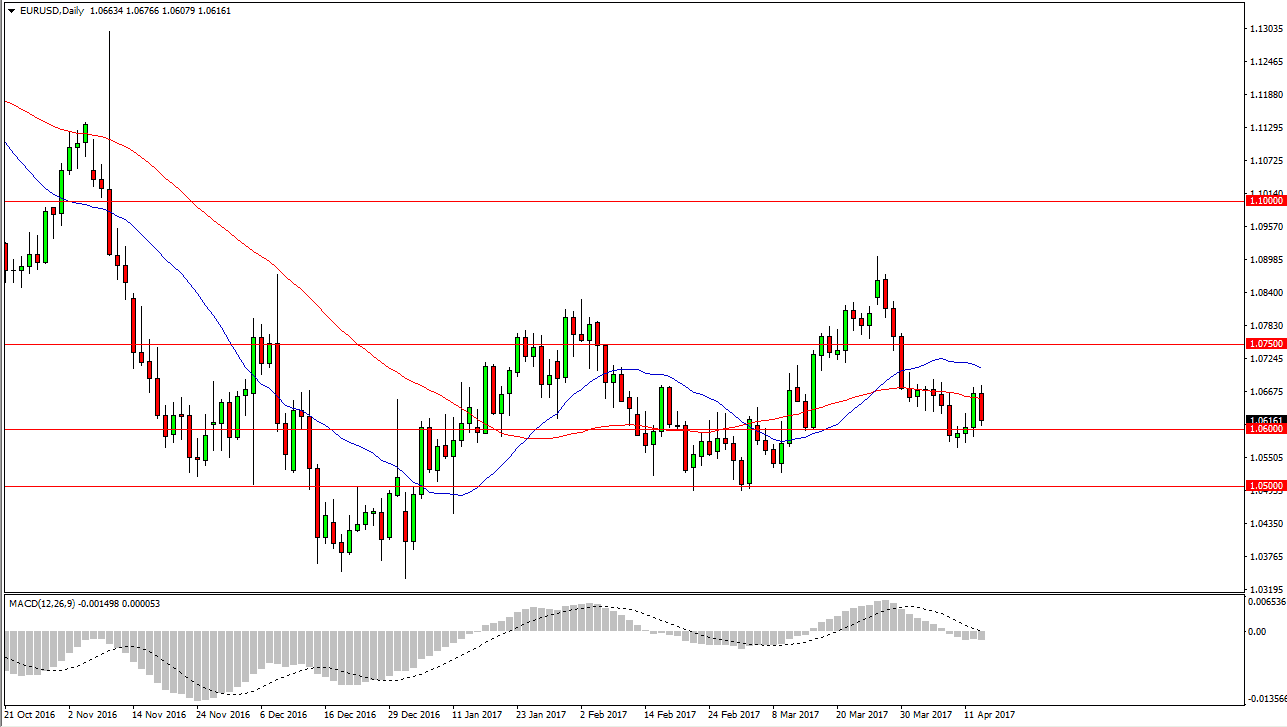

EUR/USD

The EUR/USD pair turned around during the session on Thursday, taking out most of the gains from Wednesday. Remember, a lot of the gains had more to do with President Trump suggesting that the value of the US dollar was too high than anything else. We ran into a significant amount of resistance at the 1.07 level as I had anticipated, and now have shown just how resilient that area could be. I believe that the Euro continues to lose value in the meantime, and a break below the lows of the Tuesday could be a nice selling opportunity down to the 1.05 handle. I don’t have any interest in buying this market until we get above the 1.07 level, and on a daily close.

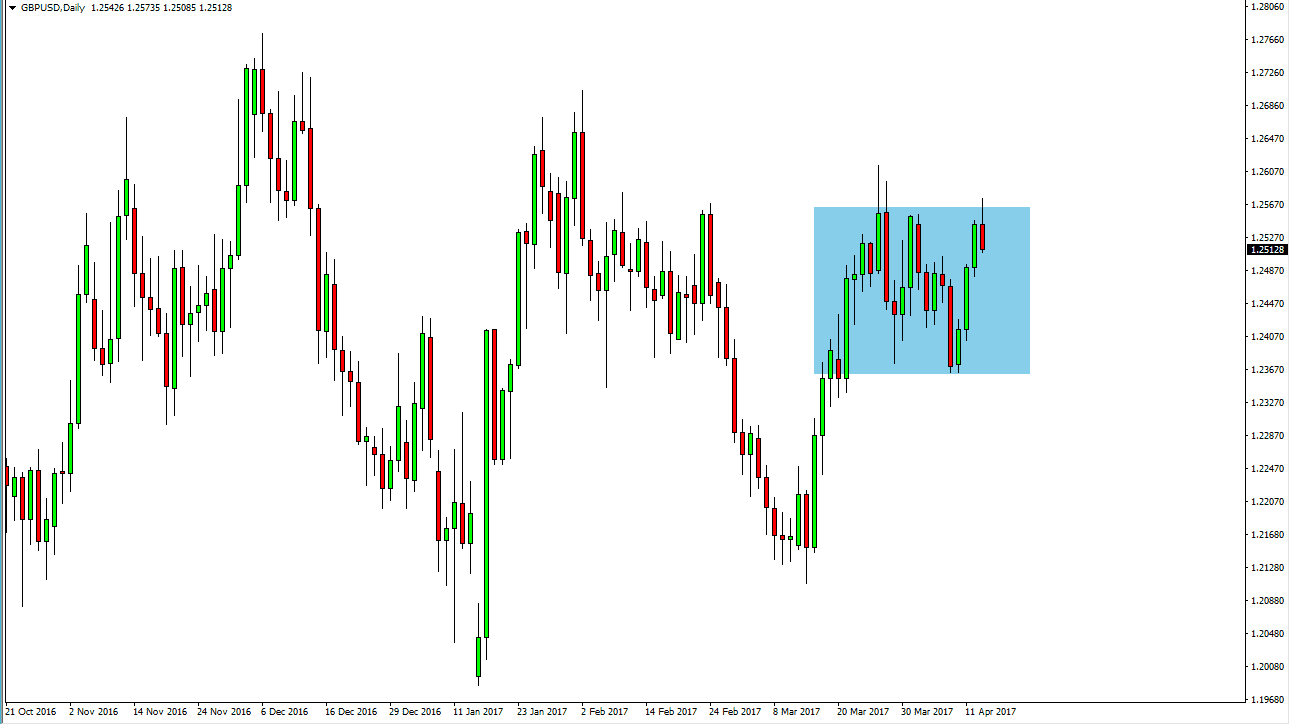

GBP/USD

The British pound initially rally on Thursday but found enough resistance above to turn things around and form a hammer like candle. This suggests that we are staying within the consolidation area, and because of this I think that a pullback is very likely. This will be especially true if there are no shock headlines as we have been consolidating for a while, and the consolidation has been relatively reliable. I believe that the market will find support near the 1.2350 level though, so I’m not looking for some type of major move. Alternately, if we can break above the 1.2650 level, the market could go much higher. At that point, we could be looking at a longer-term “buy-and-hold” type of situation. Until then, expect a lot of choppiness and back and forth type of trading.

It is because of this that traders will more than likely have to stick to range bound systems, and on shorter time frames. We have a clear support and a clear resistance level that we are working with, and with that in mind we have the ability to use short-term trading systems in order to profit.