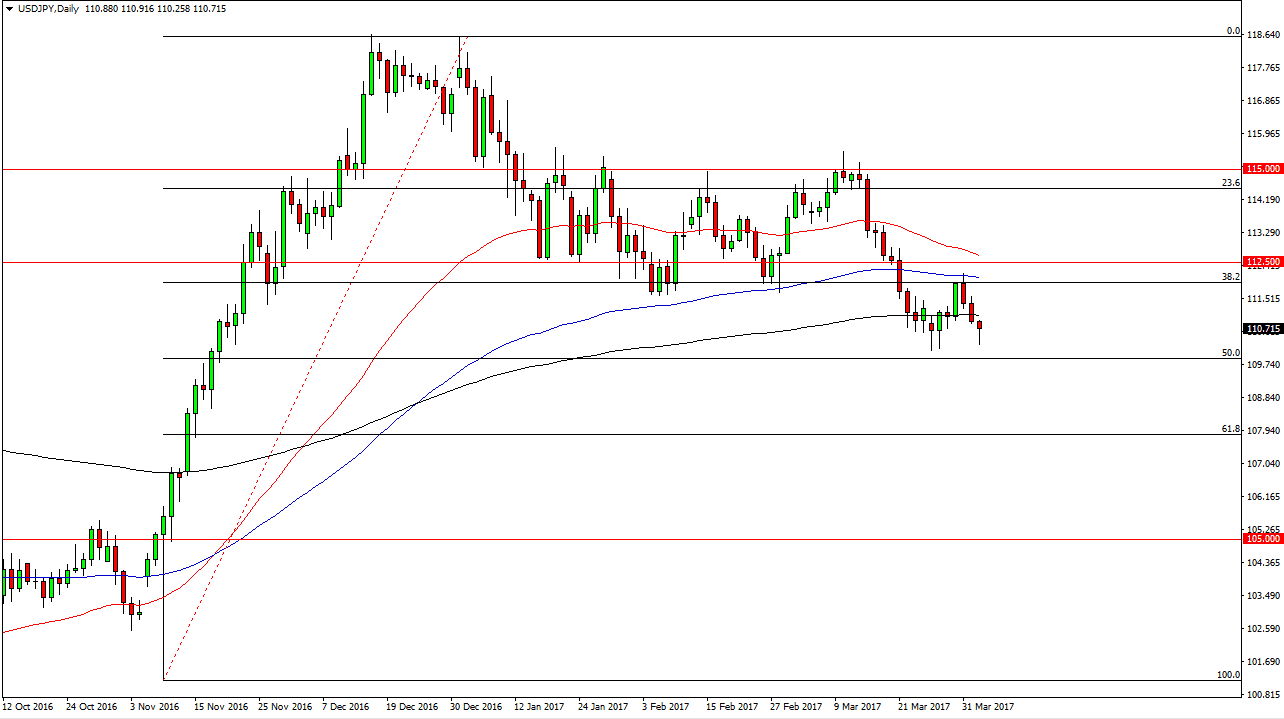

USD/JPY

The USD/JPY pair fell initially on Tuesday, but turned around to form a hammer. By doing so, it suggests that we are going to continue to consolidate, and that the market could very well find itself reaching towards the 112 level again. I believe there is more than enough reason to think that we are going to grind back and forth, and I recognize that the 110 level below is the 50% Fibonacci retracement level. A breakdown below there would of course be negative, and I think that point we would reach towards the 108 level. However, a break above the top of the daily candle should send this market looking for the aforementioned 112 level. Either way, I expect that we are going to see quite a bit of volatility and chop.

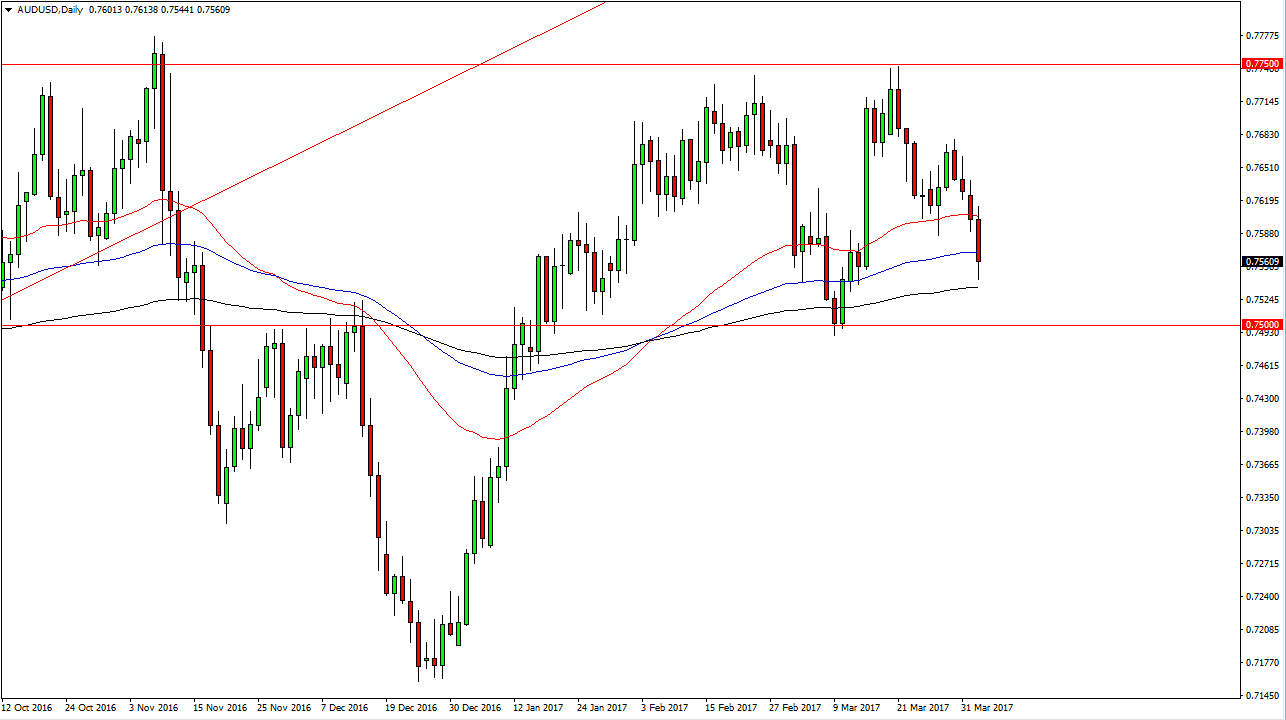

AUD/USD

The AUD/USD pair fell during the day on Tuesday, testing the 200-day exponential moving average. Although I believe that gold markets will eventually help the Australian dollar go higher, it clearly isn’t ready to do so yet. Because of this, I believe it’s only a matter of time before the buyers return though we certainly don’t have a signal now. The 0.75 level underneath is massively supportive, and I think a breakdown below there changes everything. In the meantime, pay attention to gold as a breakout would be very positive for the Australian dollar. However, until that happens I think that any rally will be short-lived as this market continues to chop. The moving averages look very healthy though, so having said that it’s likely that the markets will continue to be difficult to navigate.

If we do get the bullish pressure that I’m anticipating, we will then reach towards the 0.7750 level again. A breakdown below the 0.75 level should send the market down to the 0.73 region. Either way, expect difficult trading conditions.