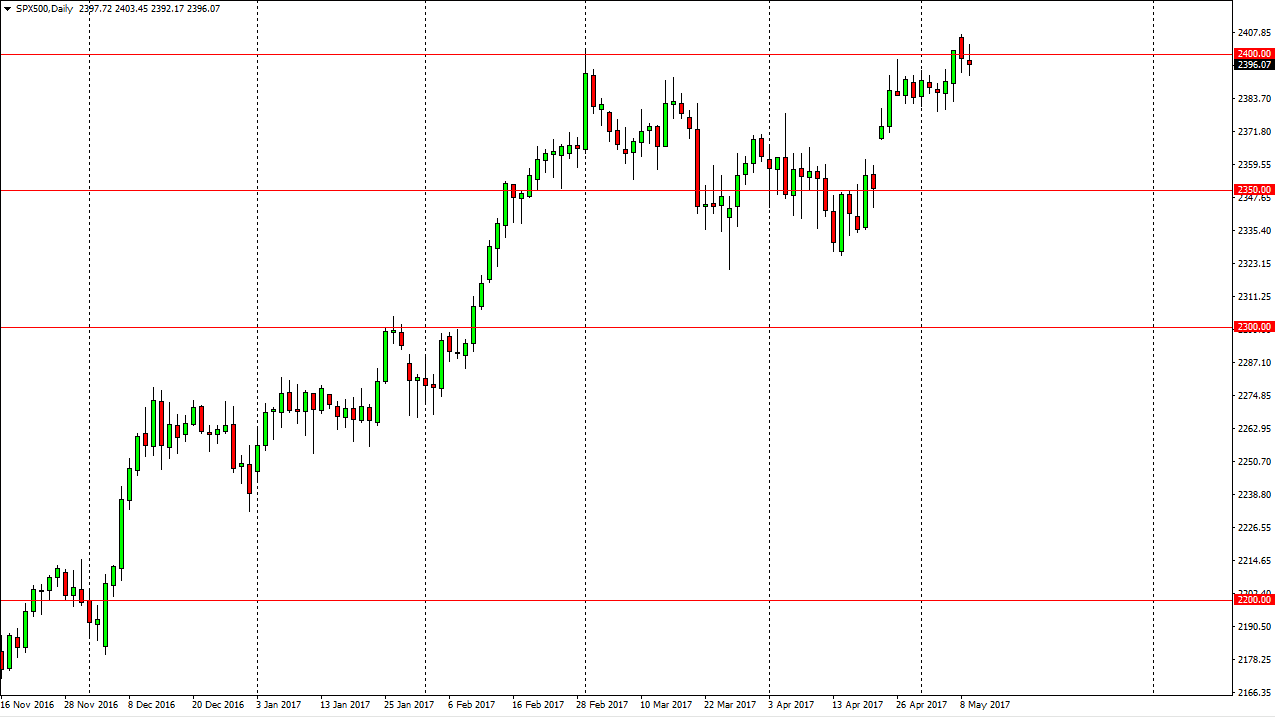

S&P 500

The S&P 500 had a choppy session on Tuesday, as we bounced around below the 2400 level. We did spend some time above, but turned around to form a less than impressive candle. Because of this, it looks like we could pull back a little bit looking for buying opportunities and of course momentum building orders below. If we can break down below the 2380 handle, the market should then reach towards the gap below which is near the 2360 handle. So, I believe that a supportive candle underneath will offer value, but I will probably wait until it forms on the daily chart to take that trade. Until then, I’m going to sit still unless of course we make a fresh, new high. That of course is a buying opportunity as well.

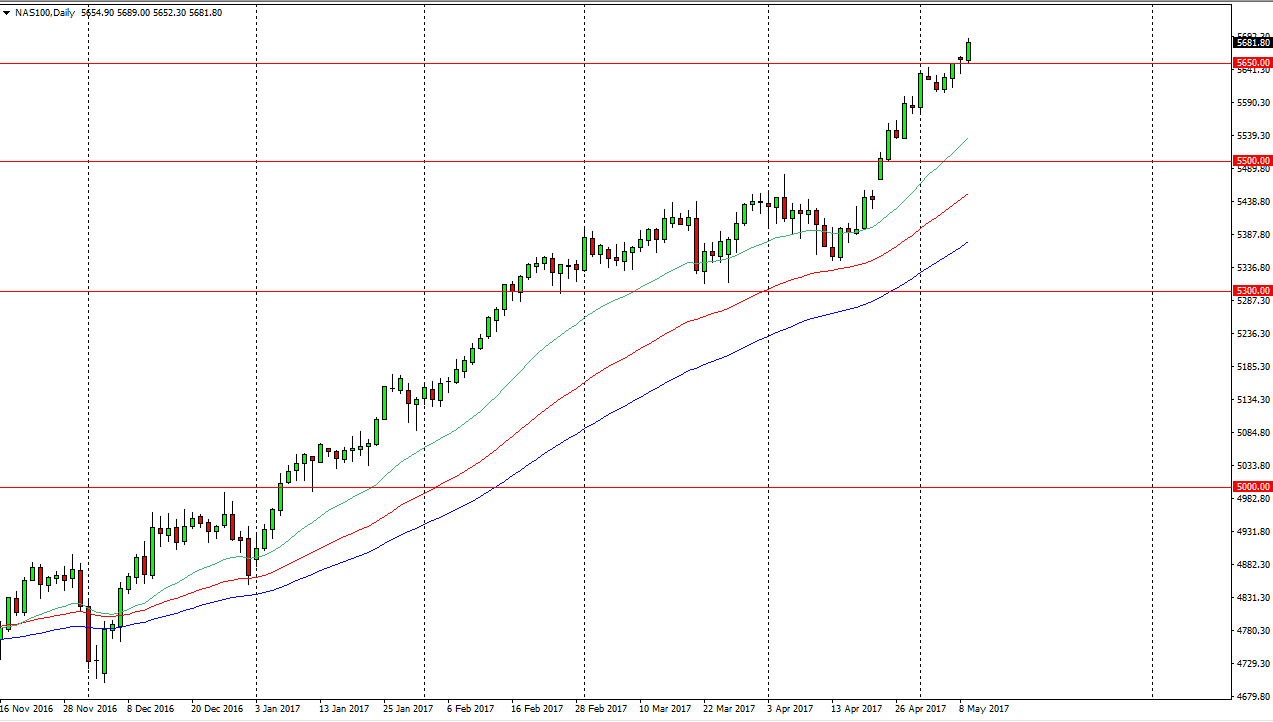

NASDAQ 100

The NASDAQ 100 broke higher during the session on Tuesday, using the 5650 level as a springboard. We have made a fresh, new high, and that of course is a very bullish sign. A break above would continue the longer-term uptrend, and quite frankly I think the best way is to simply wait for short-term pullbacks that offer a nice value play. I don’t have any interest in selling this market, and believe that we will continue to go much higher over the longer term. There’s nothing on this chart that suggests we should short this market, and I believe that the 5700 level will be the next target. Because of this, I am very bullish and realize that the NASDAQ 100 should continue to lead the rest of the indices that we follow going forward. I believe that the absolute “floor” in the market is just below the 5500 level, and therefore we would have to breakdown far below that level for me to consider selling this market, which is something that I don’t see happening anytime soon.