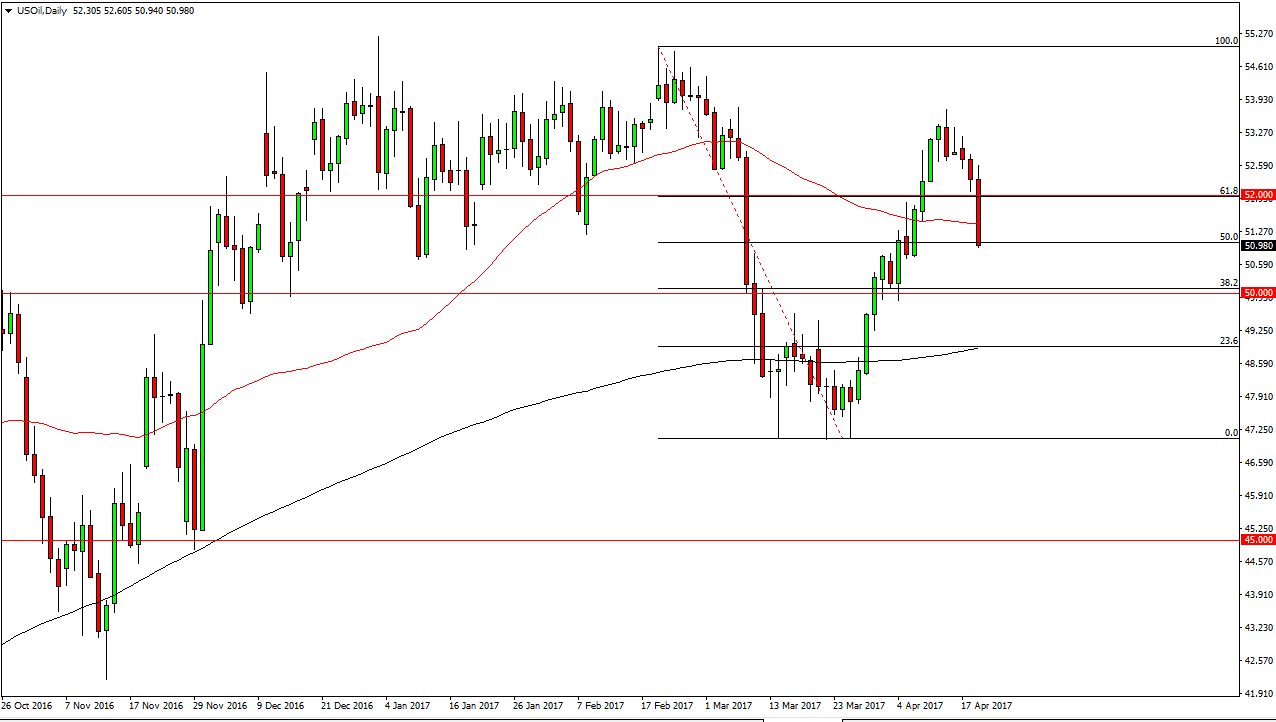

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Wednesday, after a loss of inventory was announced, but more importantly a build of gasoline came about in the United States. We are currently testing the $51 level, and it now looks as if the market may try to reach the $50 handle next. I don’t necessarily think that the buyers have disappeared, just that we are taking a bit of a breather as the market has been a bit overbought as of late. Ultimately, I think we will continue to bounce around and I would expect $50 to be very attractive to longer-term traders, so we’ll have to see how that works out. In the meantime, I believe that short-term selling is probably what we will see.

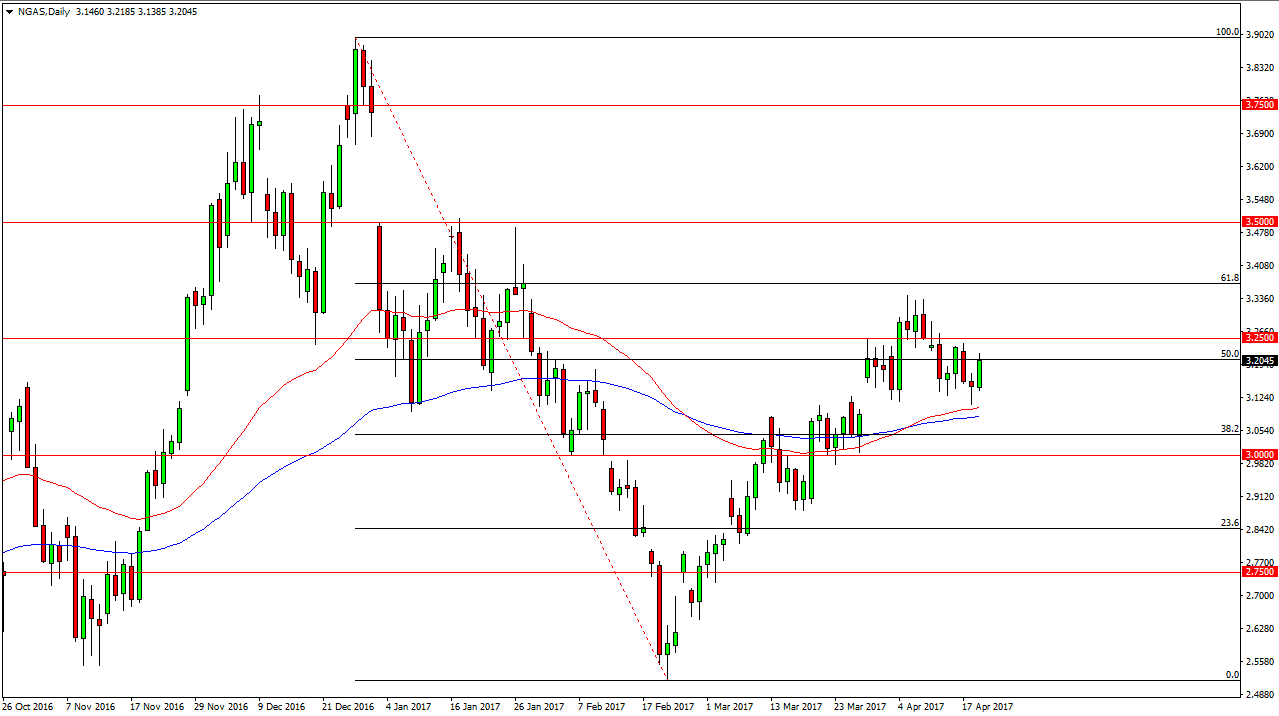

Natural Gas

The natural gas markets rallied during the day on Wednesday, as the market broke above the hammer from Tuesday. The 50-day exponential moving average has offered support, and it looks as if we are going to continue to bounce around with an upward bias. I think the market will probably test the $3.25 level above, and a break above there could send the market looking for the $3.33 level. I believe that we will see a lot of choppiness, but quite frankly I think that the buyers are still very much in control, so I don’t have any interest in selling. If the natural gas markets break above the $3.33 level, the market could find itself reaching towards the 3.50 level above.

Ultimately, I think that there is a longer-term oversupply issue, but right now it seems as if the market is focusing on the US export market which has been very strong. You could make an argument for a potential bullish flag, which would be a very large flag, perhaps trying to fill the gap from December. Having said that, I expect a lot of noise in the meantime.