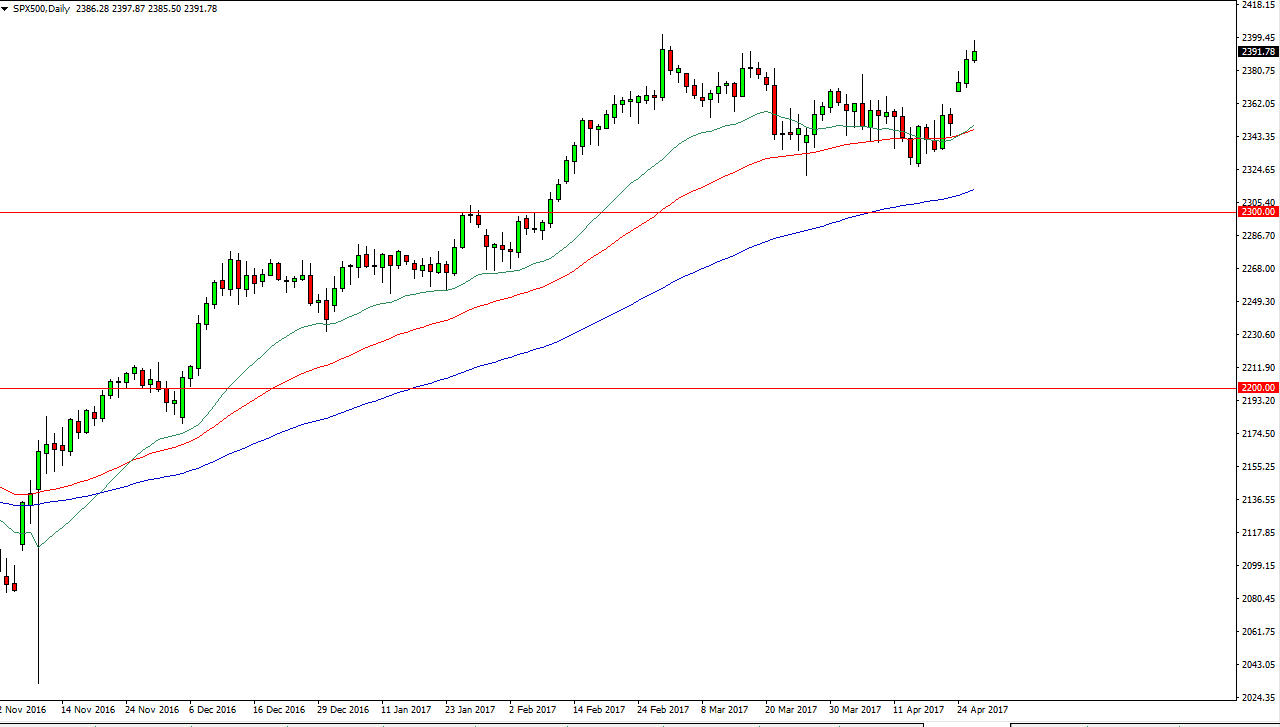

S&P 500

The S&P 500 tried to rally during the session on Wednesday but struggled at the 2400 level. It looks as if we will continue to try to go higher, but it would not surprise me at all to see a little bit of a pullback as we have seen an explosive moved higher lately, and may have to pull back in order to build up enough volume to break out to the upside. Nonetheless, I see no opportunity to sell this market, and shorting this type of move is folly at best. I believe that we will break above the 2400 level given enough time and reach towards 2500. Pullbacks should find plenty of support near the 2350 handle which of course is the bottom of the gap.

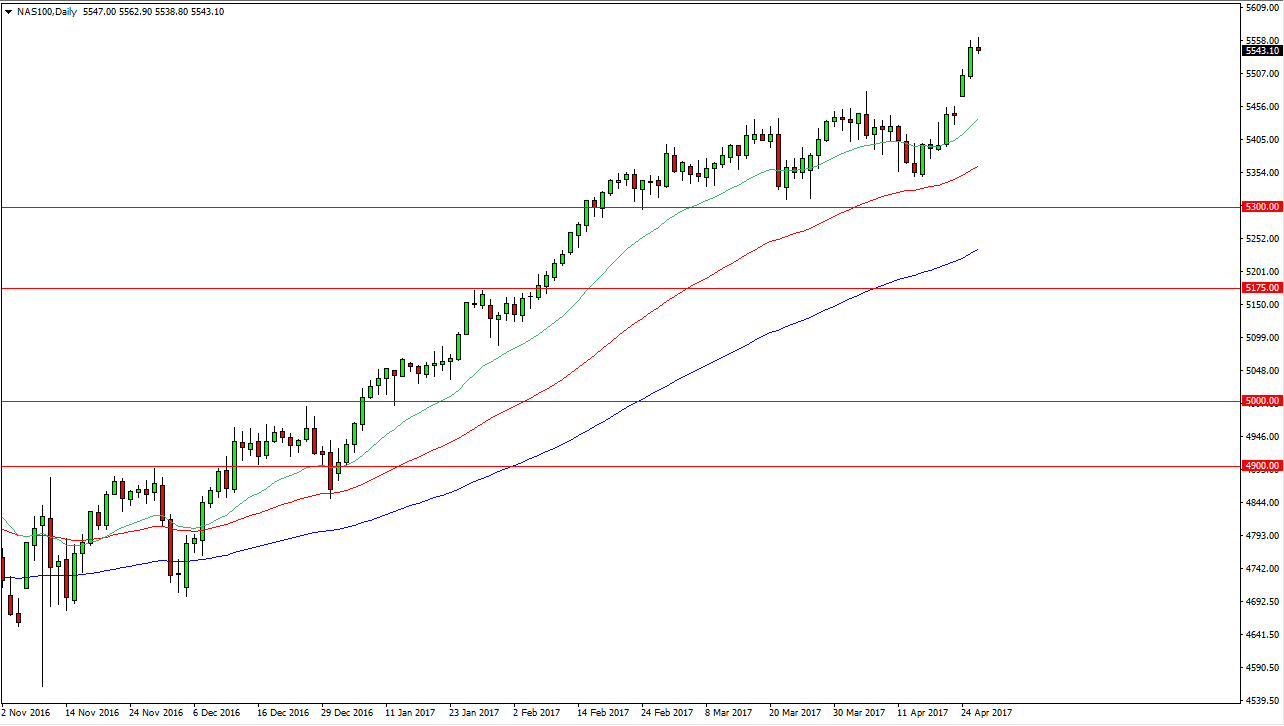

NASDAQ 100

The NASDAQ 100 initially tried to rally during the session on Wednesday, but turned around to form a shooting star. I think we are getting a bit exhausted every here as well, so a pullback is very likely. I think that a pullback will find plenty of support near the 5450 handle, which of course is where the gap was. I believe that the market should continue to find that the buyers are willing to jump in. The NASDAQ 100 has lead the other indices in the United States and of course around the world higher, and I think that will continue to be the case now that we have broken well above the 5500 level.

The green 200-day exponential moving average below should continue to offer support as well, not to mention the red 50-day exponential moving average. I think that the market will go to the 6000 level, it’s like the composite has. I have no interest in selling, and I believe that the 5400-level underneath is going to continue to be the floor in this market.