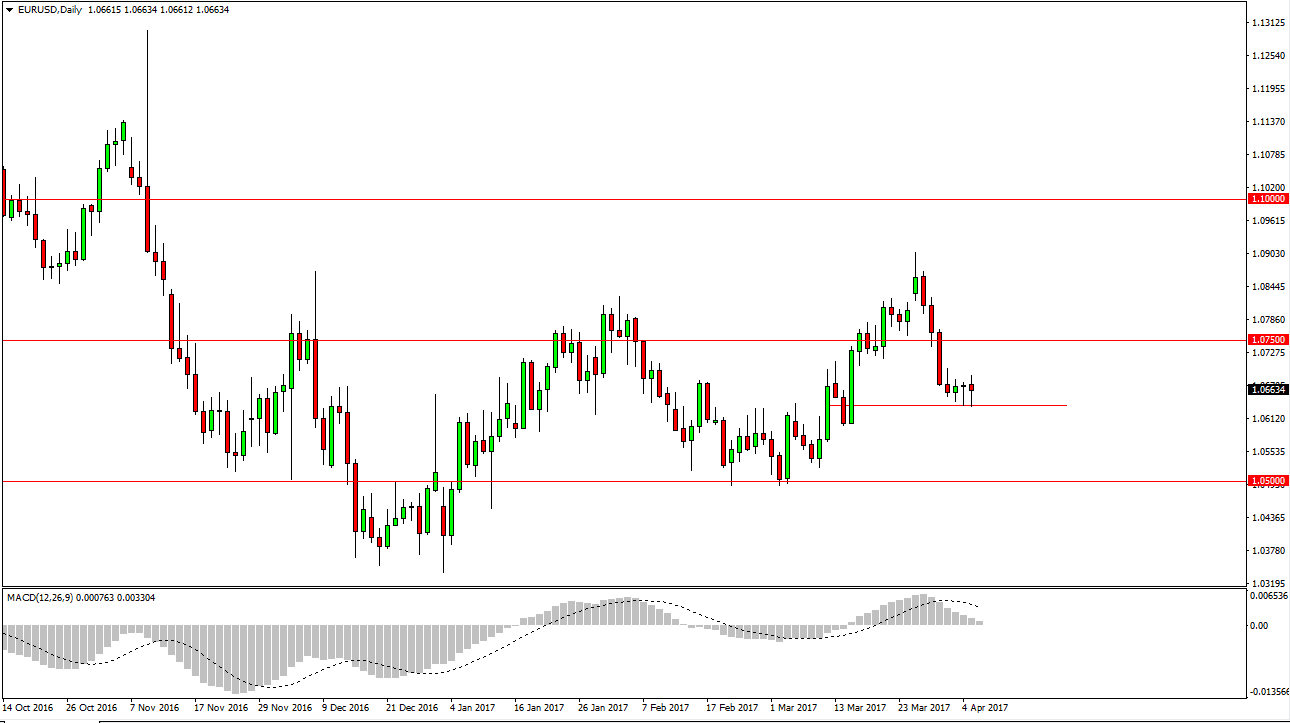

EUR/USD

The EUR/USD pair fell again during the day on Wednesday but yet again found support at the 1.06 handle. Because of this I think that the market will continue to go sideways but if we can break down below the 1.06 handle, that would be very bearish and should send this market much lower. Presently, it looks as if a bounce could be coming, but quite frankly I thought we would have seen it by now. This is essentially “dead money” at the moment, so I’m not overly interested in trading but I recognize that a bouncer here should send the market looking for the 1.0750 level where I would expect to see more bearish pressure.

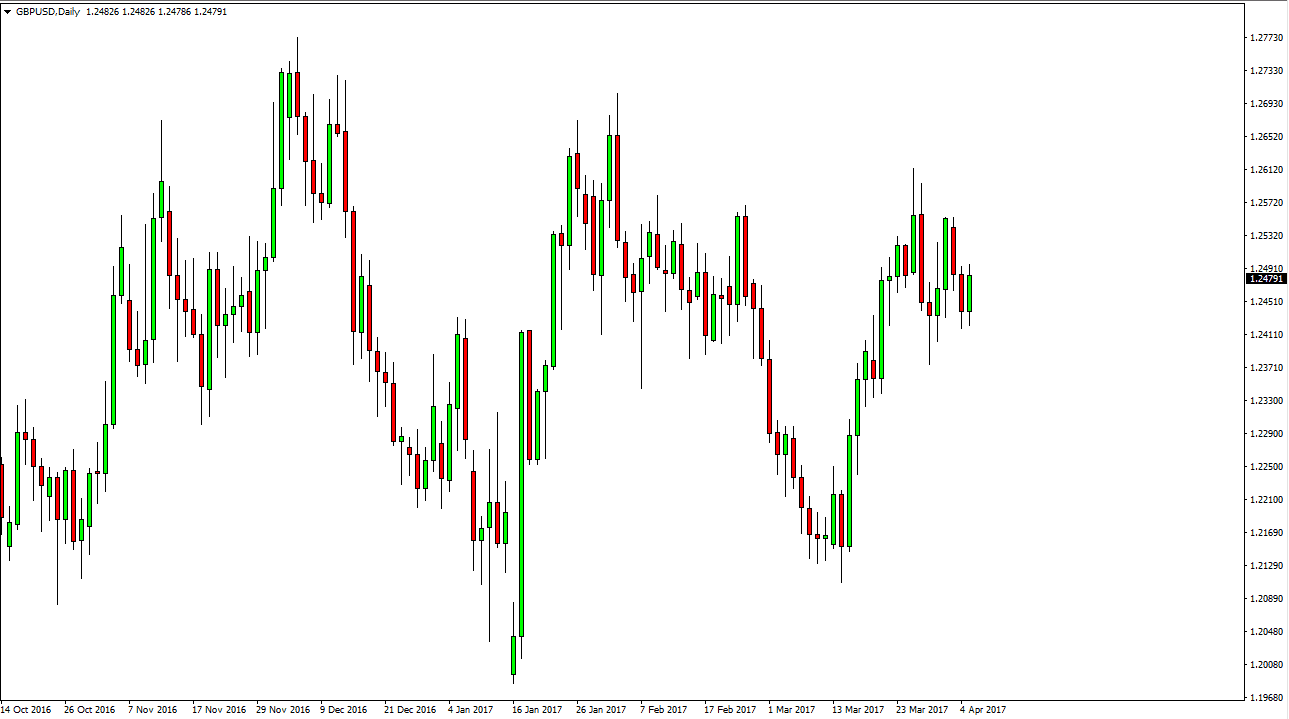

GBP/USD

The British pound spent the day making a positive candle, completely wiping out losses from the Tuesday session. We are still consolidating between the 1.24 handle and the 1.26 handle though, and not much has changed. Because of this, I believe that a lot of back and forth type of trading is probably what you can expect. Because of this, I think that the markets will continue to be very difficult to navigate, especially considering that there are so many moving headlines at the moment. Now that the British are actually going to negotiate the exit from the European Union, you can expect a lot of nervousness when it comes to playing the British pound. However, I think that eventually we will go higher but in the meantime the slightest news flow seems to be agitating the market even further. If we broke down below the 1.23 level, I think that then we would reach towards the 1.21 handle underneath which is the previous support. If we can break above the 1.26 handle, then the market should go to the 1.27 level, and then perhaps even higher than that.