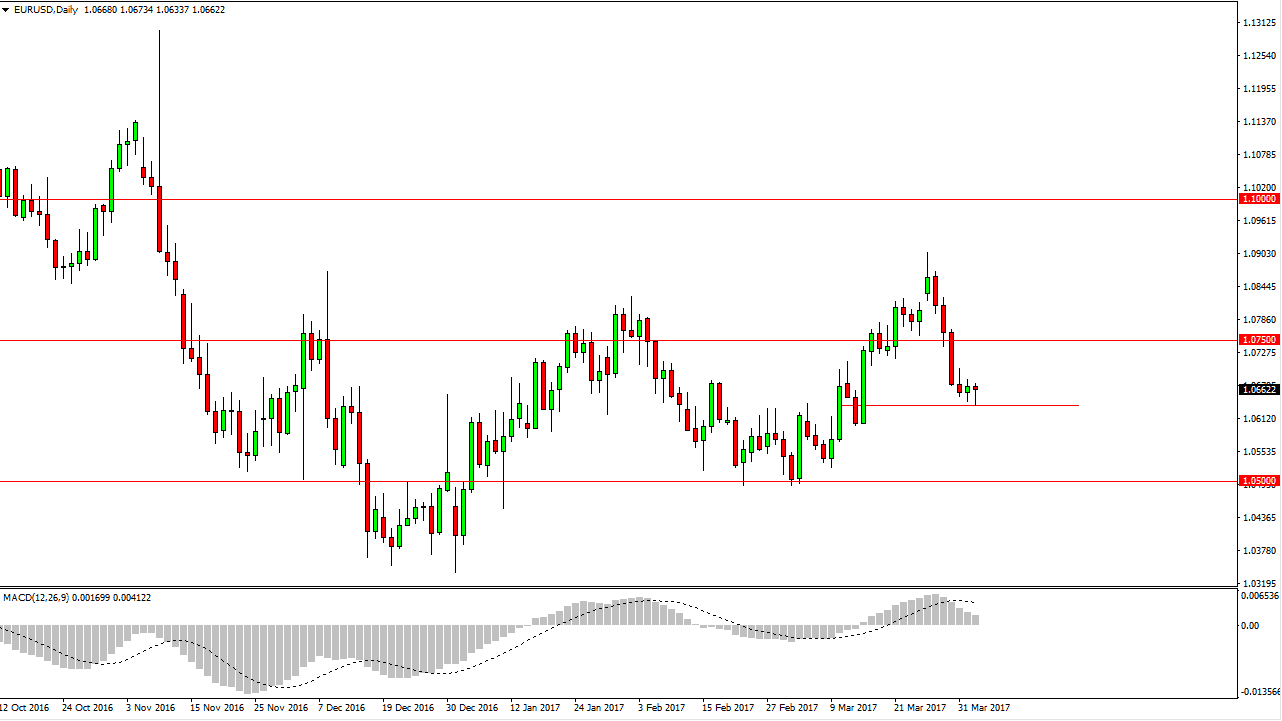

EUR/USD

The EUR/USD pair initially fell on Tuesday, but found enough support near the 1.0650 level to turn things around and show signs of support again. Because of this, it looks as if the market is ready to continue to go sideways and essentially go nowhere now. However, if we break down below the bottom of the hammer for the session on Tuesday, I believe at that point the market will reach towards the 1.05 handle. Alternately, we could go as high as the 1.0750 level and still be within consolidation, but if we can break above there at that point I think the buyers would take over. Either way, I think it’s reasonable to expect volatility more than anything else, recognizing that there are a lot of issues with the European Union currently.

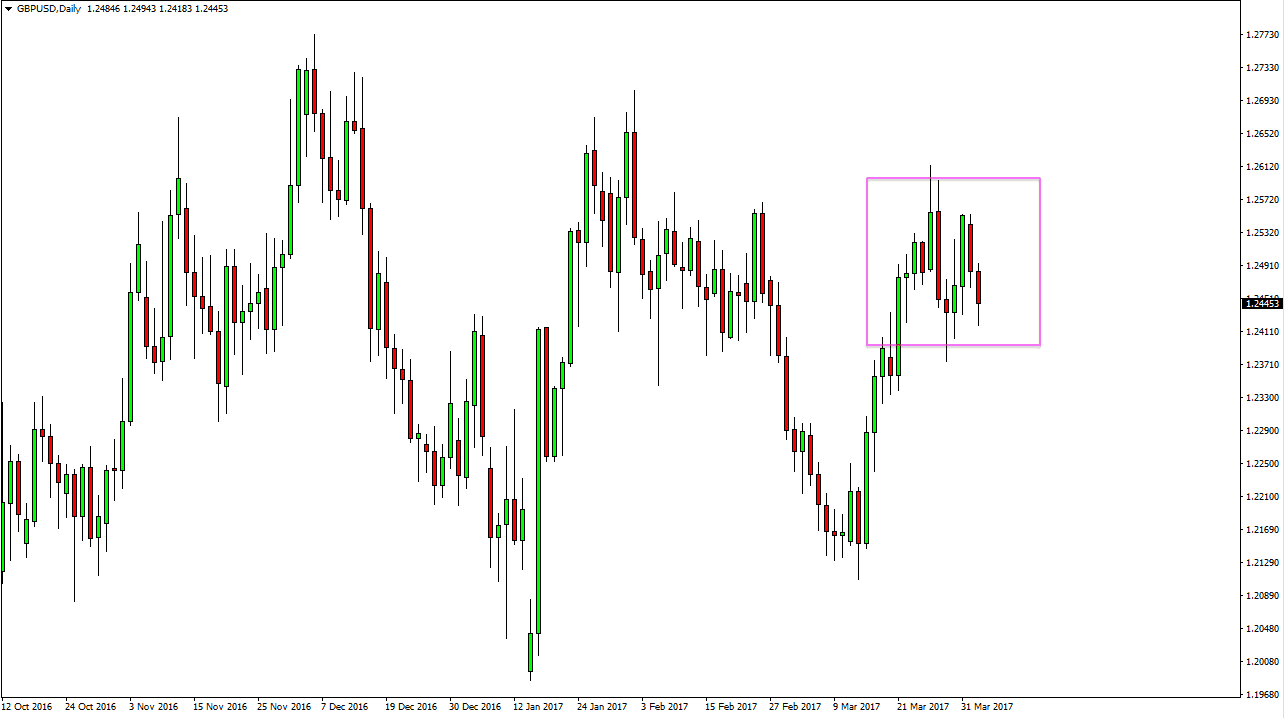

GBP/USD

The British pound fell during the day but found enough support at the 1.24 level to turn things around and form a somewhat supportive candle. Ultimately, I believe that the market will continue to go back and forth, perhaps reaching towards the 1.25 level above. Currently, I anticipate that there will be choppiness over the next several sessions, as markets continue to deal with the British leaving the European Union. Because of this, expect a lot of choppiness, and I would not expect much of a move anytime soon. There are a lot of concerns when it comes to what’s going on with the British and of course the overall divorce process from the European Union, so keep in mind that this market will more than likely be difficult to deal with. A lot of back and forth short-term trading is probably about as good as this is going to get for the next several sessions. However, if we can break above the 1.27 level, we will finally break out of the choppiness, and go much higher. In the meantime, I anticipate that we are going to bounce around in a 100 pips region.