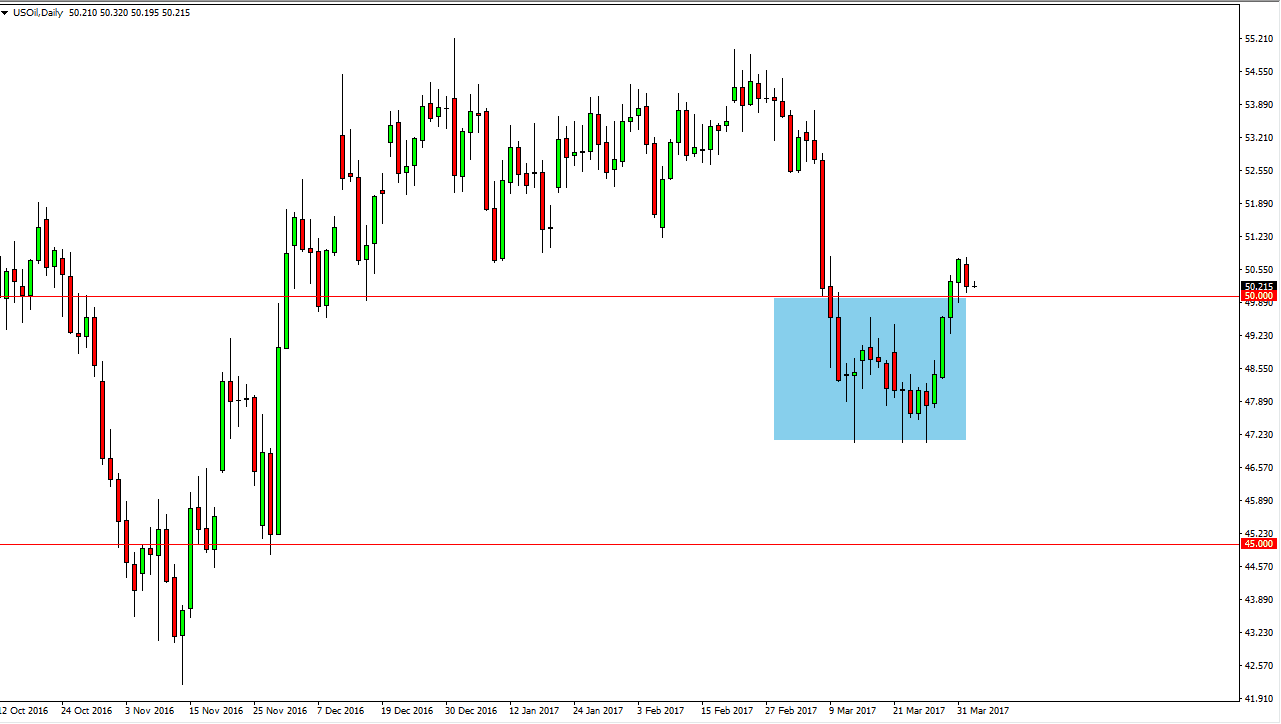

WTI Crude Oil

Oil markets were very volatile during the day on Monday, as we retraced all the gains from Friday. We remained above the $50 level though, so there is still hope for buying pressure. For myself, I don’t have any interest in shorting this market until we get below the $49.50 level, which would be reasonably significant bearish pressure to start forming a short position. In the meantime, I believe that back and forth trading will continue until the market can make up its collective mind. I anticipate that the market is going to bounce between the $49.50 level on the bottom and the $51 level on the top. Small positions will more than likely be the way to go.

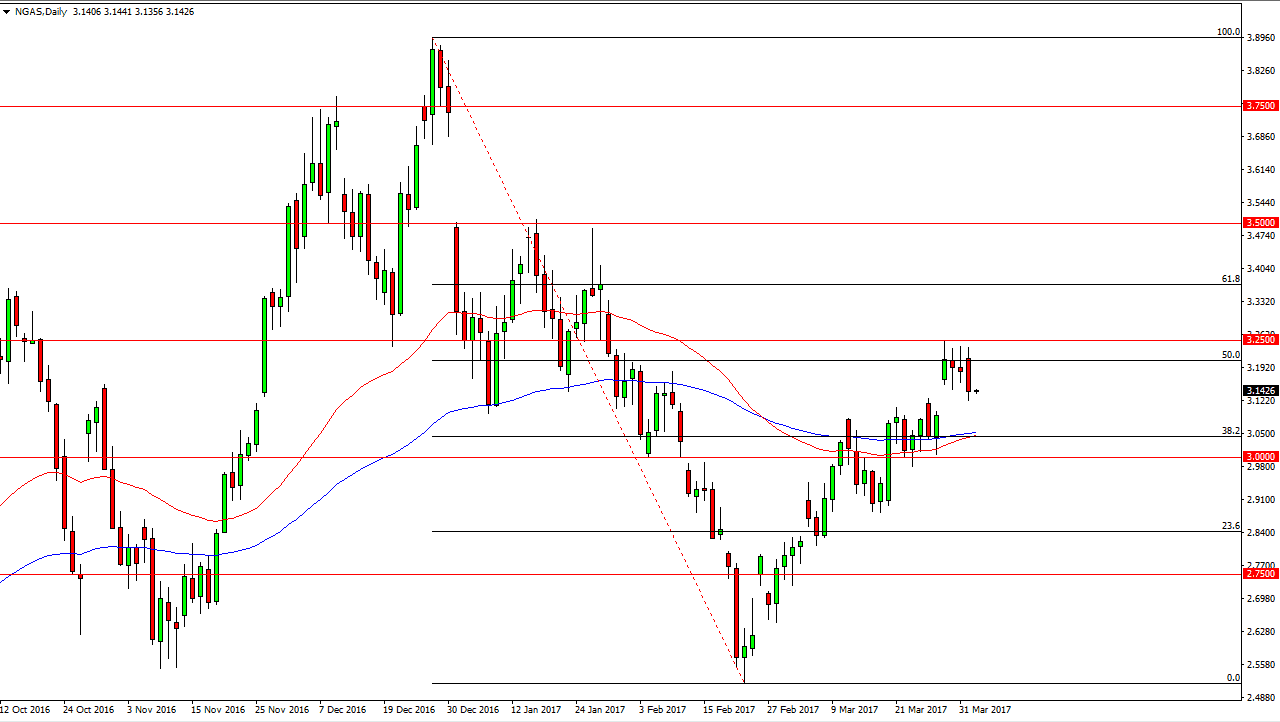

Natural Gas

The natural gas markets initially tried to rally on Monday but found far too much in the way of resistance to continue going higher. The $3.25 level continues to be rather resistive, so it’s no surprise that the market rolled right back over. It looks as if we are trying to fill the previous gap, so I believe that the market will drift down towards the $3.10 level. Having said that, a supportive candle could be a nice buying opportunity as we will have finally filled the gap, and it looks as if the 50 and the 100 day moving averages may be getting ready to cross. If we can break above the $3.25 level, the market then can go higher. Until we break above there, I believe that this will be a very choppy market as although exports are starting to look good as far as natural gas is concerned, much like the petroleum markets, we have a lot of moving pieces that are working against each other. Either way, extreme caution will be needed in what should be a very choppy market.