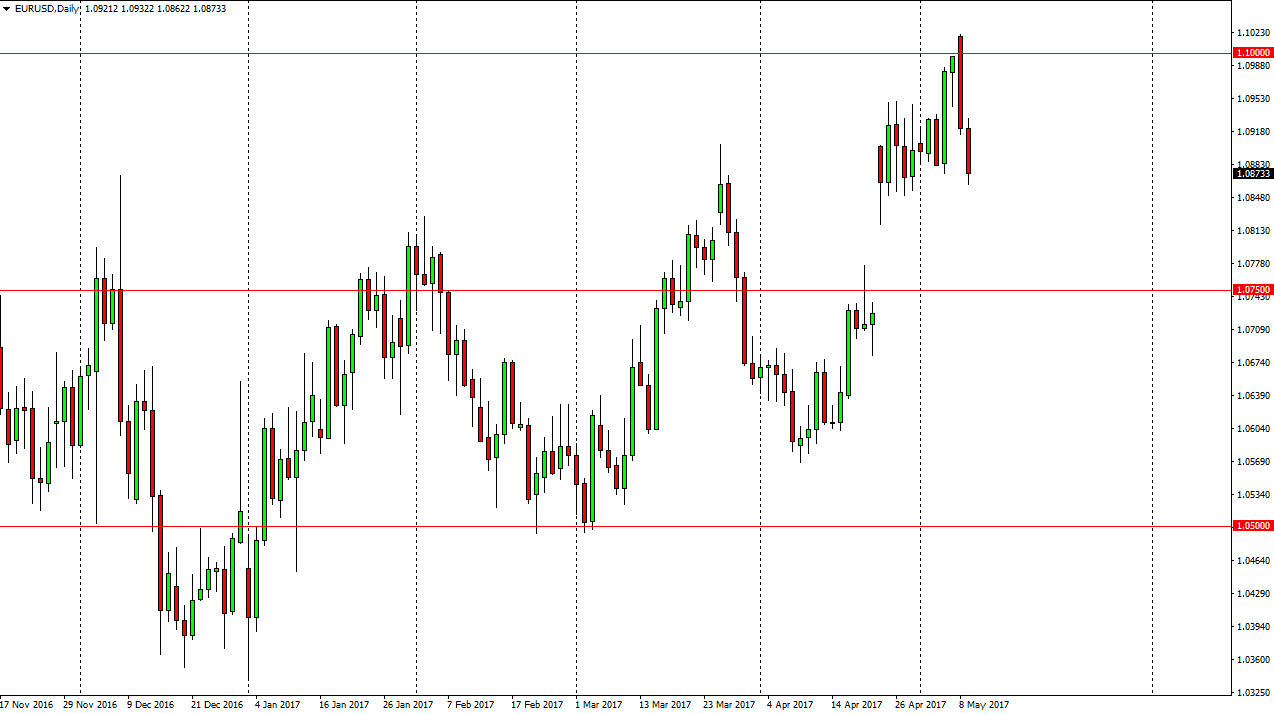

EUR/USD

The EUR/USD pair fell significantly on Tuesday, after having a horrible day on Monday. I think if we can break down below the 1.0850 level, the market will then go lower, looking to fill the gap, and reach down to the 1.0750 level. I have no interest in buying and the short-term, and I believe that short-term rallies will be selling opportunities. The markets may find quite a bit of support underneath, but in the meantime the gap looks like a very inviting target. I believe that the market will find buyers there, so I think this is a short-term selling opportunity at best.

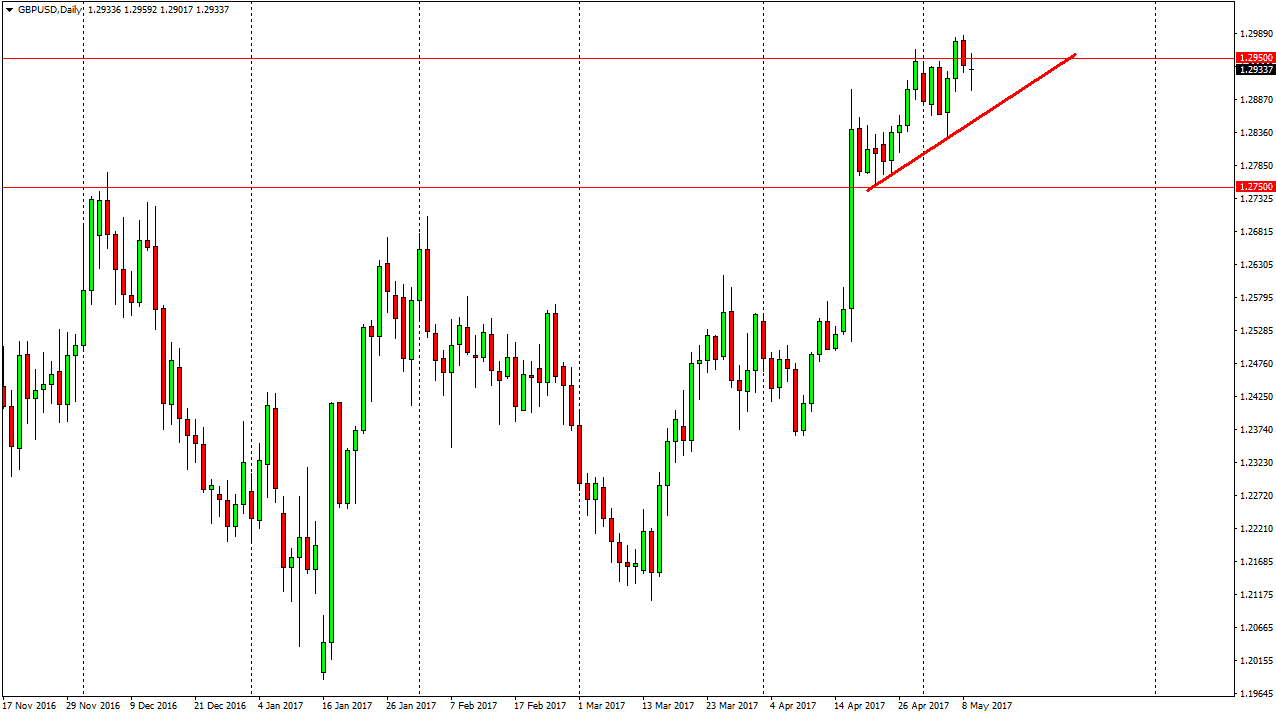

GBP/USD

The British pound had a volatile session on Tuesday, and therefore ended up forming a neutral candle. The candle sits just below the 1.2950 level, testing the 1.29 level for support. There is an uptrend line underneath, and I believe that the market will continue to obey it, and eventually we will break above the 1.2950 level and reach towards the 1.30 level after that. The British pound continues to be bullish overall as far as I can see, and we are currently in an uptrend in channel. This suggests that we should see buyers step into this market place over the longer term, and I believe that we will eventually break above the 1.30 level, and go looking for the 1.3450 level after that, which was the top of the previous consolidation area that the market had been stuck in. If we break down below the uptrend line on the chart, then I think the market will probably go looking for the 1.2750 level below, which would be even more supportive based upon how resistive it was in the past. Nonetheless, I believe that the British pound goes higher rather than lower, and given enough time I think we will see the market breakout to the upside.