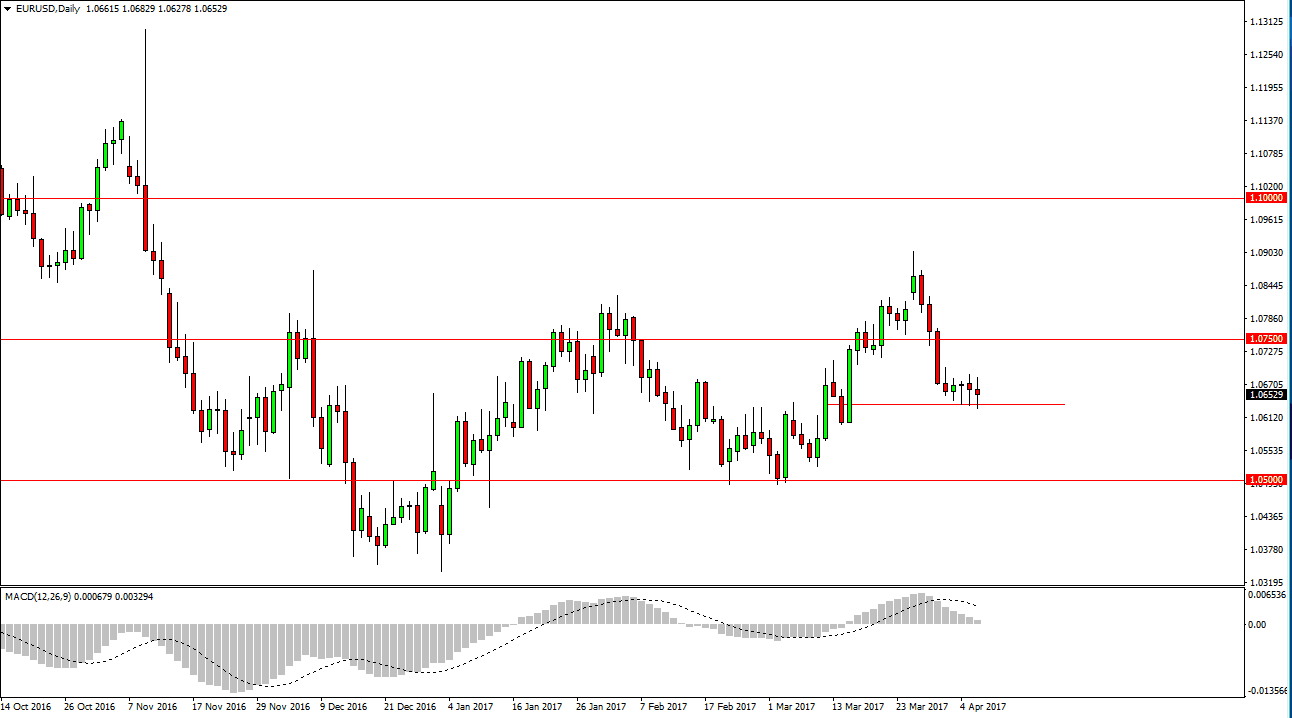

EUR/USD

The EUR/USD pair continues to grind back and forth, as we find quite a bit of support at the 1.0650 level. Because of this, the market should continue to find buyers when it dips, but it’s hard to tell what’s going to happen due to the jobs number during the session today. I believe that the currency markets are simply sitting still and waiting for that vital economic indicator, so I will wait until we form an impulsive daily candle that I can follow. Currently, I believe that the market will continue to chop more than anything else, perhaps sending the market into a short-term range still. If we can break out, I will follow the market to either the 1.0750 level on the top, or the 1.05 level on the bottom.

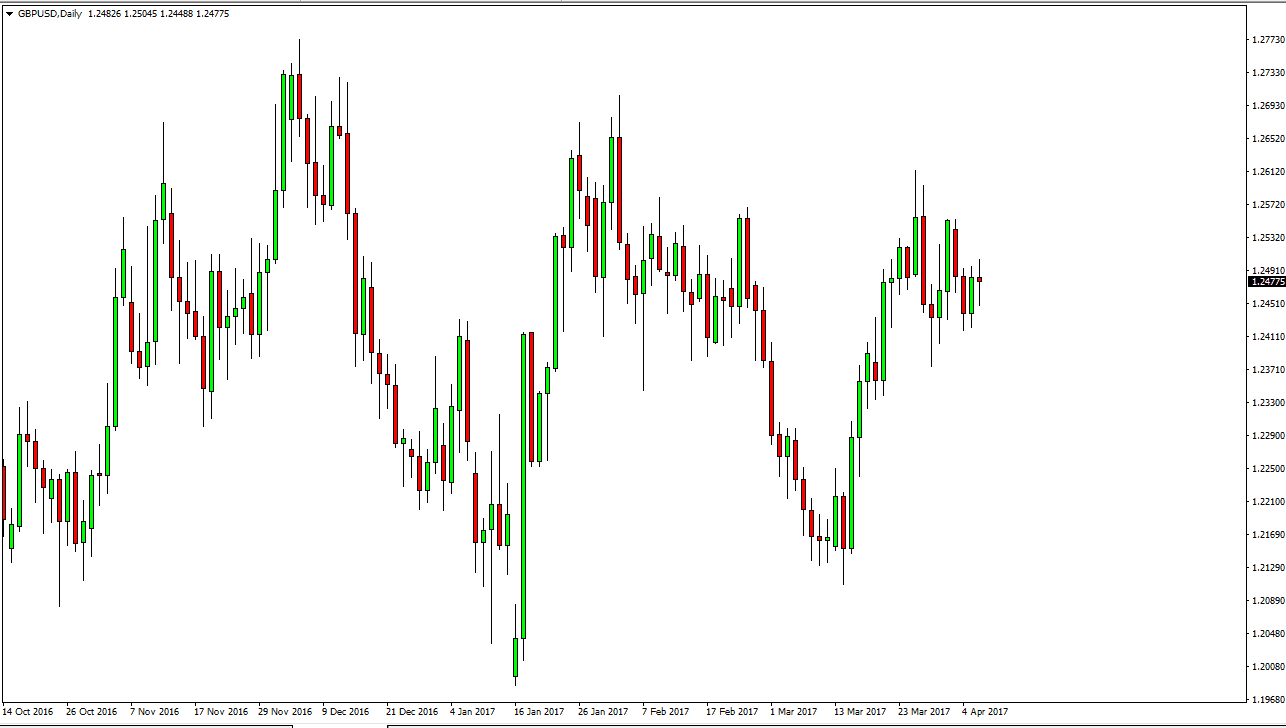

GBP/USD

The British pound went back and forth on Thursday as we continue to get choppy action in this pair. There’s a lot of noise when it comes to this pair due to the British leaving the European Union, and all the headline risks that come with that situation. Because of this, I believe that we will continue to grind back and forth, with the 1.24 level on the bottom being support, and the 1.26 level above being resistance. It’s difficult to imagine that the markets going to break out during the session today, as the jobs number is only a minor component to what’s going on in the British pound overall. After all, the breaking away of the European Union is a massive event when it comes to the future of the British pound, but ultimately, I think that the buyers will win. However, it is going to be a difficult market to trade in the short term, so you’re going to probably be better served to stay away.