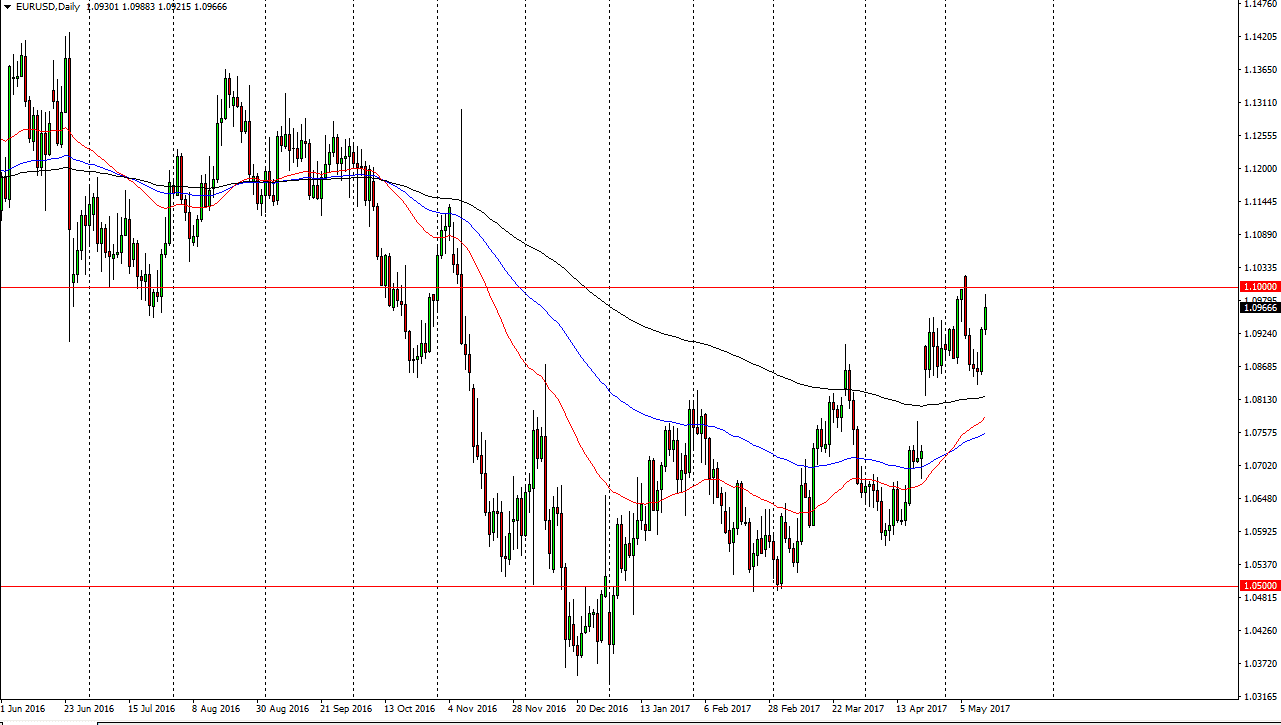

EUR/USD

The EUR/USD pair rally during the day on Monday, reaching towards the 1.10 level. A break above that handle is a very bullish sign, and should send this market looking for the 1.12 level above. Alternately, we could pull back from here but I think the gap below will offer support yet again. Eventually we will more than likely fill that gap, but it does not look like it’s going to happen right now. I believe that the pair continues to follow the risk parameters of markets overall, which look very healthy as the stock markets have made fresh, new highs. In the meantime, expect short-term pullbacks offer short-term buying opportunities in a situation that looks bullish, but choppy to say the least.

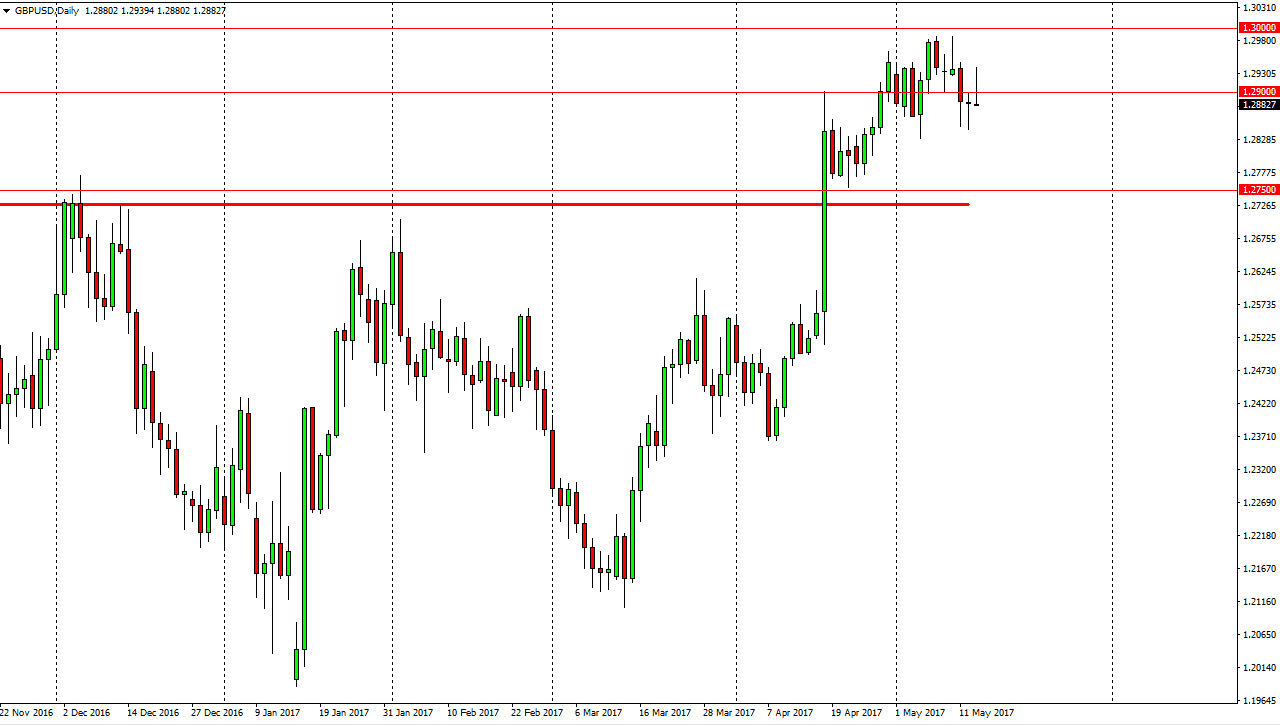

GBP/USD

The British pound tried to rally during the day but found resistance above the 1.29 level, turning things around and forming a shooting star. The shooting star of course is a negative sign, but ultimately there is a lot of support just below as well. I think that the market will continue to see volatility, but the actual “floor” in the market is closer to the 1.2750 level underneath. It’s not until we break down below there that I would consider selling. In the meantime, I’m waiting to see if we can get some type a supportive candle or a break above the top of the shooting star for the session on Monday to start going long. That should send the market looking for the 1.30 level above, and a break above there should send this market to the 1.3450 level after that. I expect quite a bit of volatility, but the recent breakout above the 1.2750 level has me thinking that we are trying to wind up the market for a bigger move to the upside.