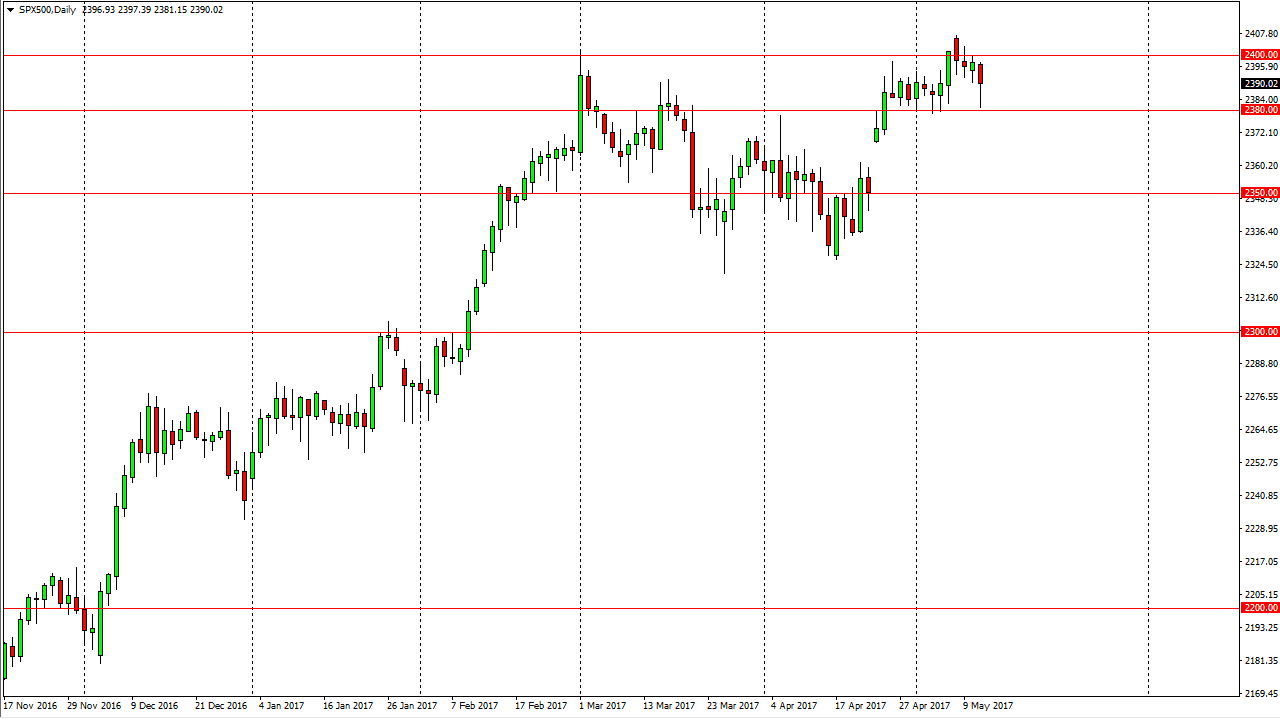

S&P 500

The S&P 500 fell initially during the day on Thursday, but found enough support at the 2380 level to turn around and form a nice looking hammer. If we can break above the 2400 level, I feel that we continue to go higher, and looking towards the 2500 level above. This is a longer-term uptrend, so I believe it’s only a matter of time before the buyers return. The markets continue to be “risk on”, so with this being the case I think that the market will continue to offer value every time we dip. The 2500 level of course is a longer-term target, and of course will offer a significant amount of resistance. Ultimately, I am a buyer.

NASDAQ 100

The NASDAQ 100 initially fell as well, but found enough support below the 5650 handle to turn around and form a hammer. The hammer is a bullish sign, and a break above the top of it should send this market towards the 5700 level. The NASDAQ 100 has lead the way for most stock indices currently, and I think that continues to be the case. I’ve no interest in selling, and I believe that every time we pull back buyers will be looking to take advantage of value that is so obvious in this market. The absolute “floor” of the market is somewhere near the 5500 level, so I believe that we have a long way to go before we could even remotely consider selling. With this, I remain bullish and I recognize that although it might become volatile, as we are bit overextended, buying is really the only thing you can do in a market that is shown so much promise over the last several weeks, not including the months before the previous consolidation.