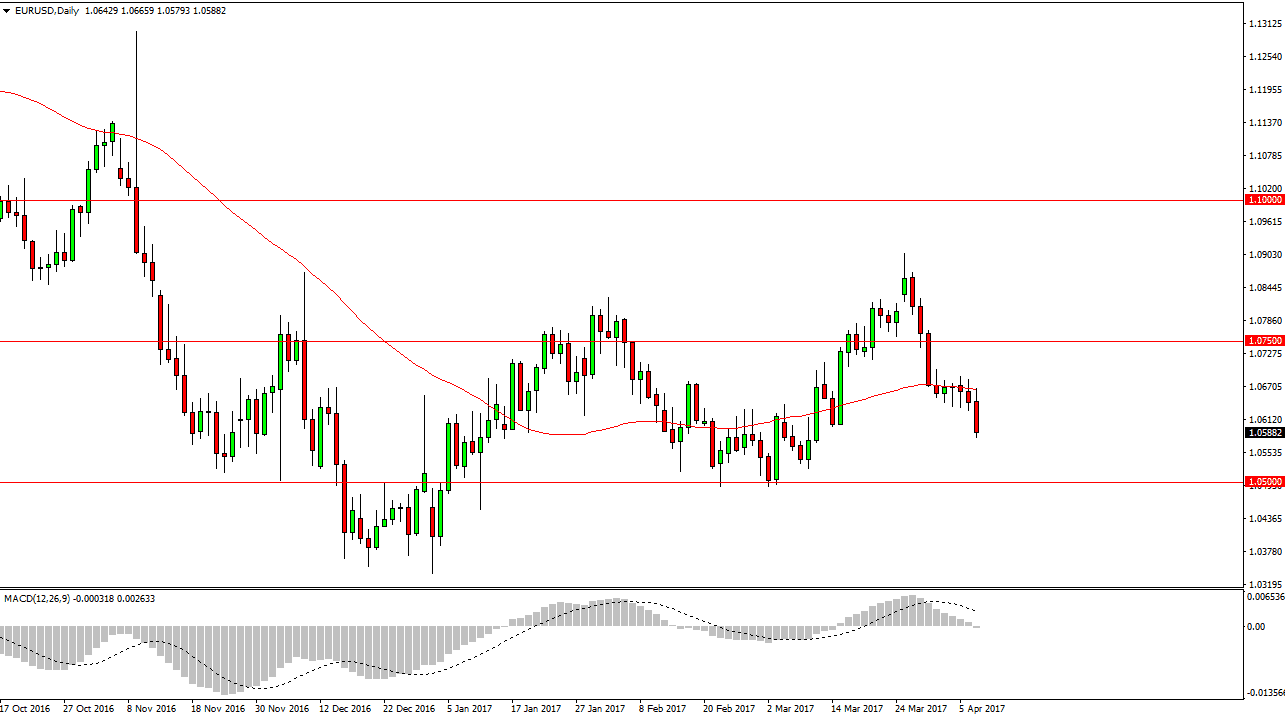

EUR/USD

The EUR/USD pair initially tried to rally on Friday, but found the 50-day exponential moving average to offer resistance yet again, and it now looks as if the market is going to try to reach towards the 1.05 level below. Because of this, I believe that short-term rally should be selling opportunities now, but there is a lot of noise below that could cause volatility. If we did break below the 1.05 level, at that point I would expect the pair to go looking for the 1.03 level under there. Rallies are ignored as far as buying is concerned, least until we break above the 1.07 handle.

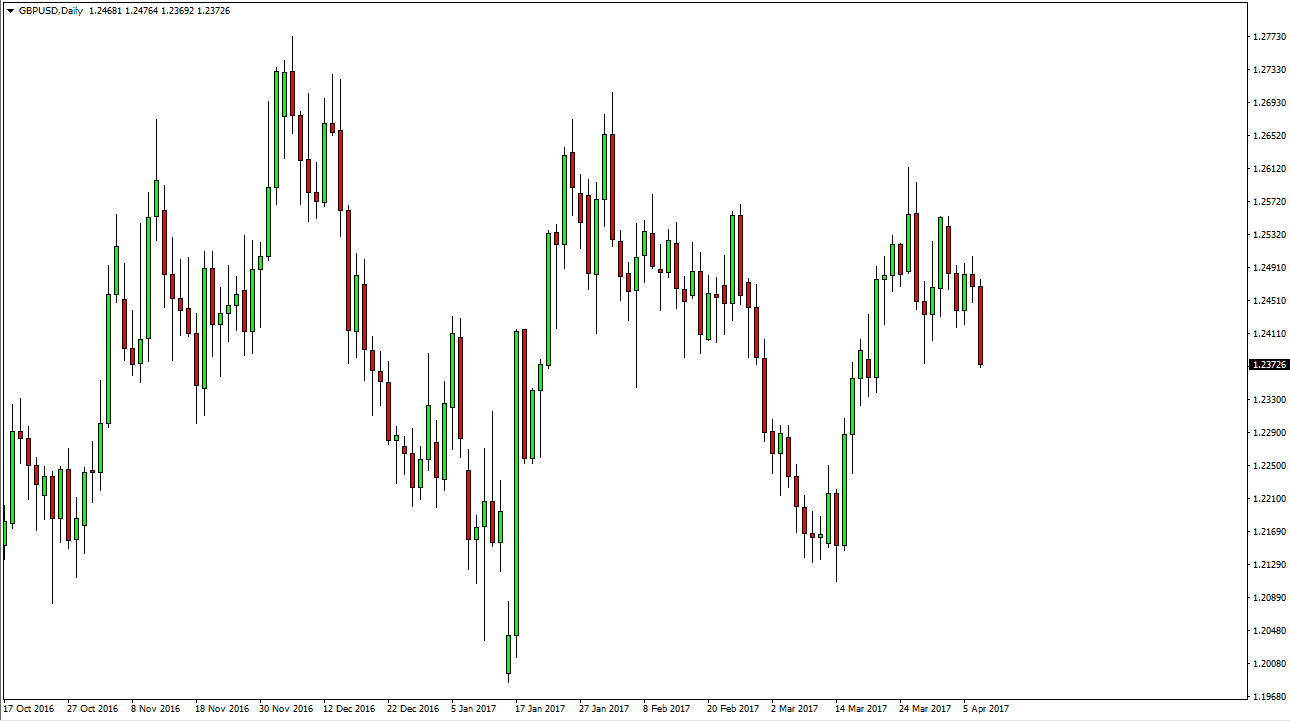

GBP/USD

The British pound fell significantly during the day, breaking below the 1.24 handle. The fact that we closed towards the bottom of the range for the session tells me that there is a significant amount of bearish pressure in this market, and that we should continue to drop. I think that short-term rallies are nice selling opportunities, and with that being the case it’s likely that bearish pressure will persist. Longer-term, I believe that the British pound is trying to form some type of major bottom, but we don’t seem to be anywhere near that currently. With this being the case, I am looking for selling opportunities short-term only. I think that the market breaking down below the 1.2350 level should send it looking for the 1.21 handle underneath. I’m not interested in buying this pair currently, but I recognize that the longer-term investment of sorts could present itself soon.

I will look for that buying opportunity on weekly chart, if not monthly charts. That becomes a “buy-and-hold” type of situation but in the meantime, it’s obvious that the sellers are starting to flex their muscles yet again. Regardless, this is going to be a choppy pair for some time.