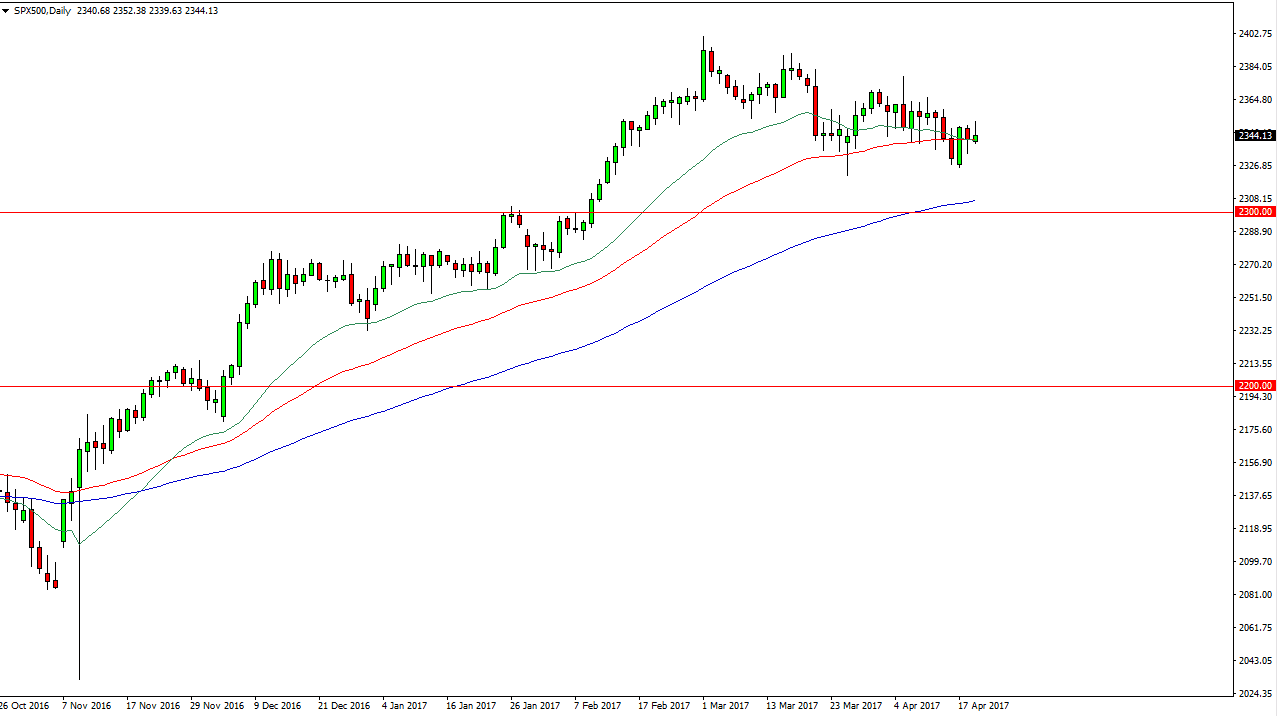

S&P 500

The Wednesday session initially tried to rally but turned around to form a bit of a shooting star during the day on Wednesday, showing signs of exhaustion. However, we are in the middle of earnings season so I’m not too concerned about this. This is a market that will more than likely grind sideways in the meantime, trying to build up enough momentum to go higher. I would however point out that the 20-day moving average is starting to cross below the 50-day moving average, which of course is a sign. However, I believe that the 2300 level underneath is essentially the “floor” in the market, and therefore I think it’s only a matter of time before we bounced and continue the longer-term uptrend. However, we are currently struggling.

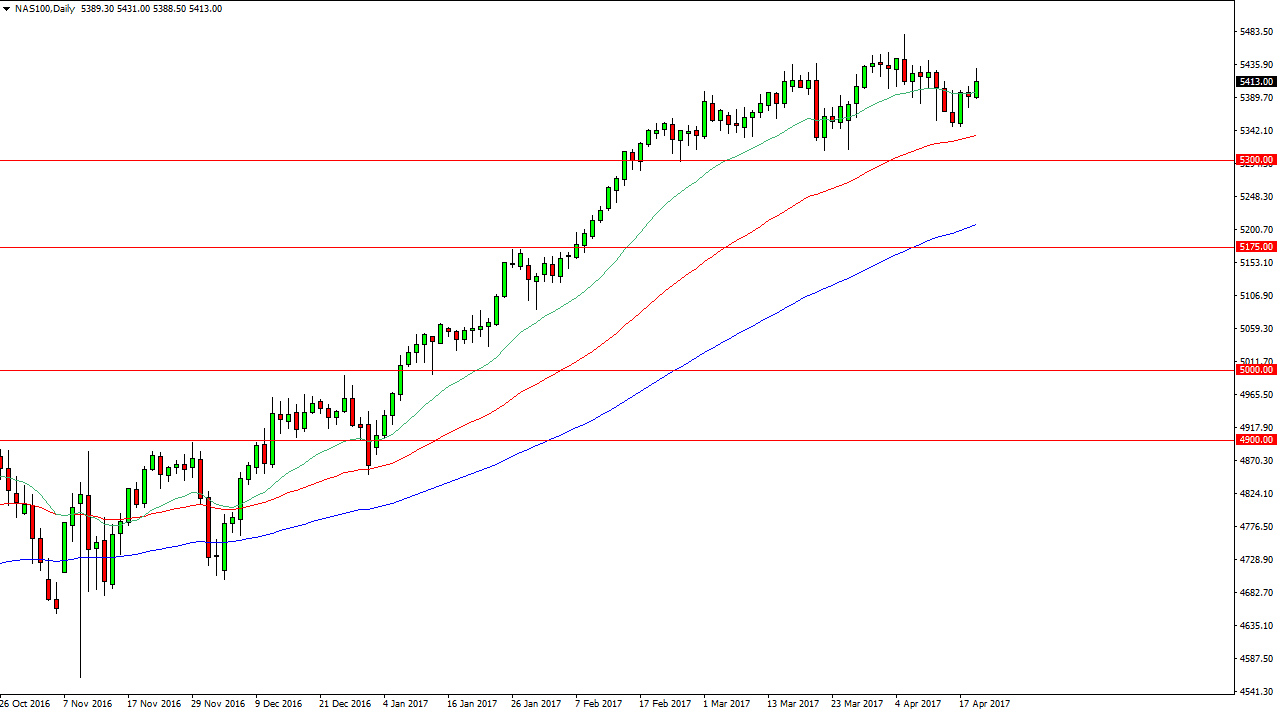

NASDAQ 100

The NASDAQ 100 rallied during the day on Wednesday, turning around after initially rally in. Ultimately, I believe that the market looks healthier than the S&P 500, so I believe that it’s only a matter of time before we continue to the upside, so pullbacks could offer buying opportunities. The 50-day exponential moving average is just below and of course I believe that the 5300 level is massively supportive. Ultimately, I believe that the market should reach towards the 5500 level above, but it’s going to be a choppy affair as the earning season of course is always influential.

I think we will eventually break above the 5500 level, but the market needs to take a break in the meantime in order to build up enough momentum. Currently, the NASDAQ 100 has been one of the more reliable indices that I follow, and therefore I think if any of them are going to take off to the upside and the short-term, it will be this one. I have course will use this as a tertiary indicator on one whether the S&P 500 is going to continue to go higher.