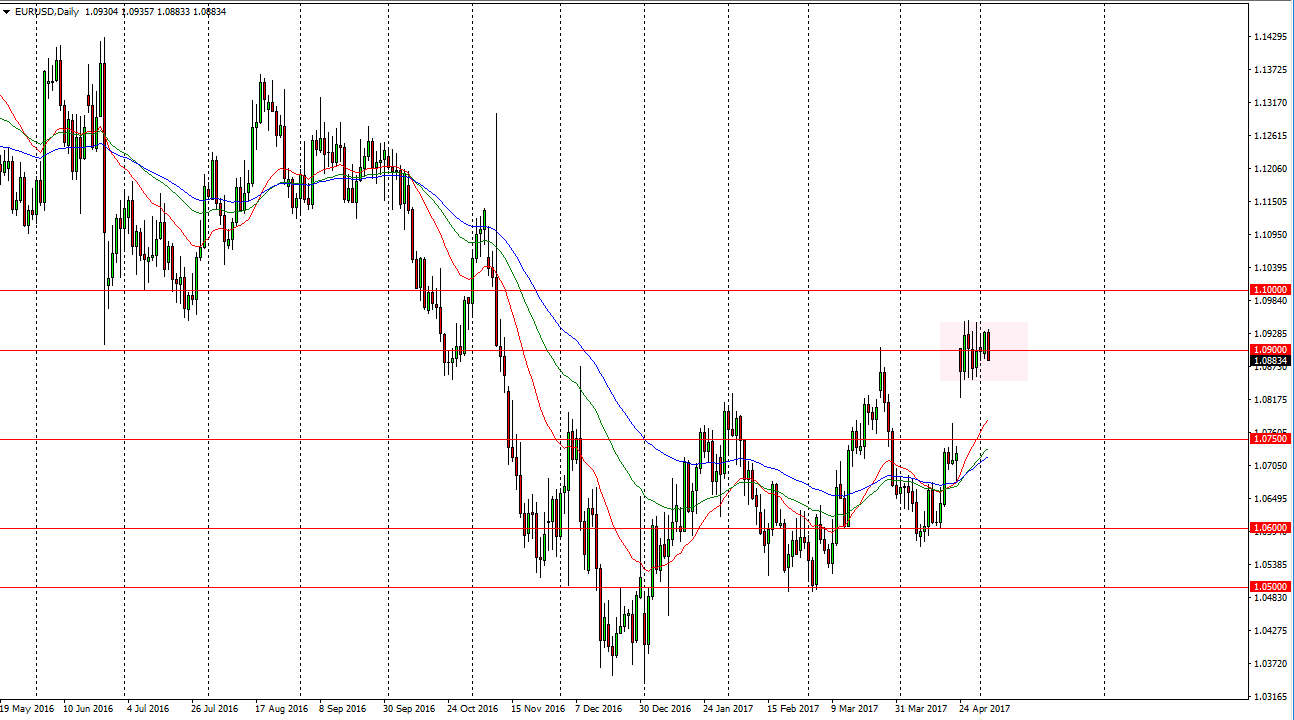

EUR/USD

The EUR/USD pair had a negative session, breaking below the 1.09 level on Wednesday. However, I think we are still consolidating and it is only a matter of time before the buyers get involved. Even if we do breakdown from here, the 1.0750 level underneath should continue to be the “floor” in this market. I’m waiting to see if we can get some type of bounce or supportive candle to go long. I have no interest in selling, I believe that if we fall to fill the gap, that is going to be a short-term opportunity at best. If we break above the 1.0950 level, the market should then go to the 1.10 level after that.

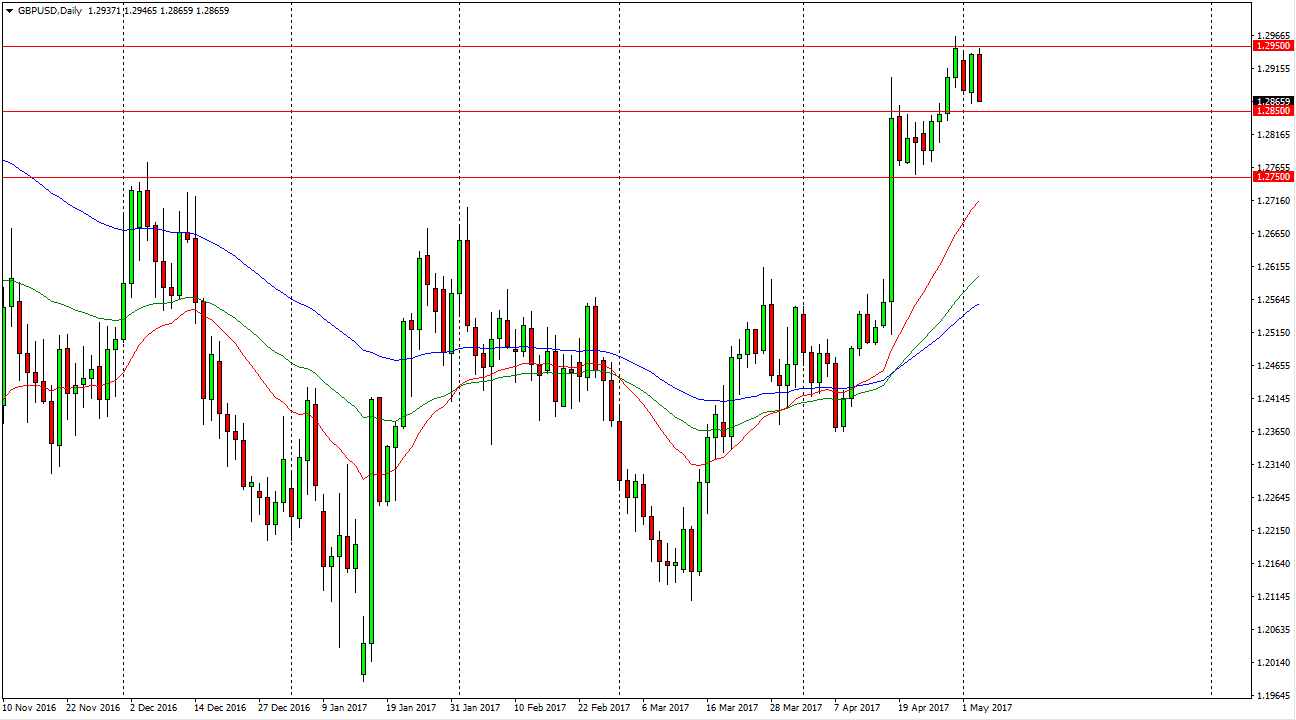

GBP/USD

The GBP/USD pair found the 1.2950 level to be too exhausted to continue going higher. I think that the 1.2850 level will be supportive, and most certainly the 1.2750 level underneath will be as well. I think some type of supportive candle is needed on short-term charts to take advantage of the longer-term uptrend. I recognize that we have traveled quite far in a very short amount of time so the pullback is probably healthy. Ultimately, this is a market that should continue to attract buyers longer-term, so I don’t have any interest in shorting. Having said that, we could get a day or two of softness, and could be a bit limp. I think that we will test the 1.30 level above over the next several weeks, and then eventually break out above there. We currently have a lot of concerns coming out of the United Kingdom leaving the European Union, so it’s likely that there will be some back-and-forth trading. Because of this, I don’t have any real interest in trying to put on a large position to the downside, and therefore I’m going to wait for an opportunity to take advantage of buying positions.