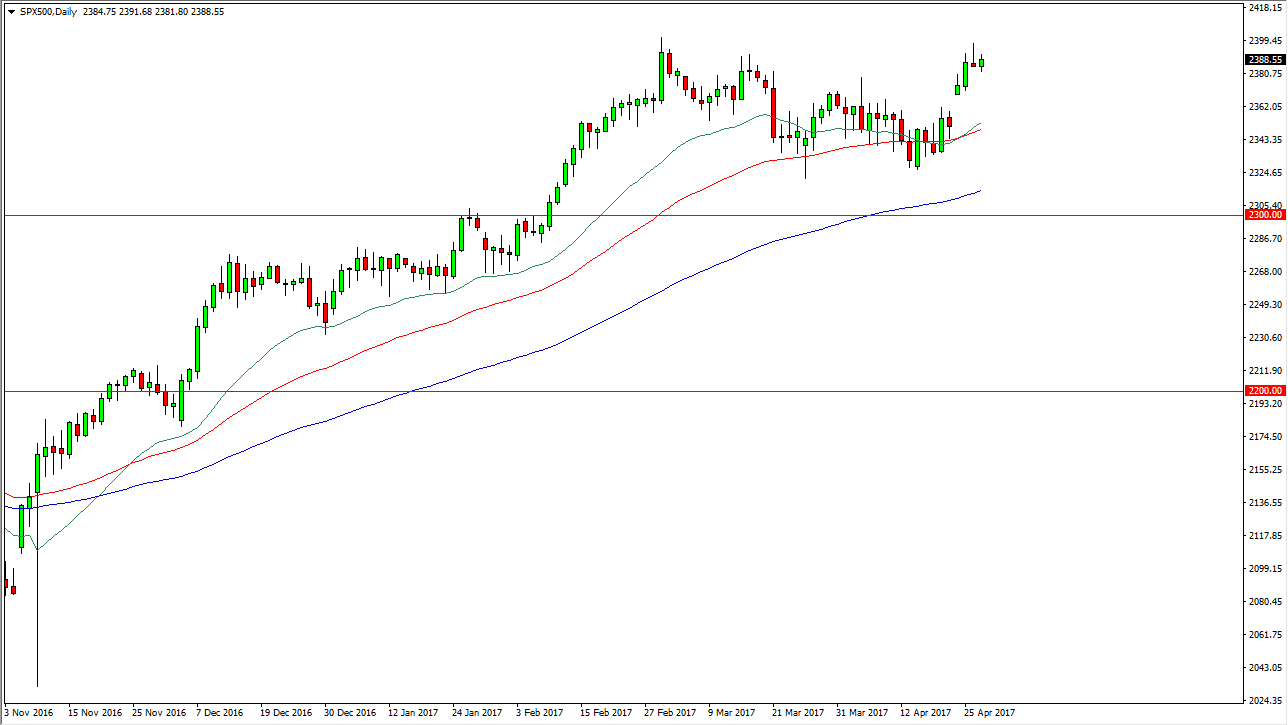

S&P 500

The S&P 500 went back and forth on Thursday, but ultimately ended up forming a slightly positive candle. With the shooting star from the Wednesday session though, I believe that it’s likely we will try to pull back a little bit to fill the gap from the beginning of the week. I believe that it is only going to be a value play though, and I have no interest in shorting this market. I believe that a supportive candle at a lower level is likely to be a nice buying opportunity. If we do break above the top of the shooting star, that would also mean a break above the 2400 level which of course is bullish as well. Ultimately, I do think the longer-term we go higher.

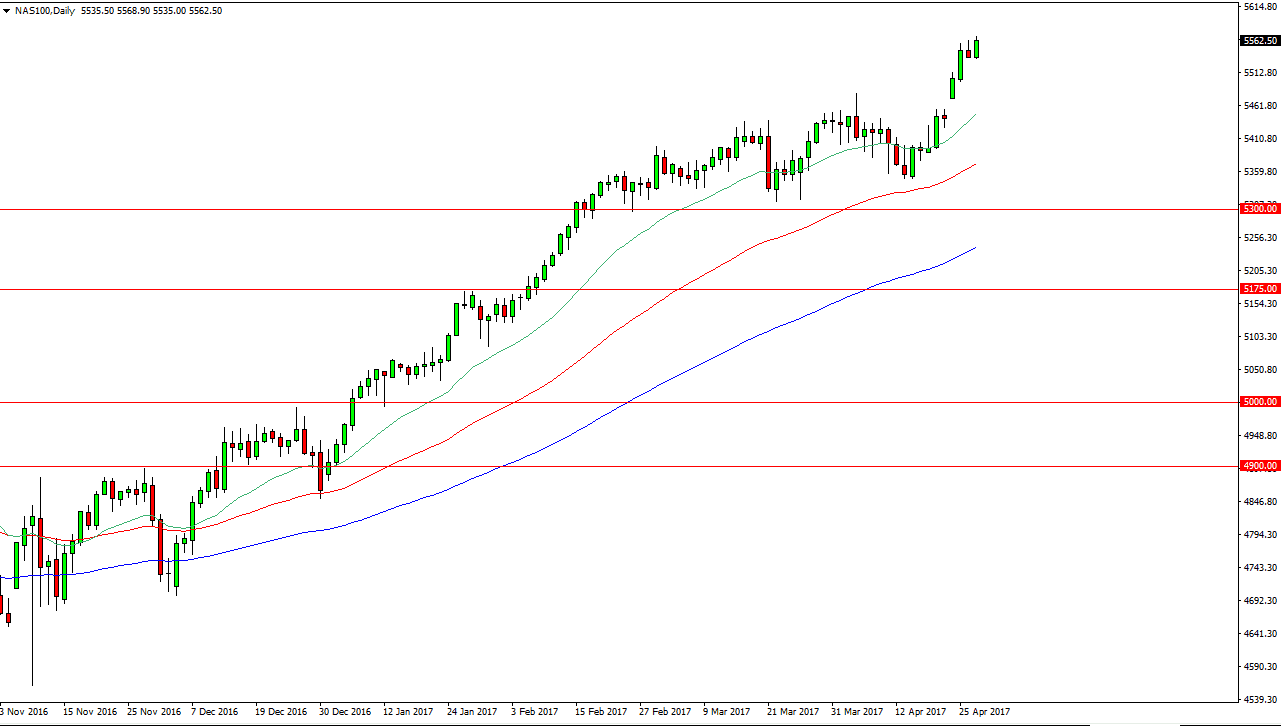

NASDAQ 100

The NASDAQ 100 rallied during the Thursday session, breaking above the top of the Wednesday session. There is plenty of bullish pressure in this market though, so I think that any pullback should end up being a buying opportunity as the market is very overextended. I believe that the 20-day exponential moving average, pictured in green on the chart, should offer support below, as well as the 50-day exponential moving average which is red.

We could even see significant support at the 5500 level, and I think that longer-term were going to go looking for the 5600 level, and then the 5700 level. This is a market that has broken out, and has been leading the other US indices higher for some time. I have no interest in shorting, and believe that the NASDAQ 100 continues to show good signs for stock indices around the world. This index could be the “canary in the coal mine” when it comes to world equities overall. Because of this, you should be watching the NASDAQ 100 regardless of what your trading.