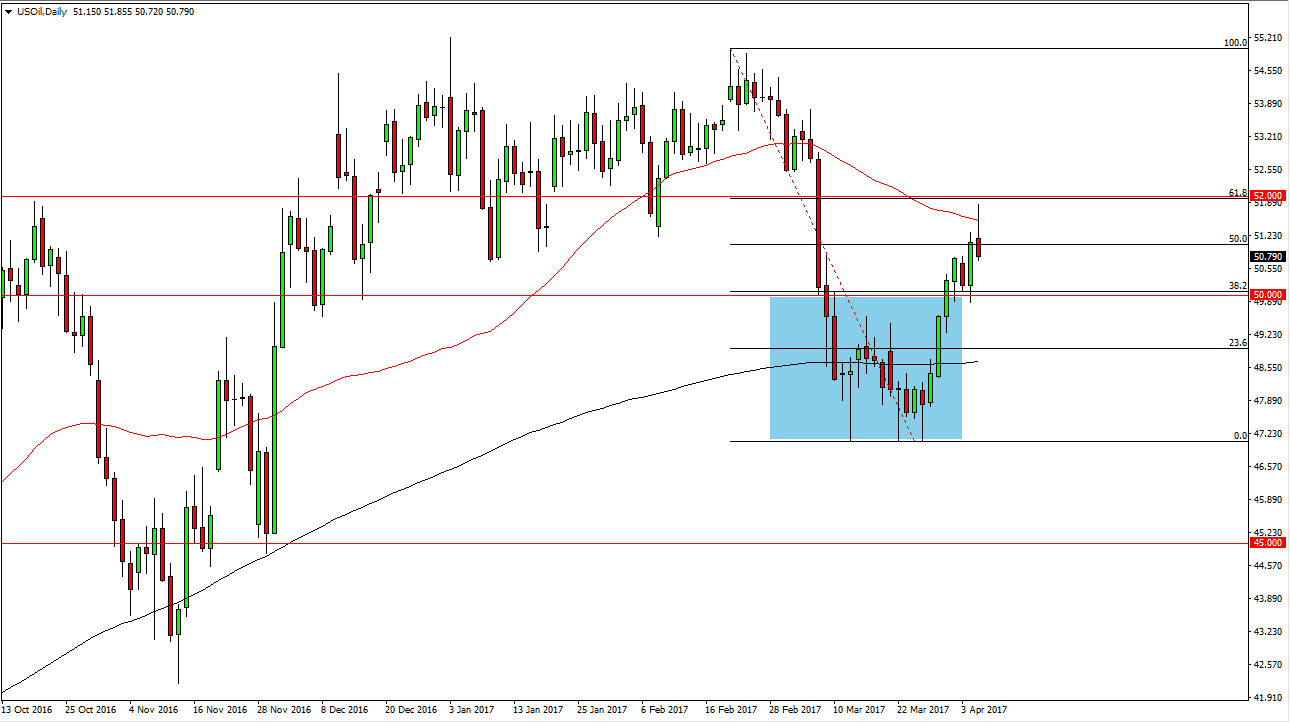

WTI Crude Oil

The WTI Crude Oil market had a very bullish beginning to the day on Wednesday, but ran into a bit of resistance near the $52 level, and the 50-day exponential moving average. On top of that, it is also the 61.8% Fibonacci retracement level, so it looks as if the bearish pressure has returned. By forming a shooting star, I think the market is going to reach towards the $50 level below, and perhaps even lower than that. I would expect to see some support at that area though, so short-term that’s as much as I’m looking for. If we break down below the $50 level, we could go much lower. Alternately, if we managed to break higher and above the $52 level, that would be an extraordinarily bullish sign.

Natural Gas

Not to be outdone, the natural gas markets rallied as well, and found resistance near the 61.8% Fibonacci retracement level. Also, there was a gap at that area from January, and by reaching up there and being rejected, we ended up forming a shooting star. I believe a breakdown below the $3.25 level is bearish and should send this market lower. This is a market that has been extraordinarily bullish as of late, so we could be looking at a pullback to build up enough pressure to continue the move. Longer-term, I’m very negative when it comes to natural gas, but obviously, that has not been the trade to take lately. This is a very bearish candle though, and I think we could be seeing the beginning of a turn around. Alternately, if we break above the top of the shooting star that would be extraordinarily bullish but it looks as if commodities in general are starting to struggle, especially the energy sector.