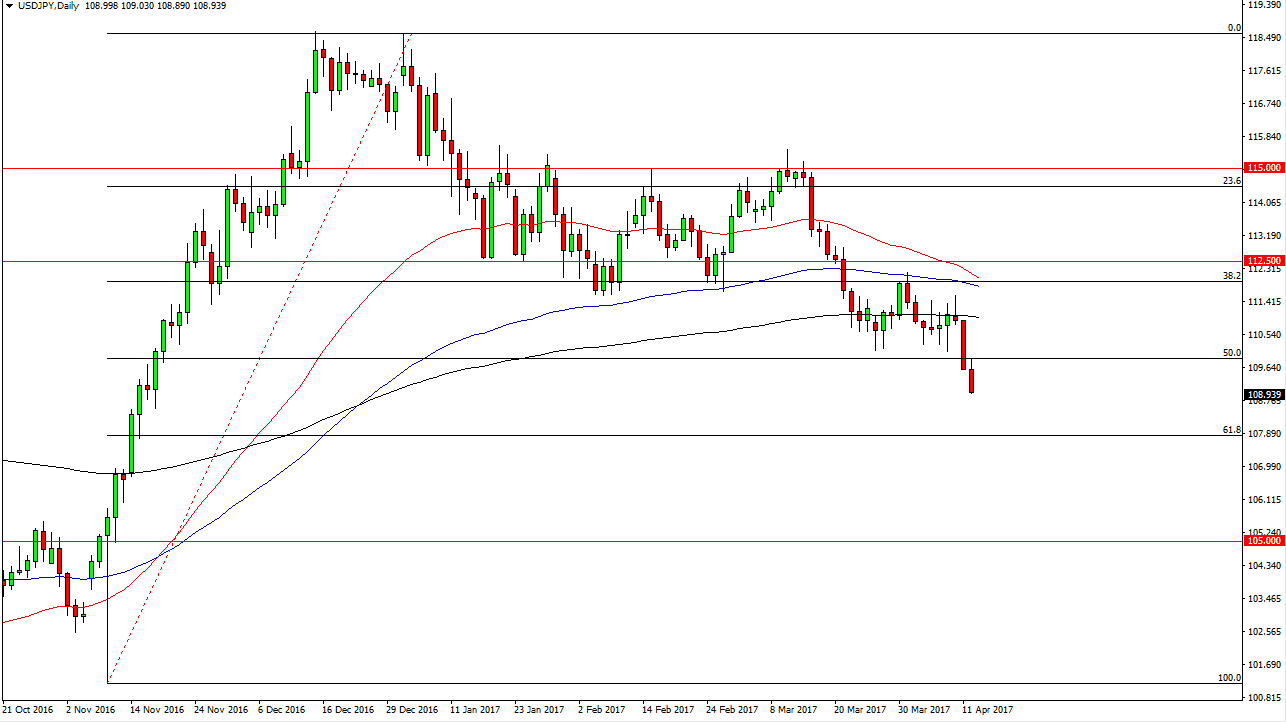

USD/JPY

The USD/JPY pair broke down during the day on Wednesday, slicing through the 109 level. We had broken down already, but with President Trump suggesting that the US dollar was overvalued, traders jumped all over that move and started buying the Japanese yen. Currently, I believe that we are going to reach towards the 61.8 Fibonacci retracement level, which is near the 108 handle. Short-term rally should be selling opportunities, and I believe that the 110 level is now the “ceiling” in the market. Longer-term, I think that the market will rebound, but it’s obvious that we are doing that currently, and it now looks as if the sellers continue to run the show.

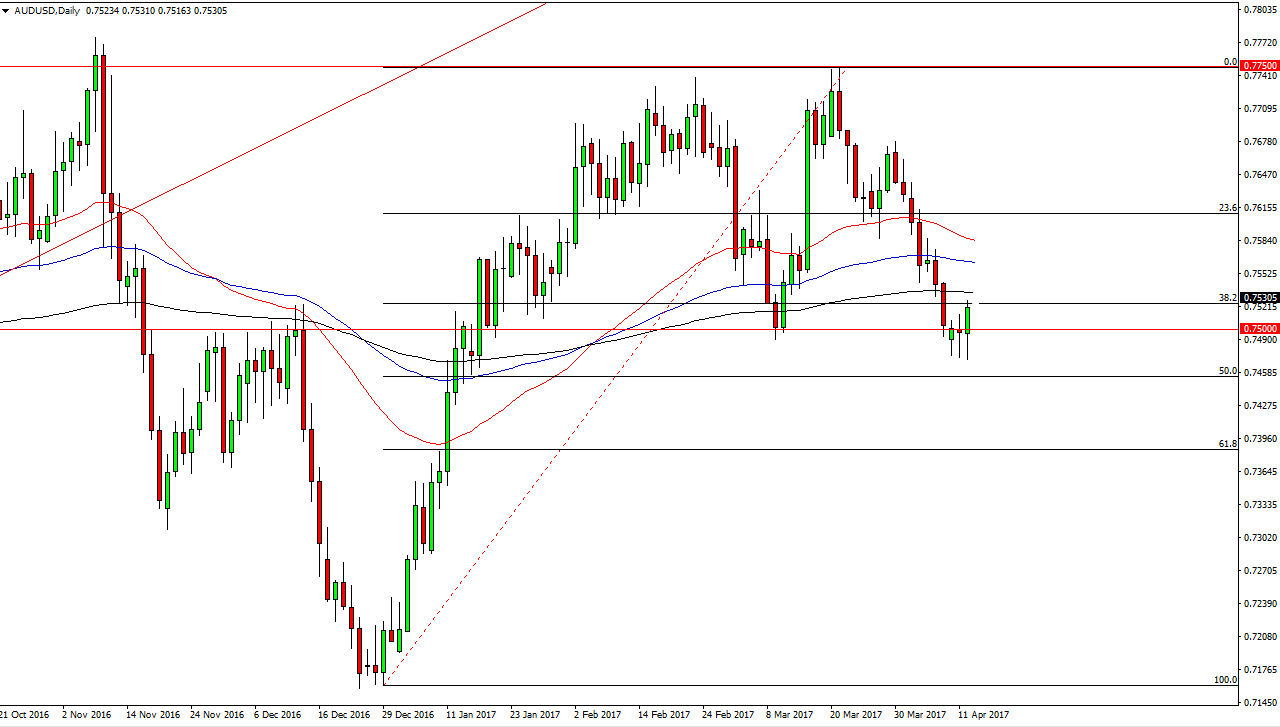

AUD/USD

The AUD/USD pair initially fell as well, but then broke out to the upside. It now looks as if we will try to go higher, but I also recognize that recently there’s been a bit of a “risk off” trade, and although gold has absolutely exploded to the upside, the reality is that the Australian dollar hasn’t necessarily followed suit. I think this is more of an “anti-dollar” move than a “pro Aussie move”, so I think that we could grind higher, but there are better currencies to buy against the US dollar currency.

Even if we broke down, I think there’s enough noise just below to keep this market somewhat stable. Because of this, I’m going to stand on the sidelines but I do recognize that the commodity currencies are getting a little bit of a bump due to the President’s words. I do not expect much more than that, and recognize that we have been following for several different reasons. The 200-day exponential moving average is just above, so having said that we could get a bit of technical resistance as well. I think volatility is going to be here for a few days.