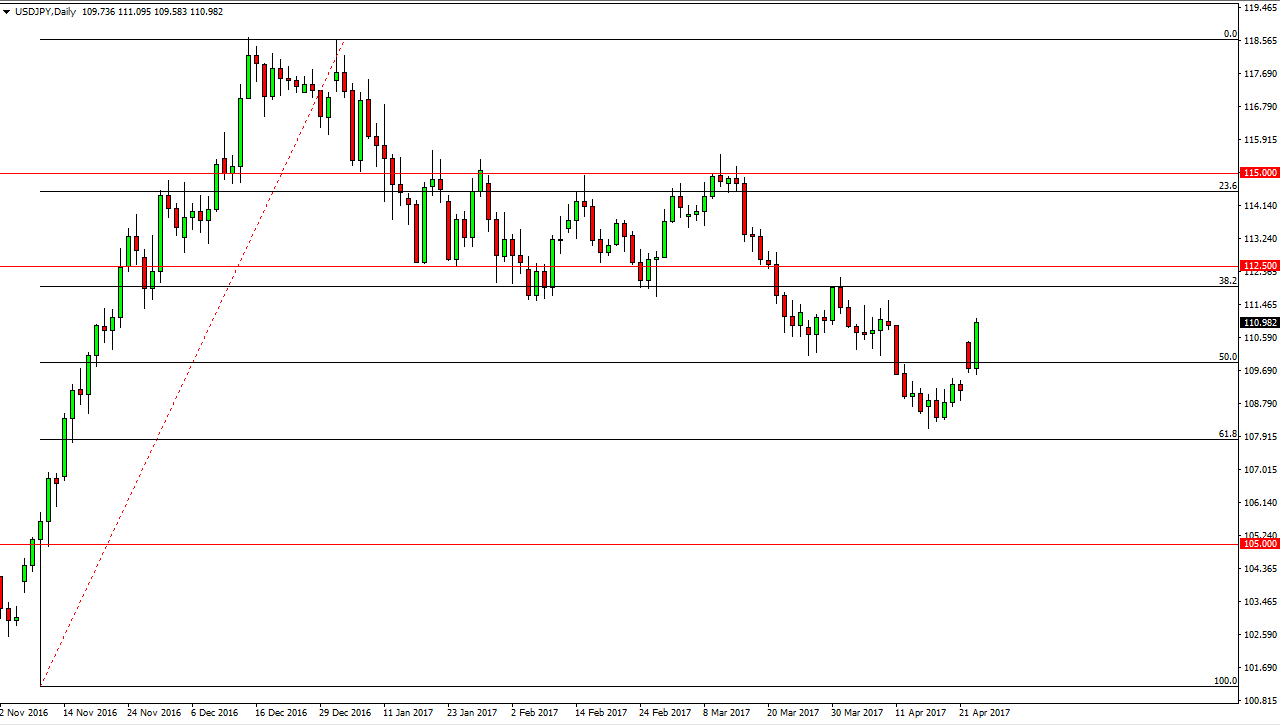

USD/JPY

The USD/JPY pair rallied during the Tuesday session, reaching above the 111 level. This is a very bullish sign, and I believe we will continue to reach towards the 112 area above. It will be volatile, because we have seen such a negative move over the last several weeks. Because of this, I think it will be difficult to hang onto a long position, but I don’t want to short this market currently. I believe that the pair will run into significant trouble around the 112.50 level, but if we can break above there then I think it opens the door to the 115 level. Either way, I think it is going to be choppy.

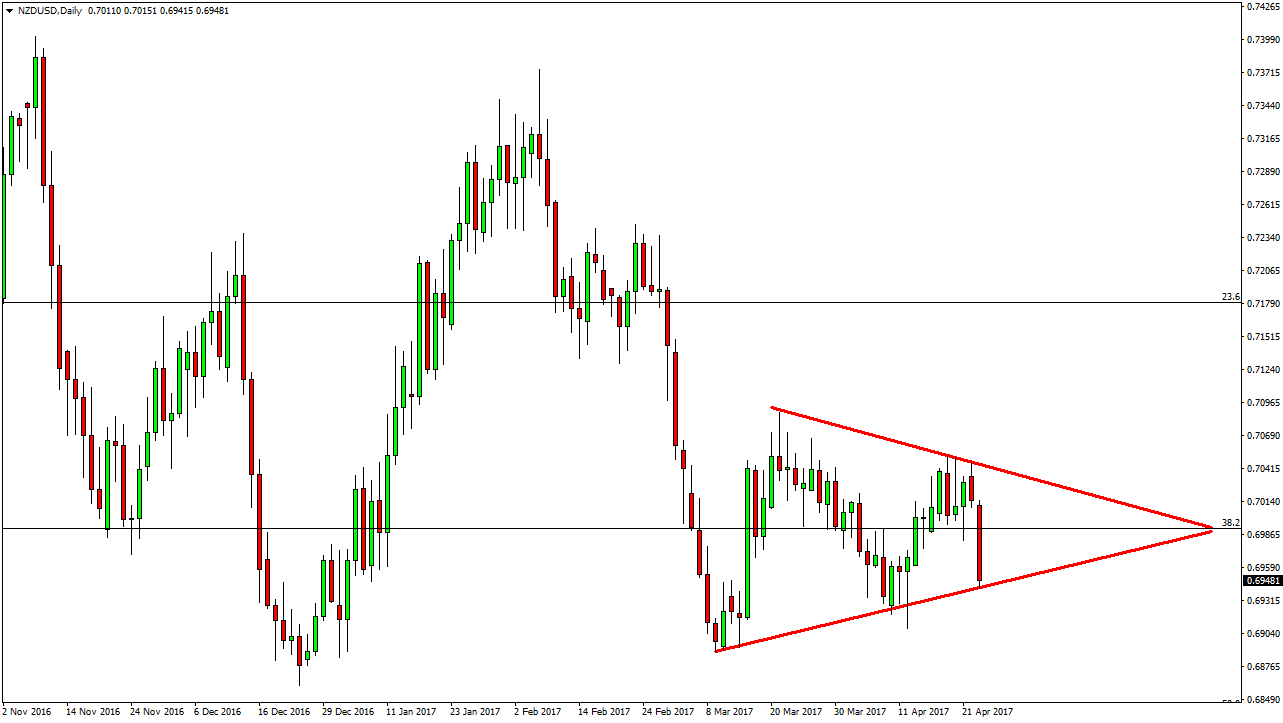

NZD/USD

The New Zealand dollar fell significantly during the session on Tuesday, and we are now testing the bottom of what could be thought of as asymmetrical triangle. Because of this, I believe that if we break down below the 0.69 level the market will probably then start going up much lower. Alternately, we could bounce from here but that should just be more consolidation as we have seen so much recently. I believe that the market will continue to be choppy, but a breakdown looks more likely than not at this point. Pay attention to the commodity arena, as the New Zealand dollar tends to follow the overall attitude of commodity players.

Alternately, if we somehow break above the top of what I see as the symmetrical triangle, then that would be a very bullish sign. I’m not looking for some type of massive breakdown, just that it appears that the sellers are starting to get a bit more aggressive. The fact that we are closing towards the bottom of the range is a very negative sign, so I believe that the odds most certainly favor lower pricing.