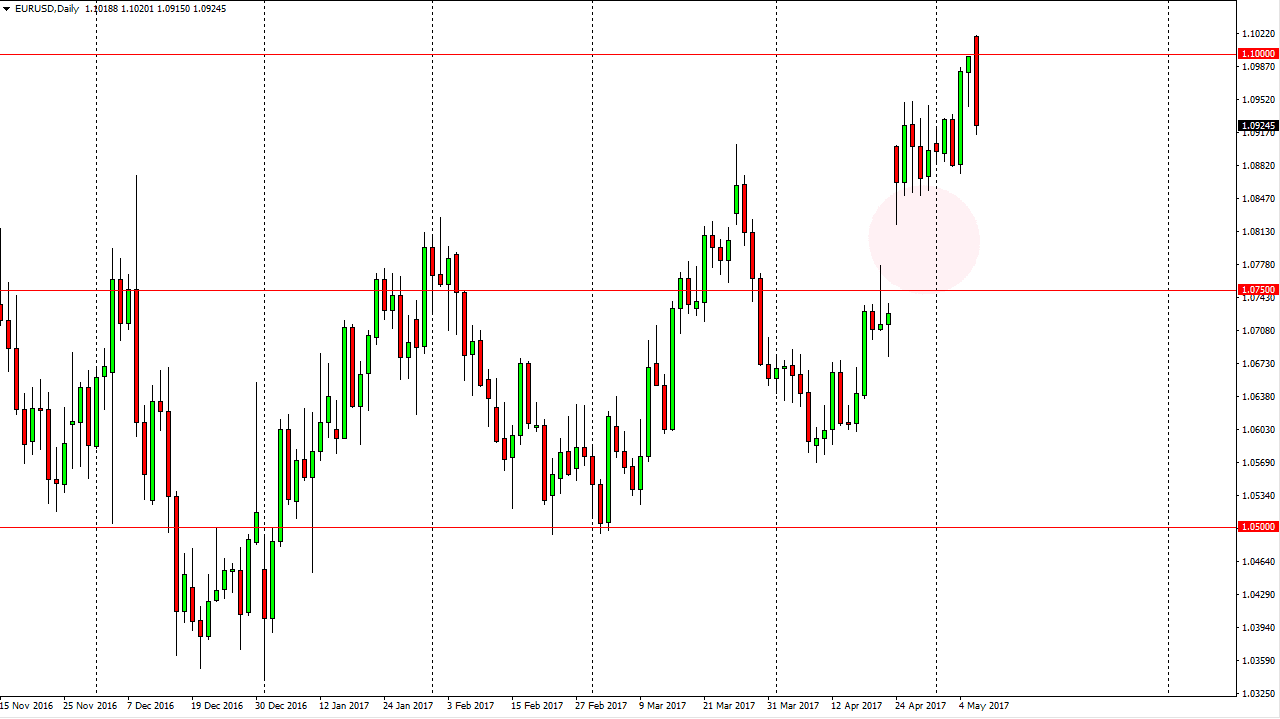

EUR/USD

The EUR/USD pair had an interesting session, as we initially gapped higher in reaction to the French elections, but you can see we fell apart almost immediately, and had formed a massive bearish engulfing candle. This is a very negative sign, and on the chart, I have the gap highlighted that had previously started this move higher. Because of this, I think that the market is probably going to continue to fall and try to fill that gap. With this in mind, I believe that selling is probably the prudent thing to do, and that we will head towards the 1.0750 level underneath. That’s not to say that it’s going to be easy to short this pair, but I certainly don’t want to go long after the massive candle that had formed for the session on Monday. Things suddenly look very bearish.

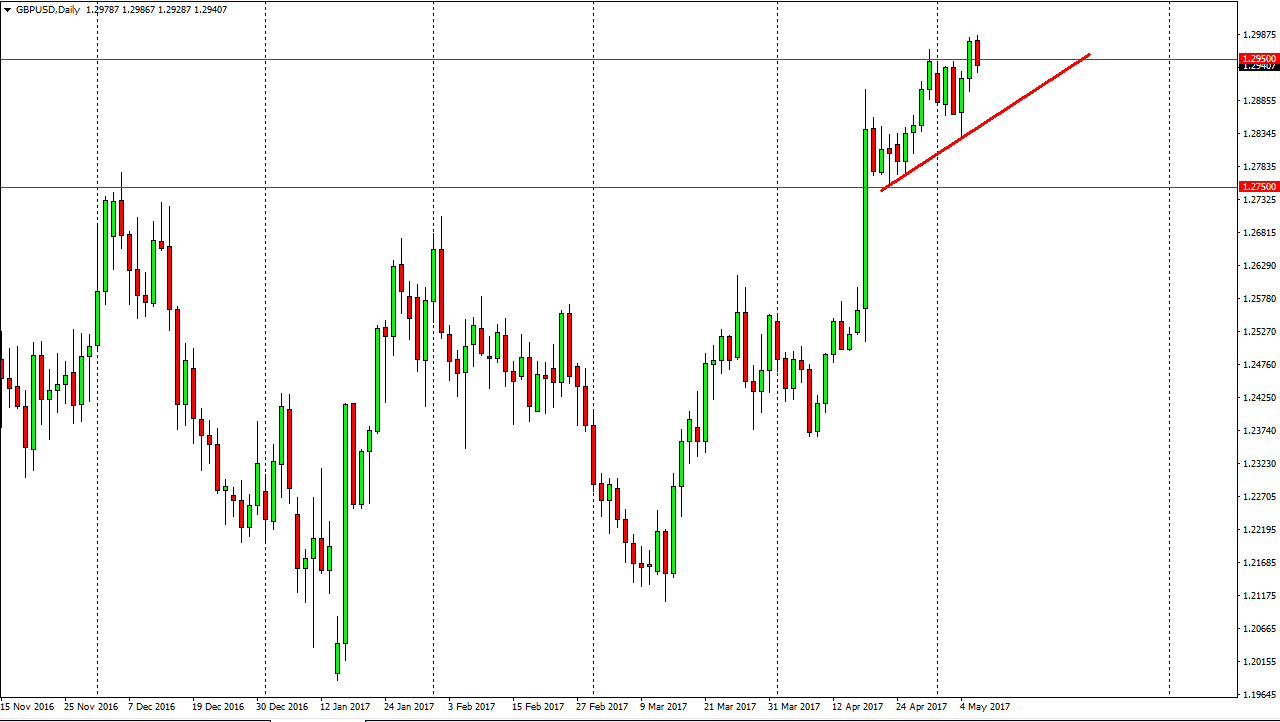

GBP/USD

The GBP/USD pair fell slightly during the day on Monday, as we broke below the 1.2950 level. The market house an uptrend line underneath, so even if we do fall from here I feel that the British pound will probably find buyers underneath. The market should continue to find buyers longer-term, and I believe that we will eventually break above the 1.30 level to go looking for the 1.3450 level above which has been my longer-term target for some time. I recognize that we are starting to see some negativity, but quite frankly I believe that the longer-term move to the upside is still very much intact, and that we should see dips thought of as value.

It’s not until we broke down below the 1.2750 level on a daily close when I started thinking about selling. Even then, I would be a bit hesitant to do so, so I do believe that we will get a supportive candle that we can take advantage of.