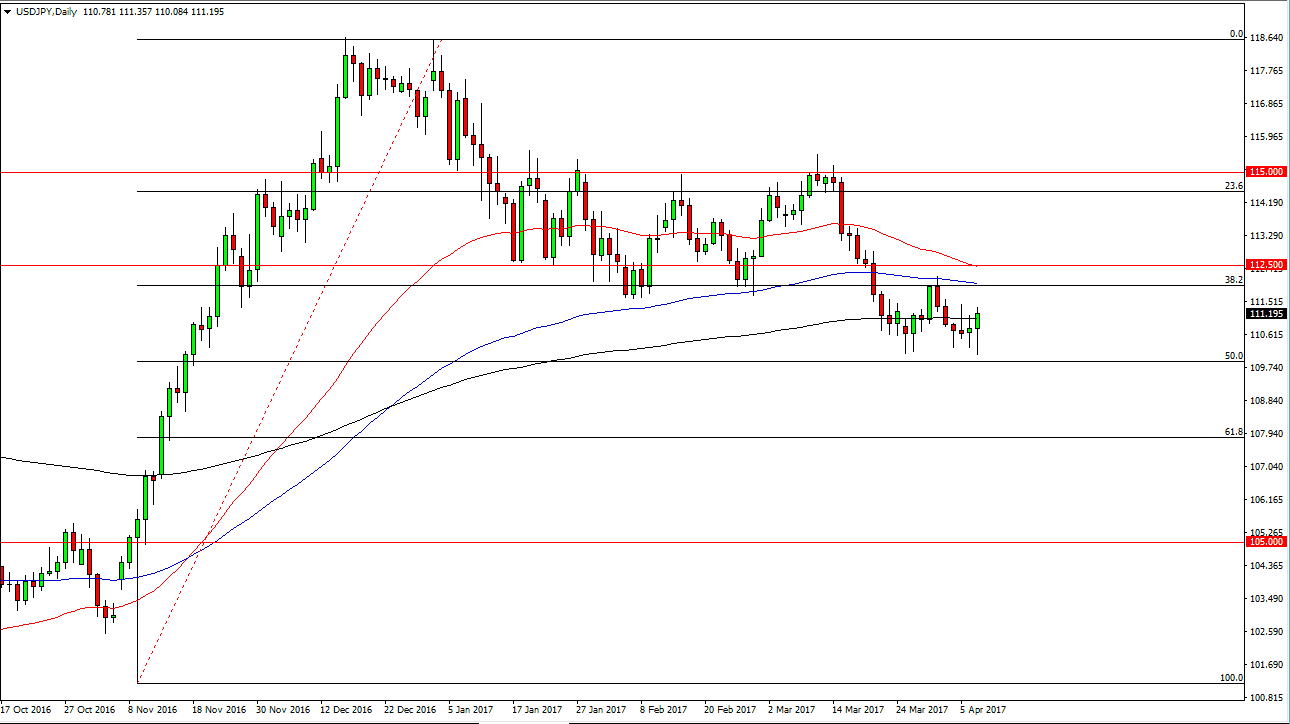

USD/JPY

The USD/JPY pair initially fell during the day on Friday as the jobs number in America came out at 98,000 jobs added, far below consensus. However, the 50% Fibonacci retracement level offered enough support to turn things around and form a hammer. A break above the top of the hammer, the market will more than likely go reaching for the 100-day exponential moving average at that point. The 112.50 level above is massively resistive, and as a result I think what we are looking for is a market that is going to continue to consolidate. Longer-term, I believe that the 50% Fibonacci retracement level will continue to offer support, especially near the 110 handle. On a breakdown below that level, the market would more than likely reach towards the 108 level below, which is the 61.8% Fibonacci retracement level.

AUD/USD

The AUD/USD pair fell significantly during the day on Friday in a bit of a “risk off” move, breaking below the 0.75 handle. I believe that the market will more than likely continue to find selling pressure, as we are now clearly below the 200-day exponential moving average and of course are closing at the very bottom of the range. Ultimately, I believe that the market will reach towards the 50% Fibonacci retracement level at the 0.7450 level. The fact that the gold markets rallying did not help the Australian dollar tells me that this is “risk off” instead of the typical correlation that we see between the Australian dollar and the gold markets.

If we do bounce from here, it’s not until we break above the top of the candle from the Friday session that I would consider buying. Currently, looks as if the US dollar is strengthening in general, and that probably won’t be any different in this market.