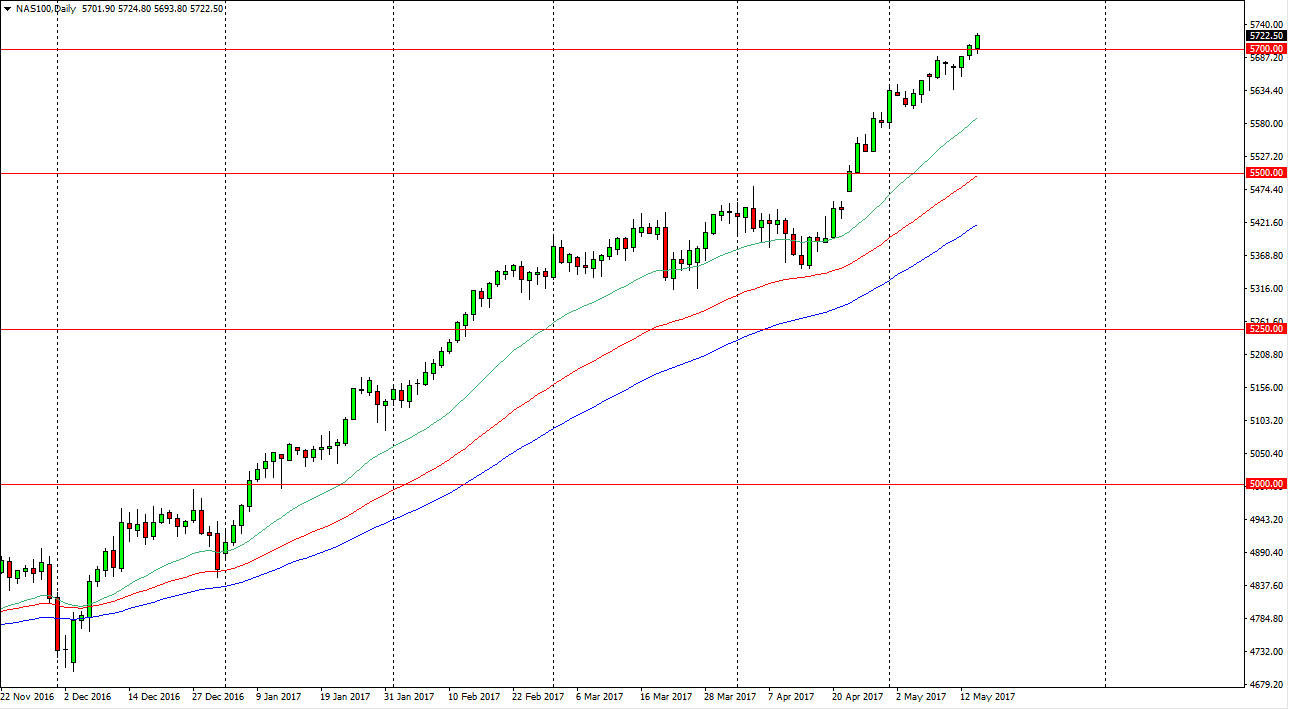

NASDAQ 100

The NASDAQ 100 rally during the day on Tuesday, using the 5700 level as support, and it now looks as if the NASDAQ 100 is ready to continue going much higher. This is a harbinger of what happens to the other indices in the United States, and I believe that the market will continue to drive to the upside, so therefore I believe in being buying on dips, as the market should continue to reach towards the 5750 handle, and then the 5800 level. I have no interest in shorting this market, it tells me that the market should continue to go higher overall, so therefore I am “long only” when it comes to not only the NASDAQ 100, but US indices overall. I do recognize that we could pull back a bit, but I believe there is an absolute “floor” in this market at the 5500 level which is the bottom of the uptrend. It’s not until we break down below there that I would be a seller.