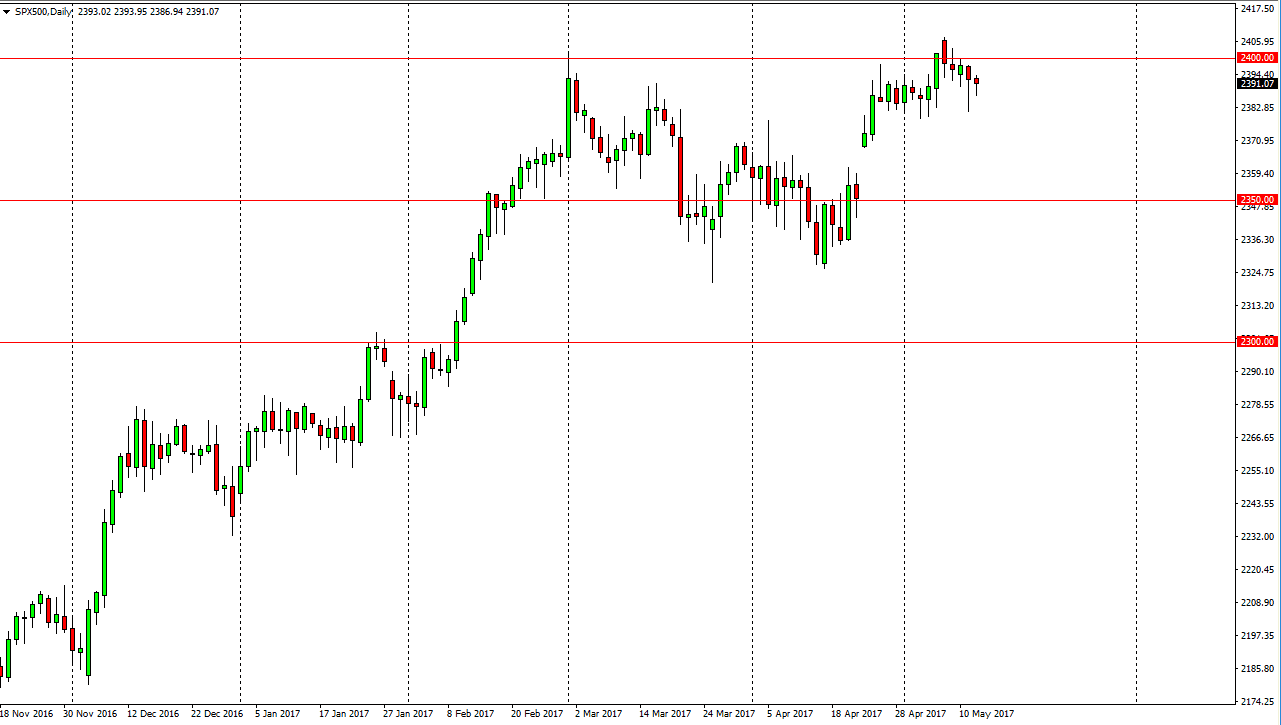

S&P 500

The S&P 500 initially fell on Friday but did recover some of the losses later in the day. It looks like the 2380 level below is going to continue to be supportive, and that should continue to drive this market to the upside over the longer term. I think the 2400 level above is going to be resistive, but I think we will break above there and then challenge the 2405 level above which is where we gapped to at the open on Monday. Ultimately, once we break above there the S&P 500 is willing to go to the 2500 level in my estimation. That is my longer-term target, and therefore I look at pullbacks as a nice buying opportunities and offering significant value in a market that is extraordinarily strong.

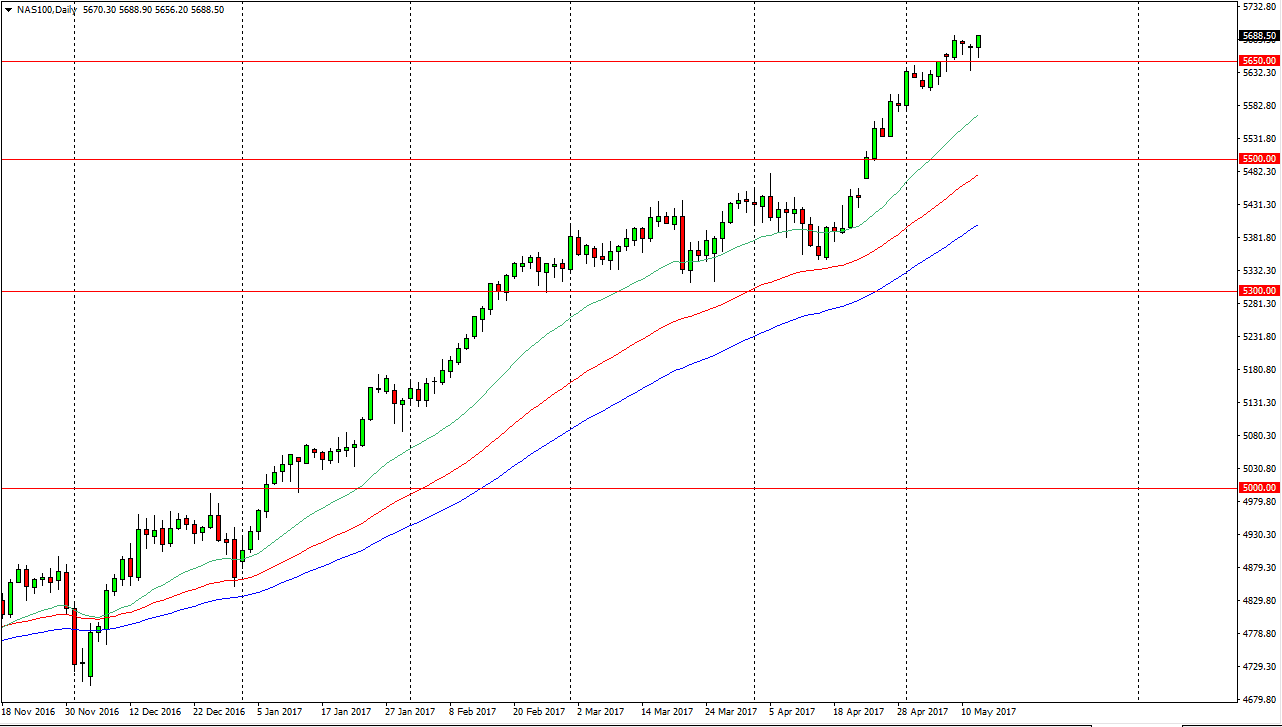

NASDAQ 100

The NASDAQ 100 fell during the day on Friday initially, but continues to find plenty of support at the 5650 handle, showing that there is real resiliency in this market. I believe that it’s only a matter of time before the buyers come back when we pull to the downside, and I also believe that the fact that we close towards the top of the range for the day suggests that we are going to go looking for 5700. Because of this, I initiated long positions again today and am willing to hang on to them. I think that the hammer on Thursday was the real sign of buyers coming back into the marketplace, and Friday was simply a continuation of that same move. It should instill quite a bit of confidence since the economic announcements on Friday weren’t exactly positive for the US market in theory, but I do believe that perhaps people are starting to think that the Federal Reserve cannot raise interest rates as quickly as they once had. Earnings themselves on a corporate level are fine, so the NASDAQ 100 continues to go higher in my estimation.