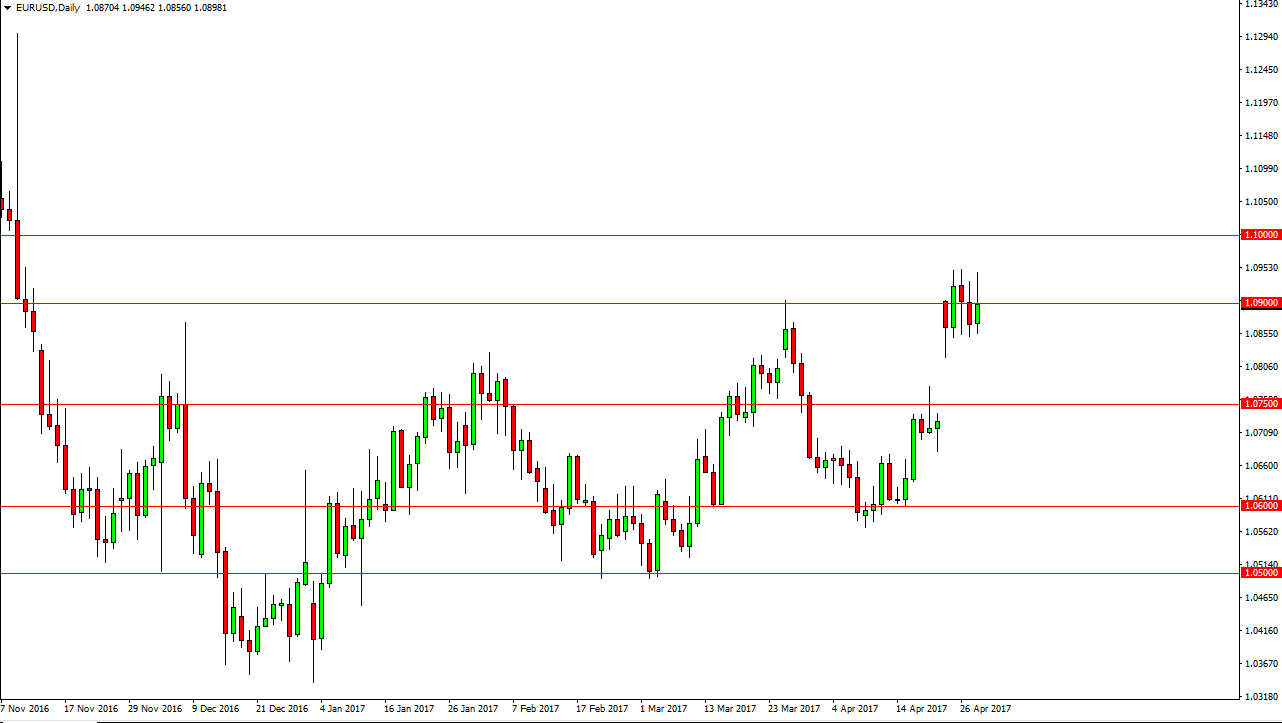

EUR/USD

The EUR/USD pair rallied on Monday, continuing the consolidation that we have seen all the week. The gap underneath that formed on Monday was of course a very bullish sign, and I believe that there is plenty of support all the way down to the bottom of that gap, which is essentially the 1.0750 level. I believe that any pullback to that area will attract a lot of buying pressure. I believe that the market will continue to go higher longer-term, due to the gap being formed and the relief of the French elections. The 1.10 level will be the target short-term, but keep in mind that the headlines coming out of France could turn this market around very quickly.

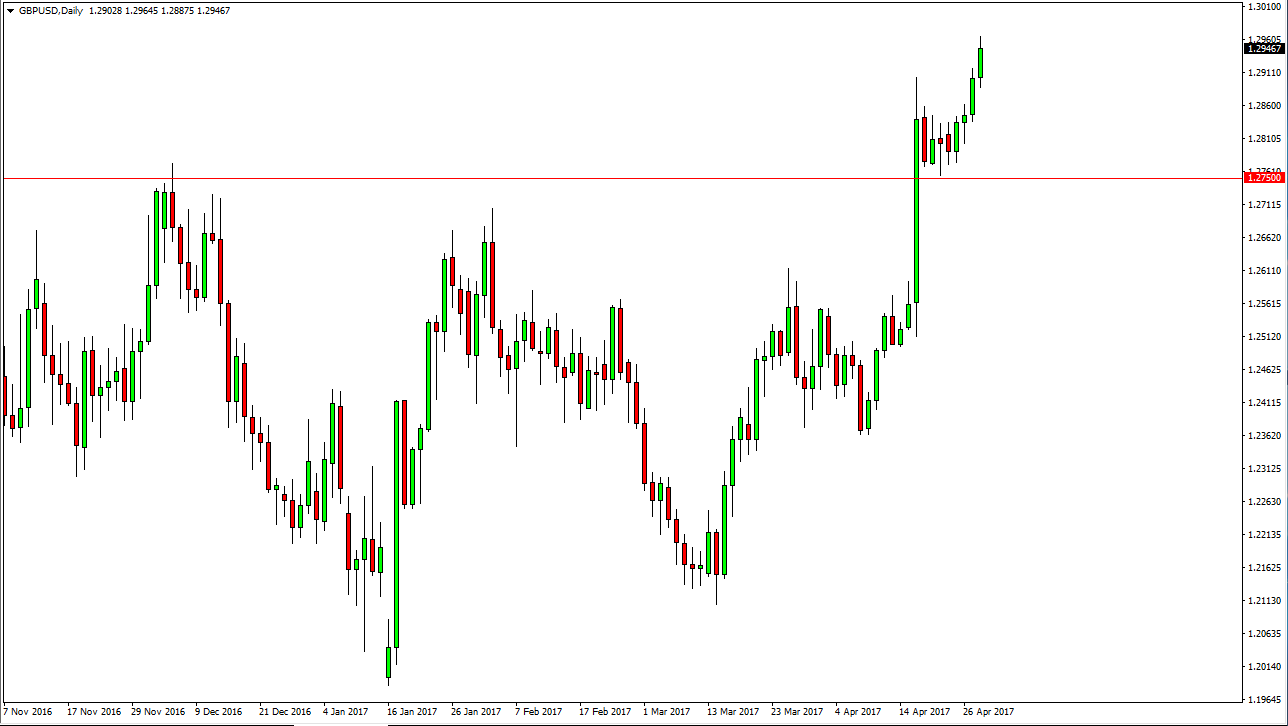

GBP/USD

The British pound rallied during the day on Friday, reaching towards the 1.30 level. This is a market that has plenty of support underneath, and I believe that longer-term we are going to continue to grind higher. The 1.30 level could have some psychological resistance, but given enough time I believe that we reach the top of the previous consolidation area, which is the 1.3450 level. I think that it could be noisy on the way up, but certainly you cannot short the British pound as it has broken out to the upside and changed the overall trend by most measures.

I believe that the 1.2750 level should continue to be the “floor” in the market, and I have no interest in shorting this market until we close well below that level. Ultimately, I believe that the market will not only reach the 1.3450 level, but go much higher. I believe that the longer-term uptrend has started, and the downward cycle is all but over. Any signs of inflation out of the United Kingdom will exacerbate this move and of course continue to drive this currency higher.