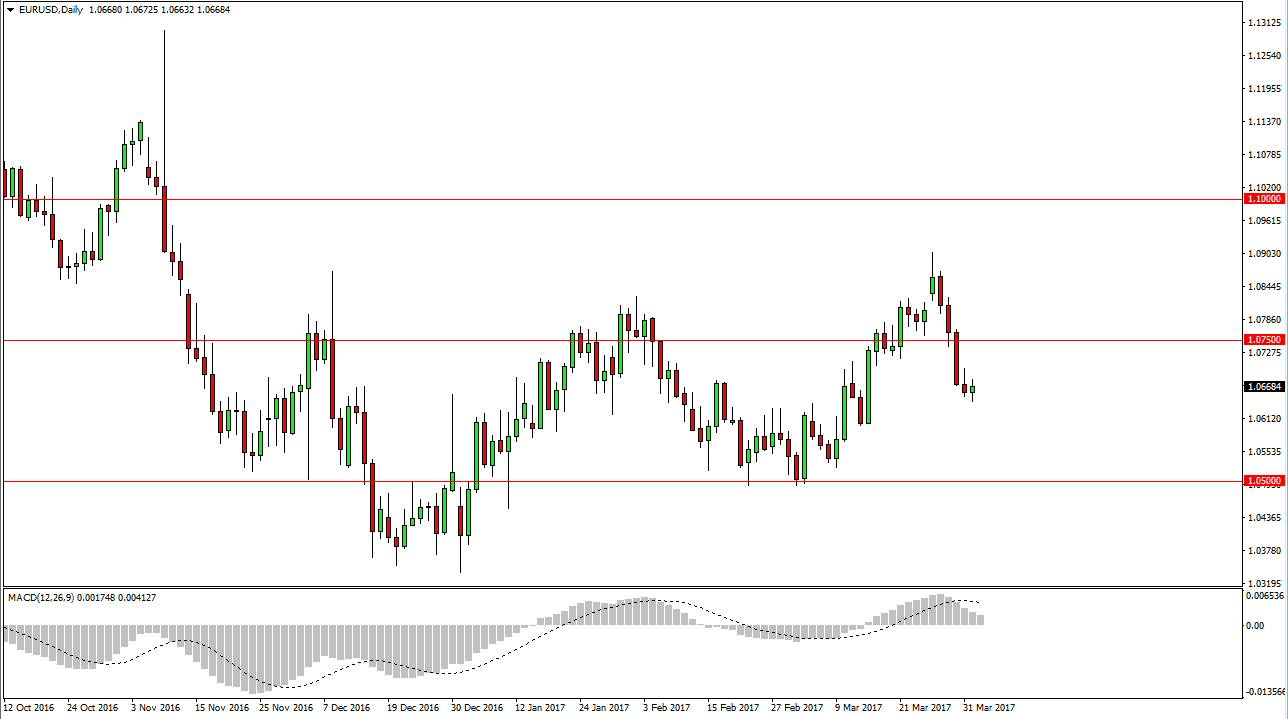

EUR/USD

The EUR/USD pair had a very quiet session on Monday, essentially treading water near the 1.0650 level. There seems to be a lot of questions around the European Union currently, and of course interest rate policy for the United States. Quite frankly, I believe that the market is just taking a bit of a breather before we continue towards our next target. Currently, it appears that the sellers are in control, so it would make sense that we continue to drift towards the 1.06 handle, followed by the 1.05 level. However, a break above the 1.0750 level would be very bullish, and could entice me to start buying this pair again. Either way, I expect a lot of volatility.

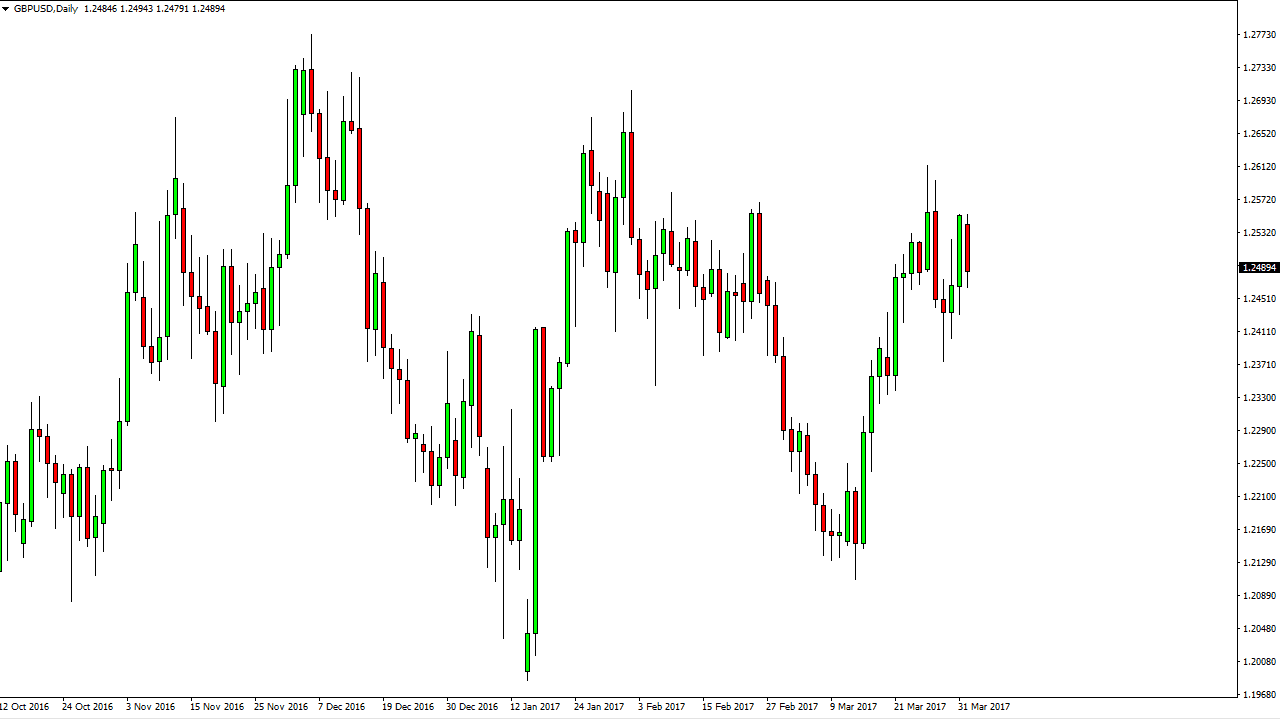

GBP/USD

The British pound fell again during the Monday trading session as we continue to bounce around and essentially make no real headway in either direction. I believe a lot of this comes down to so many questions around the leaving of the European Union that the British pound is going to continue to be very difficult to trade. One thing that I would point out is that the recent low was much higher than the previous one, so I do think that most traders want to start buying British pounds, but might be a bit hesitant to do so currently. It makes a lot of sense, because I can’t think of too many currencies out there, with perhaps the exception of the South African Rand, that carry more headline noise and risk. Because of this, expect a lot of volatility in expect a lot of very difficult trading days ahead. I believe that if we can break above the 1.27 level, that’s the “longer-term buy-and-hold” type of signal that I would love to see. In the meantime, perhaps buying dips with small positions might be the way to go, but I can’t look for much more than that right now.