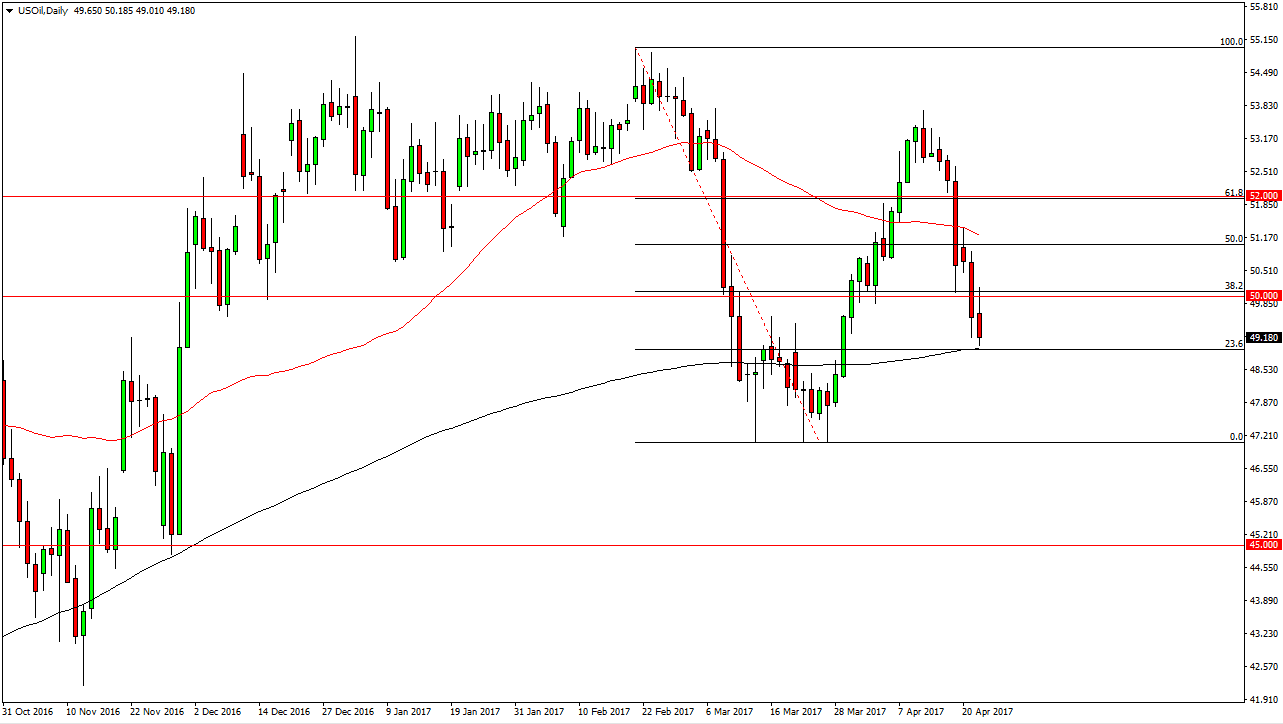

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on positive sentiment from the French elections, but the $50 level caused far too much in the way of exhaustion and resistance. Because of this, the market turned around to form a bit of a shooting star like candle, as we dove down to the $49 level. I believe that short-term rallies should continue to be selling opportunities in a market that will continue to look for reasons to break down. The oversupply has finally taken a hold of trader sentiment, and that being the case it’s likely that the market will reach towards the $47.25 level underneath. That was an area that was rather supportive in the past, and if we can break down below there, the market then should go to the $45 level.

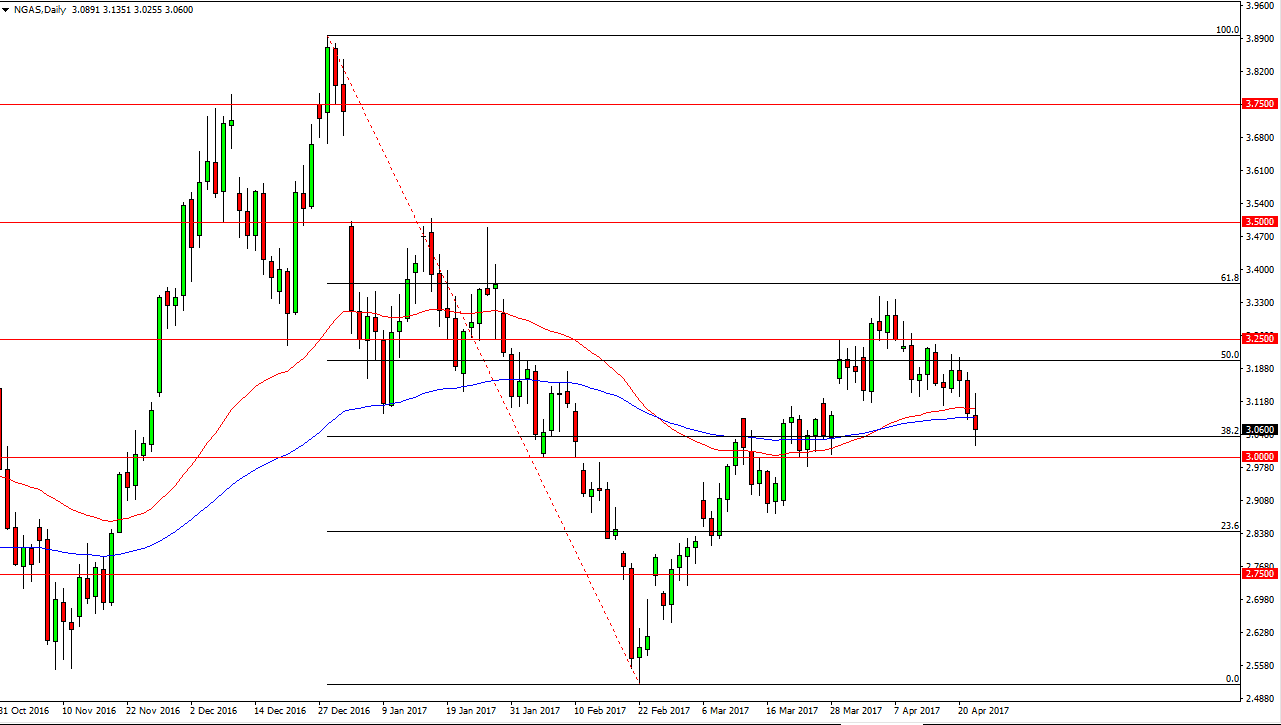

Natural Gas

Natural gas markets went back and forth during the session as well, and initially tried to rally. However, we found enough resistance above to turn things around and form a shooting star. The shooting star kind of candle looks very weak, and if we can break down below the psychologically important $3 level, I believe that the market will reach towards the $2.90 level underneath. Alternately, if we can break above the top of the candle for the session, the market should then go to the $3.25 level above. At this point, I believe that oversupply in the energy markets will continue to weigh upon both natural gas and oil, and I believe that hedge funds are starting to step away from these markets, and then reach towards the lower levels that we have seen as of late. We are getting into the summer months in North America, and that should continue to weigh upon demand as well. Recently, traders had been paying attention to exports out of the United States, but that seems to be in the background now.