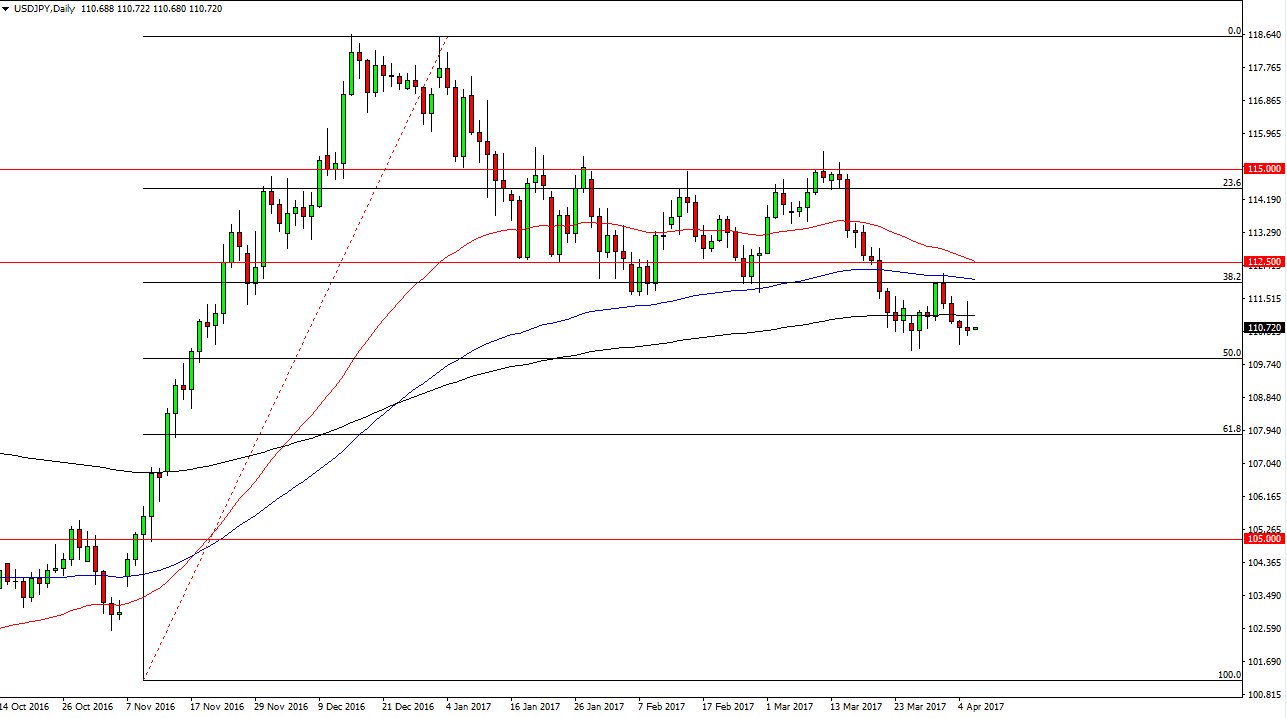

USD/JPY

The USD/JPY pair tried to rally during the day on Wednesday, but found the far too much in the way of resistance at the 200-exponential moving average. Because of this, the market looks as if it is going to try to break down below the 110 level now. If we do, I believe that the next target will be 108 which is the 61.8% Fibonacci retracement level. It seems as if we are heading into a “risk off” type of situation today, as several indices and currency pairs are showing the same type of general weakness. With this, it makes sense of this pair might drop a bit, and perhaps try to find the next support level. Alternately, if we break above the top of the candle for the Wednesday session, that is bullish and should send this market looking for the 112 level again.

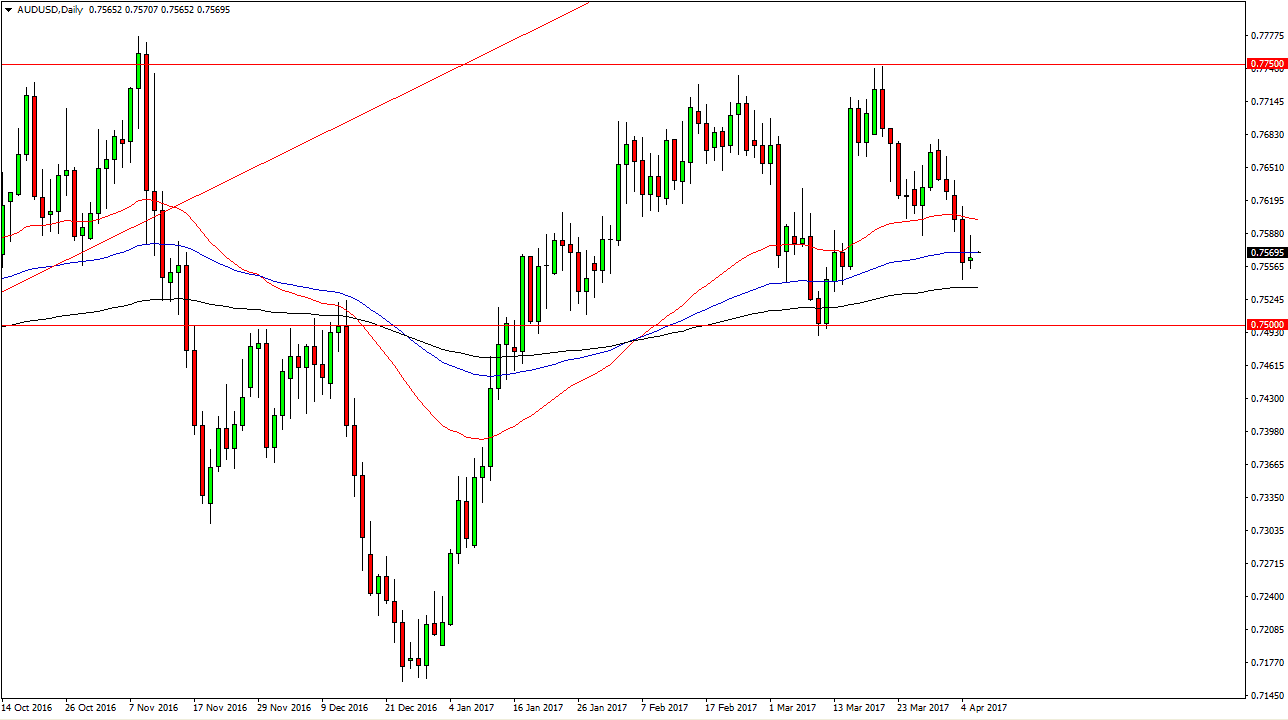

AUD/USD

The Australian dollar tried to rally as well, but continues to find bearish pressure. The fact that we ended up forming a shooting star at the very bottom of the most recent move lower tells me that the Aussie may continue to fall from here. If we do, I expect to see support at the black 200-day exponential moving average, and then below there at the 0.75 handle which has been supportive in the past. I don’t know that I’m calling for any type of break down here, just that there seems to be a general “risk off” trade presenting itself around the markets. I think that we will continue to see sellers step into this market on rallies, but longer-term we have consolidation between the 0.75 level on the bottom and the 0.7750 level on the top. Expect choppy conditions, there is quite a bit of news flow out there that has been throwing the markets around. If gold can finally break out, then this market will shoot much higher but gold struggled at times during the Wednesday session.