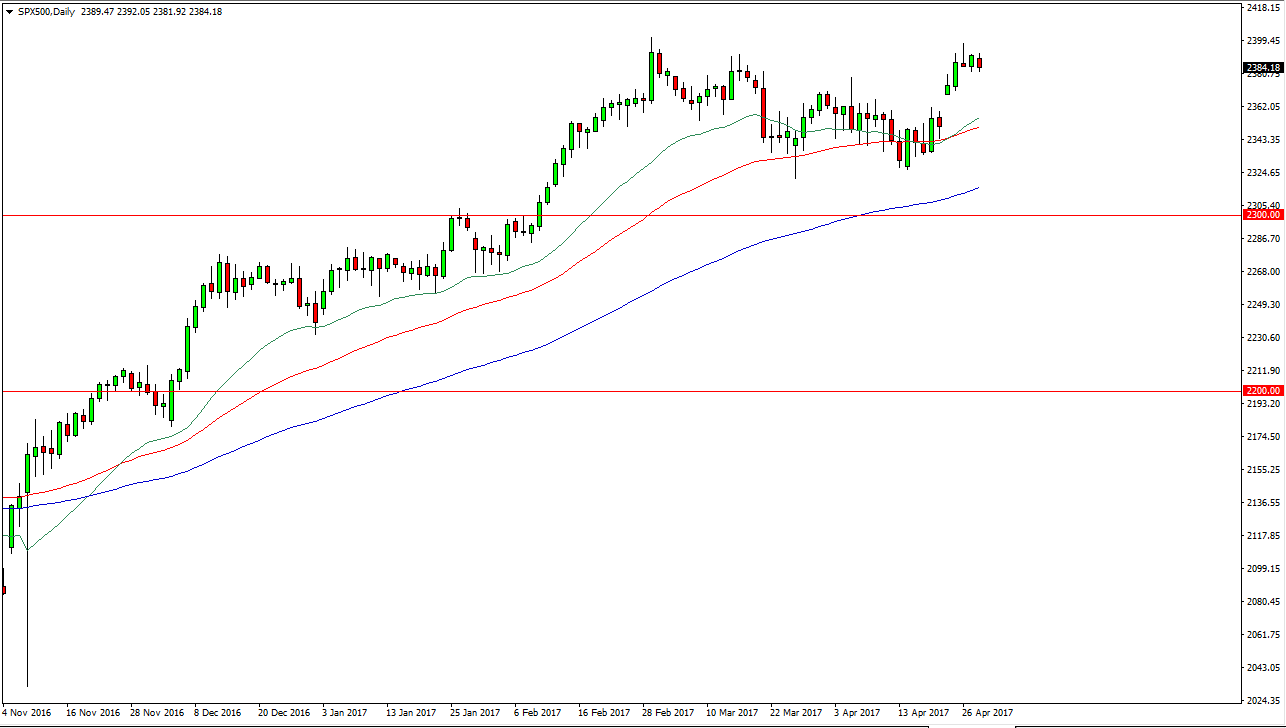

S&P 500

The S&P 500 fell slightly during the session on Friday as we ran into a bit of exhaustion. We do have a gap below though, and I think that will offer quite a bit of support going forward. I believe that the S&P 500 will continue the longer-term uptrend, and now that we’re getting through earnings season relatively unscathed, I think that’s a good sign in the market will reach towards the 2400 level again, and then breakout above there to reach towards the 2500 level. Shorting isn’t even a thought, and the 20 day and 50-day exponential moving average is below should continue to offer dynamic support as well. I believe we will not only reach towards the 2500 level, but I think will break above there given enough time.

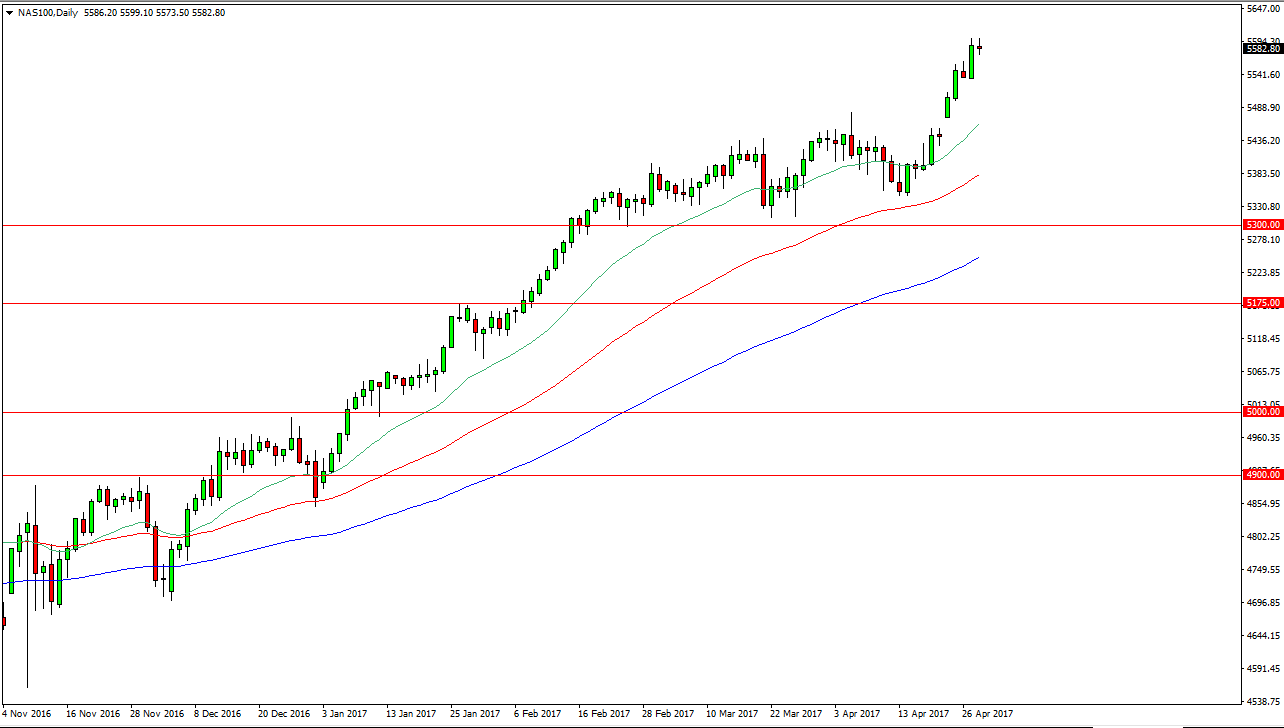

NASDAQ 100

The NASDAQ 100 did very little during the session, as the market ran into a bit of resistance near the 5600 level. I think a pullback is probably necessary but that pullbacks should offer quite a bit of value in a market that has been so strong. The NASDAQ 100 continues to lead the other indices around the world higher, and I think it is a bit of a harbinger as far as risk appetite is concerned. If this market falls, other markets will fall. On the other hand, if we fall and find support, that could be the first sign of the potential turn around in stock markets worldwide, offering an opportunity for traders to jump on a very bullish market. I believe that selling is all but impossible, and that the 20-day exponential moving average, pictured in green, will continue to offer dynamic support. I believe that the 5450 level will be the floor, so any downdraft from here has a very limited amount of room to run.